Home /

Expert Answers /

Accounting /

required-prepare-journal-entries-to-record-a-the-sale-and-retirement-of-the-bonds-in-scenario-1-pa197

(Solved): Required Prepare journal entries to record: a. the sale and retirement of the bonds in scenario 1; ...

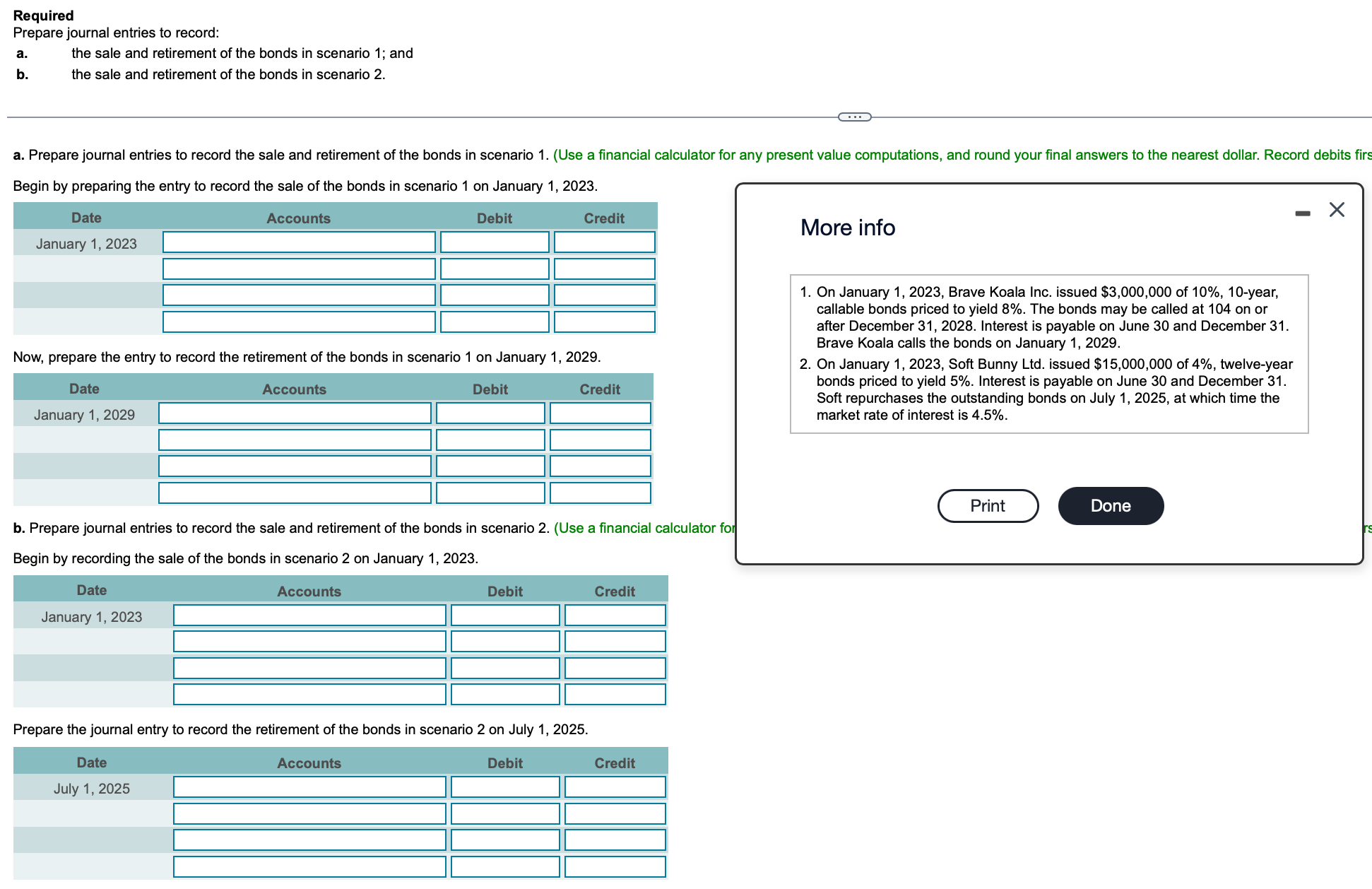

Required Prepare journal entries to record: a. the sale and retirement of the bonds in scenario 1; and b. the sale and retirement of the bonds in scenario 2 . Begin by preparing the entry to record the sale of the bonds in scenario 1 on January 1, 2023. Now, prepare the entry to record the retirement of the bonds in scenario 1 on January 1, 2029. More info 1. On January 1,2023 , Brave Koala Inc. issued of -year, callable bonds priced to yield . The bonds may be called at 104 on or after December 31, 2028. Interest is payable on June 30 and December 31. Brave Koala calls the bonds on January 1, 2029. 2. On January 1,2023 , Soft Bunny Ltd. issued of , twelve-year bonds priced to yield . Interest is payable on June 30 and December 31. Soft repurchases the outstanding bonds on July 1, 2025, at which time the market rate of interest is . b. Prepare journal entries to record the sale and retirement of the bonds in scenario 2. (Use a financial calculator for Begin by recording the sale of the bonds in scenario 2 on January 1, 2023.