Home /

Expert Answers /

Accounting /

required-1-record-the-adjusting-entry-for-uncollectible-accounts-using-the-percentage-of-receiva-pa389

(Solved): Required: 1. Record the adjusting entry for uncollectible accounts using the percentage-of-receiva ...

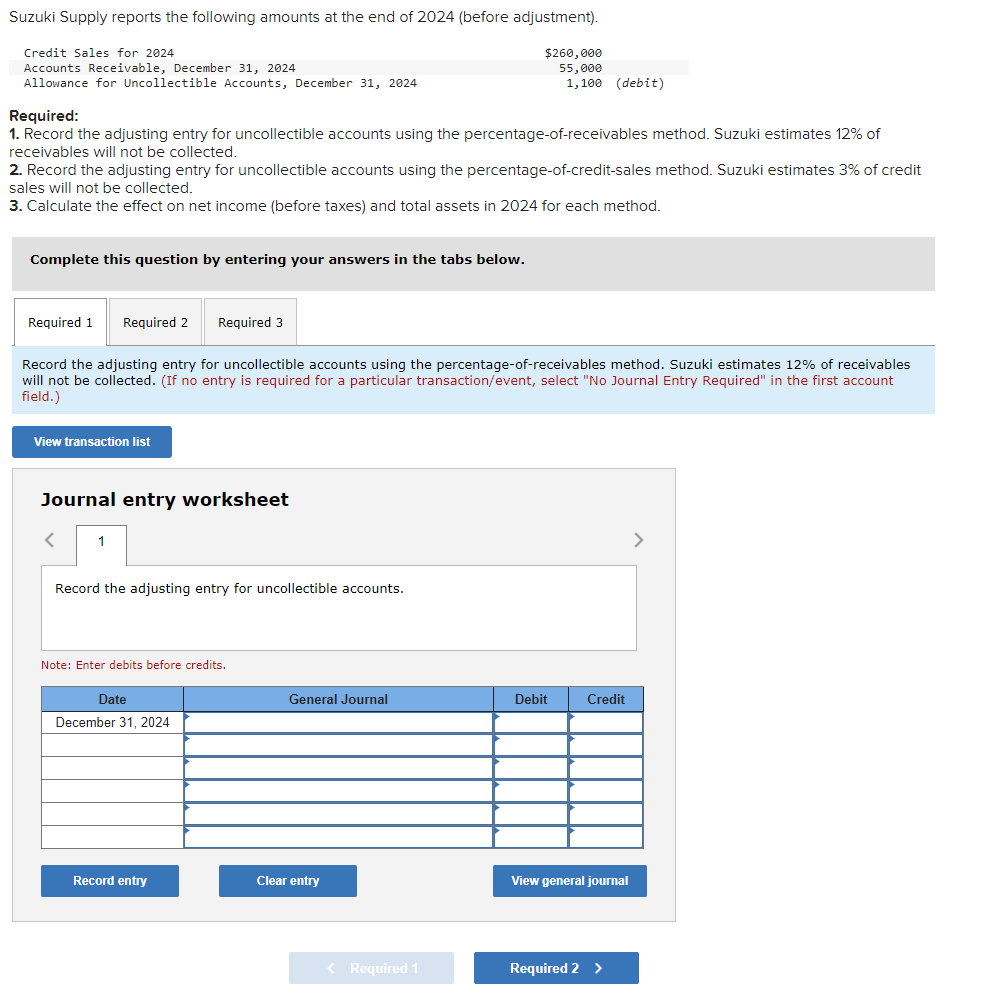

Required: 1. Record the adjusting entry for uncollectible accounts using the percentage-of-receivables method. Suzuki estimates \( 12 \% \) of receivables will not be collected. 2. Record the adjusting entry for uncollectible accounts using the percentage-of-credit-sales method. Suzuki estimates \( 3 \% \) of credit sales will not be collected. 3. Calculate the effect on net income (before taxes) and total assets in 2024 for each method. Complete this question by entering your answers in the tabs below. Record the adjusting entry for uncollectible accounts using the percentage-of-receivables method. Suzuki estimates \( 12 \% \) of receivables will not be collected. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the adjusting entry for uncollectible accounts. Note: Enter debits before credits.

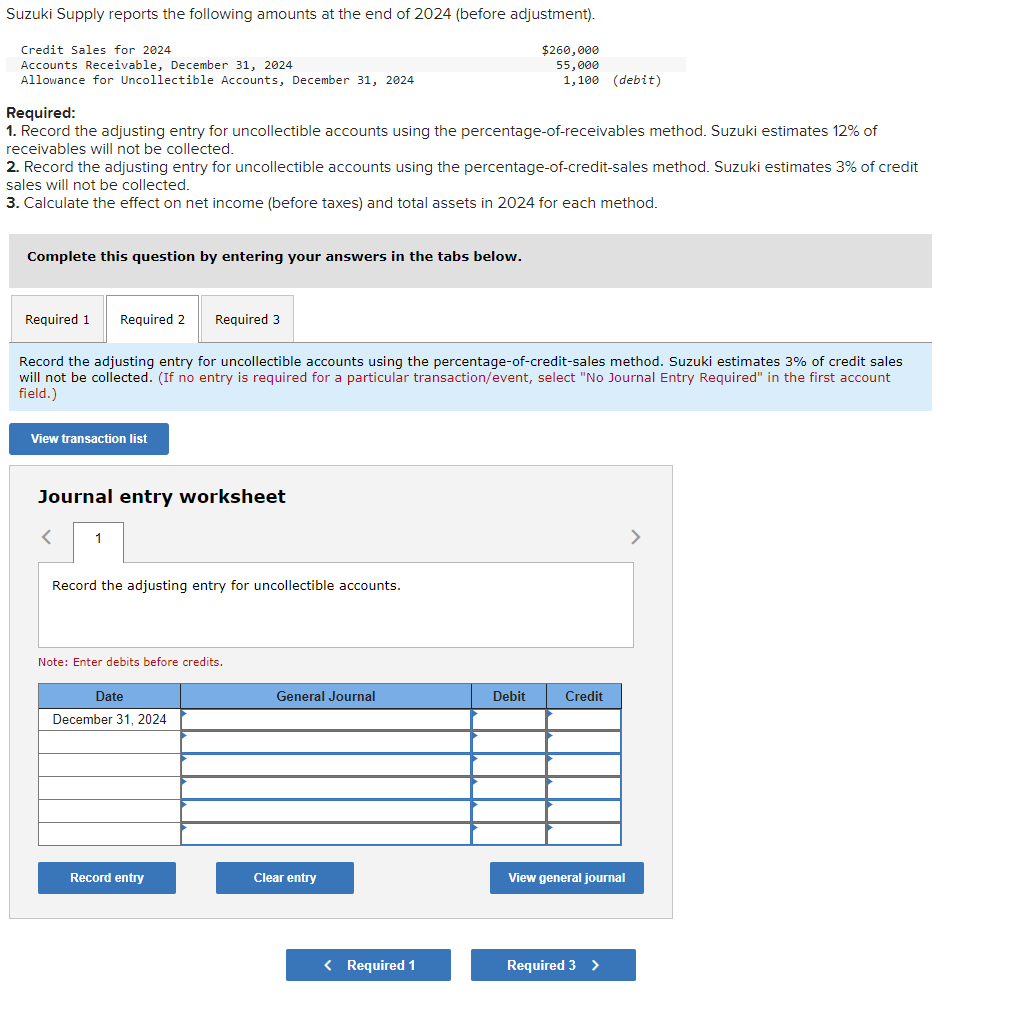

Required: . Record the adjusting entry for uncollectible accounts using the percentage-of-receivables method. Suzuki estimates \( 12 \% \) of eceivables will not be collected. 2. Record the adjusting entry for uncollectible accounts using the percentage-of-credit-sales method. Suzuki estimates \( 3 \% \) of credit ales will not be collected. 3. Calculate the effect on net income (before taxes) and total assets in 2024 for each method. Complete this question by entering your answers in the tabs below. Record the adjusting entry for uncollectible accounts using the percentage-of-credit-sales method. Suzuki estimates \( 3 \% \) of credit sales will not be collected. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the adjusting entry for uncollectible accounts. Note: Enter debits before credits.

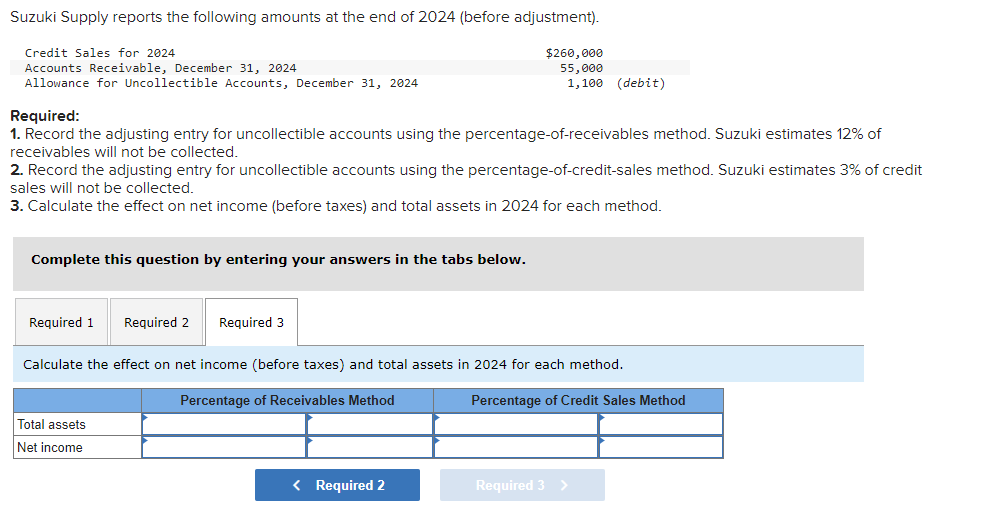

Required: 1. Record the adjusting entry for uncollectible accounts using the percentage-of-receivables method. Suzuki estimates \( 12 \% \) of receivables will not be collected. 2. Record the adjusting entry for uncollectible accounts using the percentage-of-credit-sales method. Suzuki estimates \( 3 \% \) of credit sales will not be collected. 3. Calculate the effect on net income (before taxes) and total assets in 2024 for each method. Complete this question by entering your answers in the tabs below. Calculate the effect on net income (before taxes) and total assets in 2024 for each method.

Expert Answer

Solution 1) journal entry Date General journal debit Credit 31 dec 2024 Bad debt EXpense To Allowance for Doubtful Account 6600 6600 c