Home /

Expert Answers /

Accounting /

required-1-prepare-the-journal-entry-to-record-the-payroll-for-march-including-employee-deducti-pa319

(Solved): Required: 1. Prepare the journal entry to record the payroll for March, including employee deducti ...

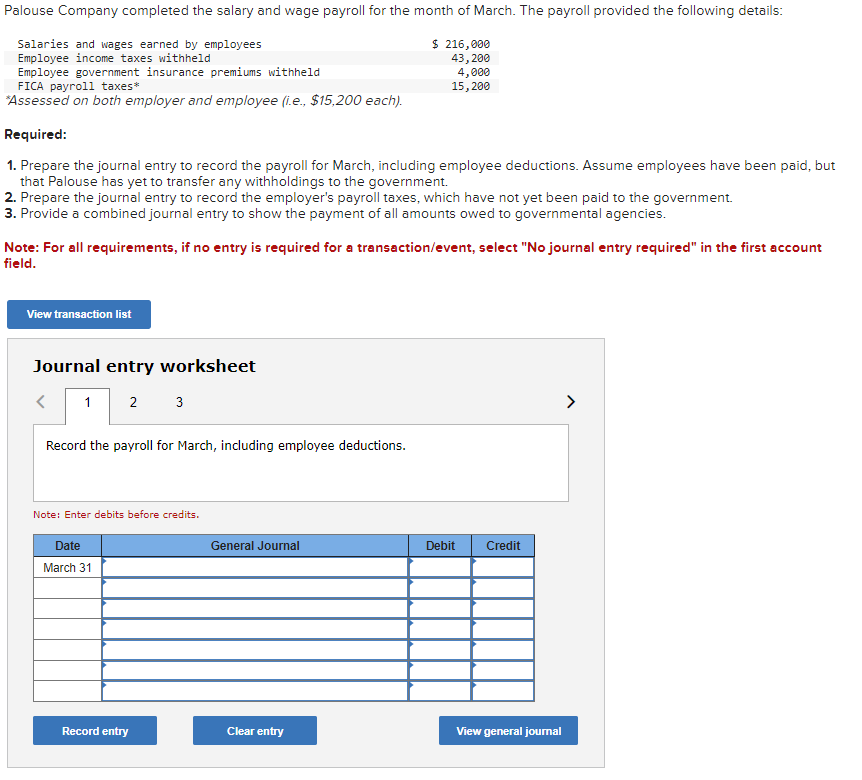

Required: 1. Prepare the journal entry to record the payroll for March, including employee deductions. Assume employees have been paid, but that Palouse has yet to transfer any withholdings to the government. 2. Prepare the journal entry to record the employer's payroll taxes, which have not yet been paid to the government. 3. Provide a combined journal entry to show the payment of all amounts owed to governmental agencies. Note: For all requirements, if no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Record the payroll for March, including employee deductions. Note: Enter debits before credits.

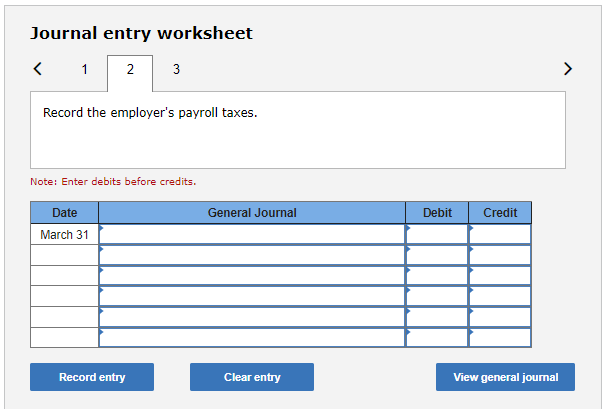

Journal entry worksheet Record the employer's payroll taxes. Note: Enter debits before credits.

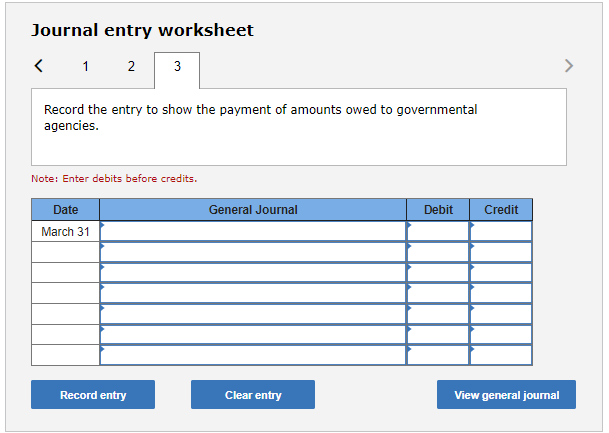

Journal entry worksheet Record the entry to show the payment of amounts owed to governmental agencies. Note: Enter debits before credits.

Expert Answer

1. The journal entries to record payroll for march, including employee deductions is shown below:- Date General Journal Debit Credit March 31 Salary a