Home /

Expert Answers /

Accounting /

required-information-the-following-information-applies-to-the-questions-displayed-below-cheesest-pa747

(Solved): Required information [The following information applies to the questions displayed below.] Cheesest ...

![Required information

[The following information applies to the questions displayed below.]

Cheesesteaks Sandwich Shop had th](https://media.cheggcdn.com/study/abe/abe1aeb5-09f0-4a94-9a5a-c4f635d272c0/image)

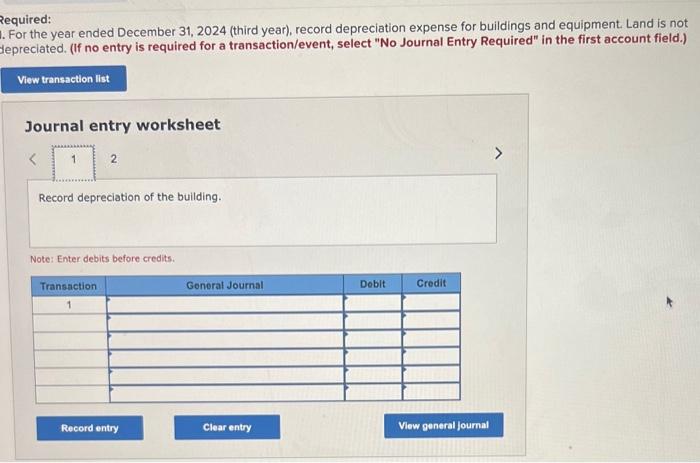

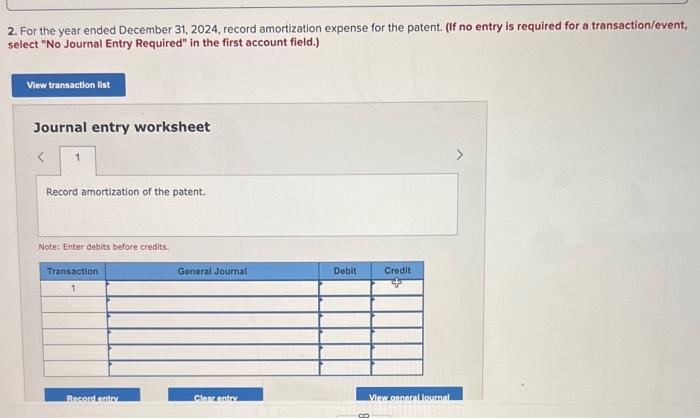

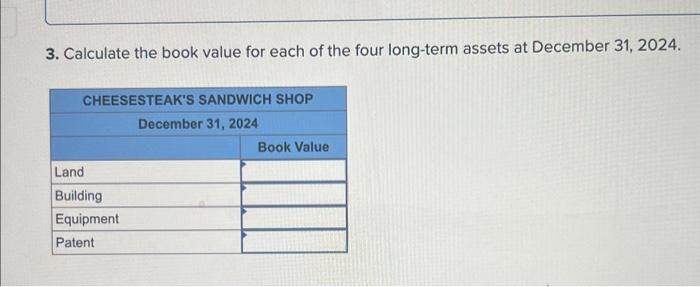

Required information [The following information applies to the questions displayed below.] Cheesesteak's Sandwich Shop had the following long-term asset balances as of January 1, 2024: Additional information: - Cheesesteak's purchased all the assets at the beginning of 2022. - The building is depreciated over a 20-year service life using the double-declining-balance method and estimating no residual value. - The equipment is depreciated over a 10-year useful life using the straight-line method with an estimated residual value of - The patent is estimated to have a five-year service life with no residual value and is amortized using the straight-line method. - Depreciation and amortization have been recorded for 2022 and 2023 (first two years). Required: 1. For the year ended December 31, 2024 (third year), record depreciation expense for buildings and equipment. Land is not depreciated. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)

equired: For the year ended December 31, 2024 (third year), record depreciation expense for buildings and equipment. Land is not lepreciated. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Note: Enter debits before credits.

2. For the year ended December 31, 2024, record amortization expense for the patent. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Note: Enter detis defore crecits.

3. Calculate the book value for each of the four long-term assets at December 31, 2024.