Home /

Expert Answers /

Accounting /

required-1-prepare-the-journal-entry-for-the-disposal-of-the-airplanes-assuming-that-the-airpian-pa580

(Solved): Required: 1. Prepare the journal entry for the disposal of the airplanes, assuming that the airpian ...

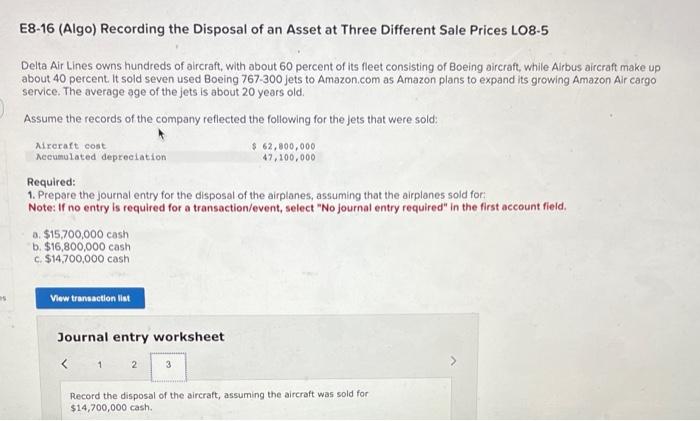

Required: 1. Prepare the journal entry for the disposal of the airplanes, assuming that the airpianes soid for: Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. a. \( \$ 15,700,000 \mathrm{cash} \) b. \( \$ 16,800,000 \) cash c. \( \$ 14,700,000 \) cash Journal entry worksheet Record the disposal of the aircraft, assuming the aircraft was sold for \( \$ 14,700,000 \) cash.

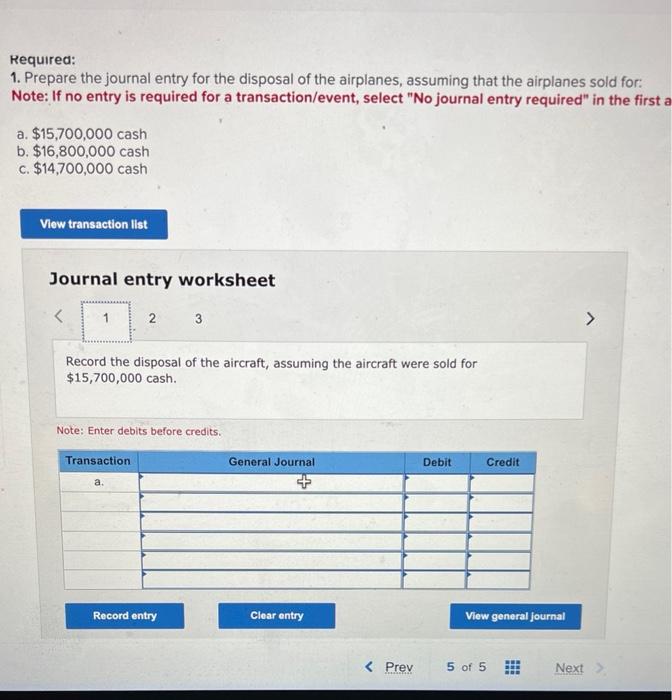

Required: 1. Prepare the journal entry for the disposal of the airplanes, assuming that the airplanes sold for: Note: If no entry is required for a transaction/event, select "No journal entry required" in the first a. \( \$ 15,700,000 \mathrm{cash} \) b. \( \$ 16,800,000 \mathrm{cash} \) c. \( \$ 14,700,000 \mathrm{cash} \) Journal entry worksheet Record the disposal of the aircraft, assuming the aircraft were sold for \( \$ 15,700,000 \) cash. Note: Enter debits before credits.

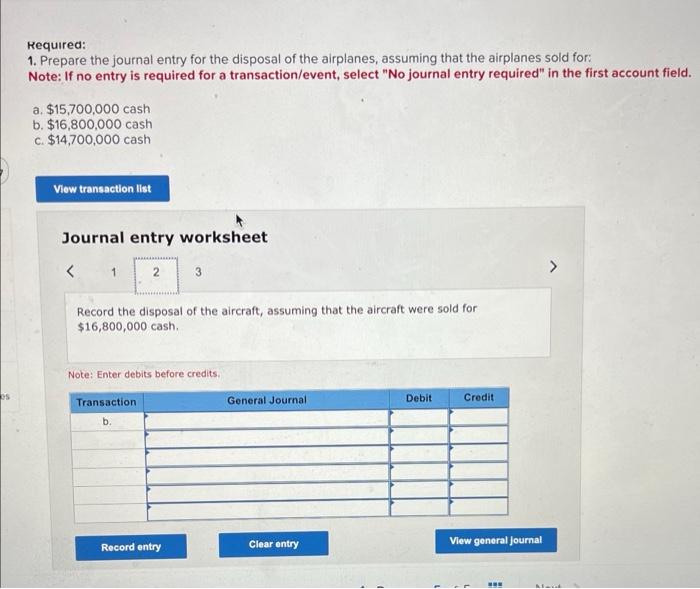

Kequired: 1. Prepare the journal entry for the disposal of the airplanes, assuming that the airplanes sold for: Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. a. \( \$ 15,700,000 \mathrm{cash} \) b. \( \$ 16,800,000 \) cash c. \( \$ 14,700,000 \mathrm{cash} \) Journal entry worksheet Record the disposal of the aircraft, assuming that the aircraft were sold for \( \$ 16,800,000 \) cash. Note: Enter debits before credits.

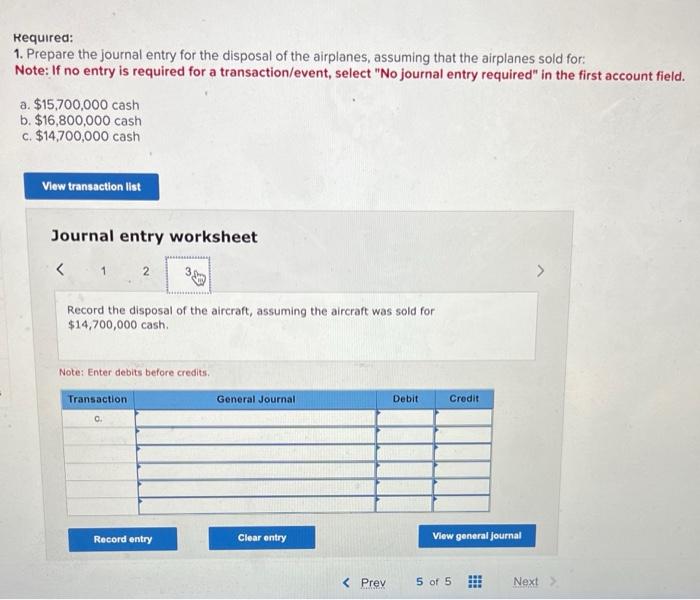

Required: 1. Prepare the journal entry for the disposal of the airplanes, assuming that the airplanes sold for: Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. a. \( \$ 15,700,000 \) cash b. \( \$ 16,800,000 \mathrm{cash} \) c. \( \$ 14,700,000 \mathrm{cash} \) Journal entry worksheet Record the disposal of the aircraft, assuming the aircraft was sold for \( \$ 14,700,000 \) cash. Note: Enter debits before credits.

Expert Answer

Required a: When airplanes sold for $15,700,000. Transaction General Journal Debit Credit a Cash $15,700,000 Accumulated depreciation $47,100,000 Airc