Home /

Expert Answers /

Accounting /

recording-payroll-and-payroll-taxes-the-following-information-about-the-payroll-for-the-week-ended-pa603

(Solved): Recording Payroll and Payroll Taxes The following information about the payroll for the week ended ...

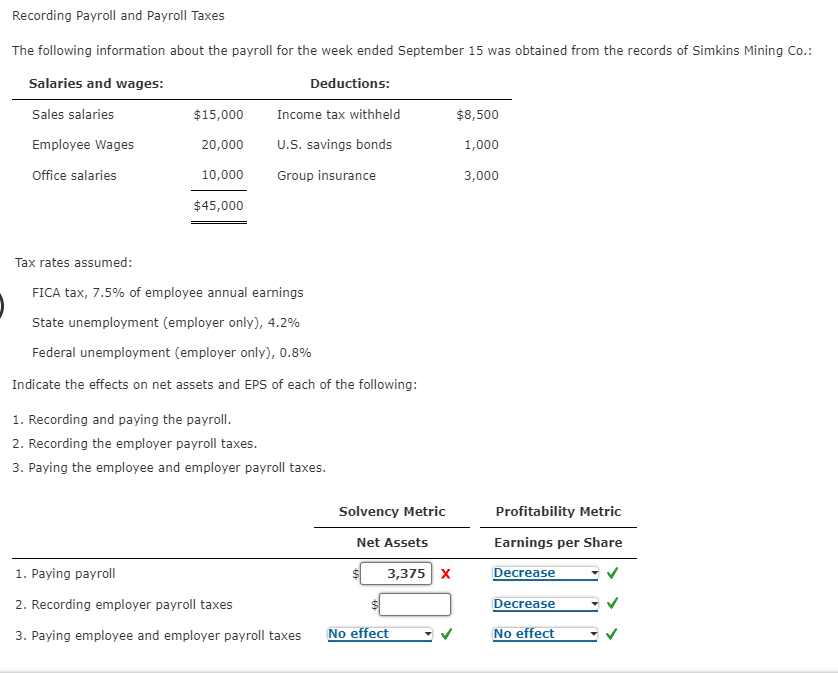

Recording Payroll and Payroll Taxes The following information about the payroll for the week ended September 15 was obtained from the records of Simkins Mining Co.: Tax rates assumed: FICA tax, \( 7.5 \% \) of employee annual earnings State unemployment (employer only), \( 4.2 \% \) Federal unemployment (employer only), \( 0.8 \% \) Indicate the effects on net assets and EPS of each of the following: 1. Recording and paying the payroll. 2. Recording the employer payroll taxes. 3. Paying the employee and employer payroll taxes.

Expert Answer

Answer:- 1. The gross Salaries for the employees given = $ 15000 + 20000 + 10000 = $ 45,000 FICA Taxes Rate given = 7.5% Employee FICA Tax Payable = $ 45000 * 7.5% Employee FICA Tax Payable = $ 3,375 2. The Effect of the Salaries or payroll involves