(Solved): Required information [The following information applies to the questions displayed below.] On Januar ...

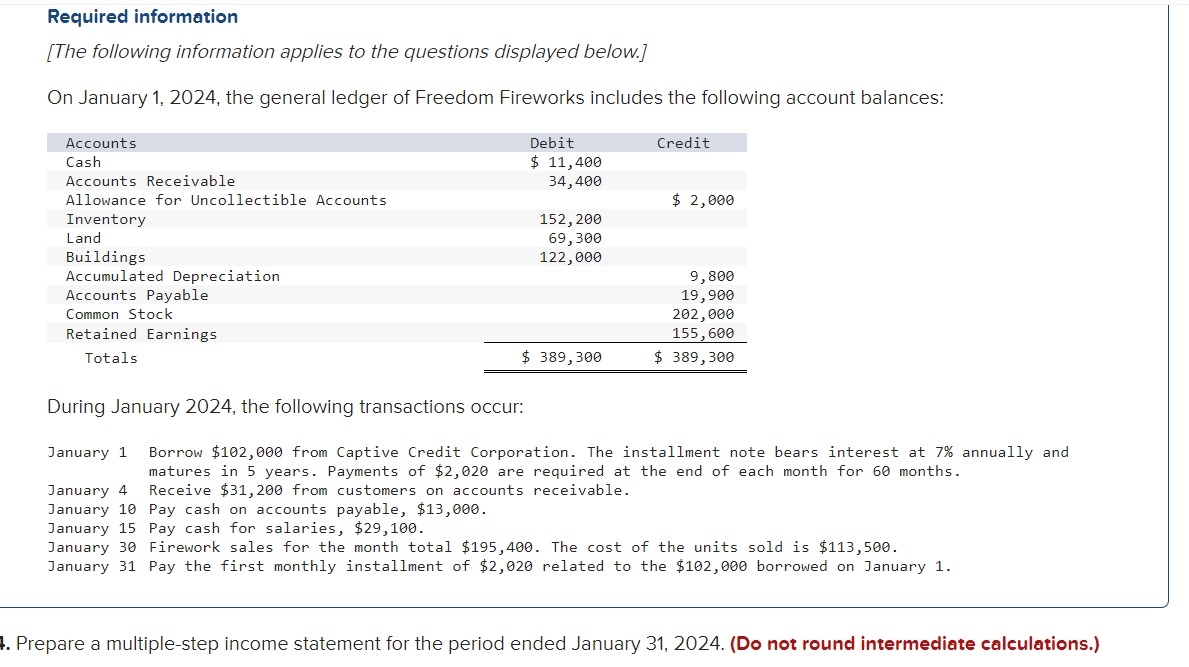

Required information [The following information applies to the questions displayed below.] On January 1, 2024, the general ledger of Freedom Fireworks includes the following account balances: \table[[Accounts,Debit,Credit],[Cash,

$11,400,],[Accounts Receivable,34,400,],[Allowance for Uncollectible Accounts,152,200,],[Inventory,69,300,],[Land,122,000,9,800],[Buildings,,19,900],[Accumulated Depreciation,,202,000],[Accounts Payable,,155,600],[Common Stock,,],[Retained Earnings,,],[Totals,,]] During January 2024, the following transactions occur: January 1 Borrow

$102,000from Captive Credit Corporation. The installment note bears interest at

7%annually and matures in 5 years. Payments of

$2,020are required at the end of each month for 60 months. January 4 Receive

$31,200from customers on accounts receivable. January 10 Pay cash on accounts payable,

$13,000. January 15 Pay cash for salaries,

$29,100. January 30 Firework sales for the month total

$195,400. The cost of the units sold is

$113,500. January 31 Pay the first monthly installment of

$2,020related to the

$102,000borrowed on January 1 . Prepare a multiple-step income statement for the period ended January 31, 2024. (Do not round intermediate calculations.)