Home /

Expert Answers /

Accounting /

reba-dixon-is-a-fifth-grade-school-teacher-who-earned-a-salary-of-38-000-in-2022-she-is-45-pa900

(Solved): Reba Dixon is a fifth-grade school teacher who earned a salary of \( \$ 38,000 \) in 2022 She is 45 ...

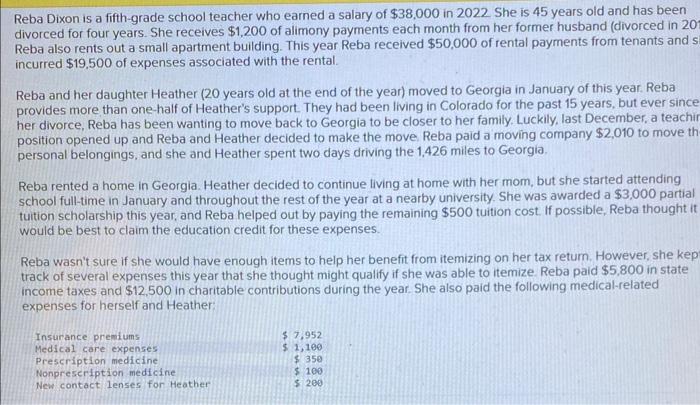

Reba Dixon is a fifth-grade school teacher who earned a salary of \( \$ 38,000 \) in 2022 She is 45 years old and has been divorced for four years. She receives \( \$ 1,200 \) of alimony payments each month from her former husband (divorced in 20 ) Reba also rents out a small apartment building. This year Reba received \( \$ 50,000 \) of rental payments from tenants and \( s \) incurred \( \$ 19.500 \) of expenses associated with the rental. Reba and her daughter Heather (20 years old at the end of the year) moved to Georgia in January of this year. Reba provides more than one-half of Heather's support. They had been living in Colorado for the past 15 years, but ever since her divorce, Reba has been wanting to move back to Georgia to be closer to her family. Luckily, last December, a teachin position opened up and Reba and Heather decided to make the move. Reba paid a moving company \( \$ 2,010 \) to move th personal belongings, and she and Heather spent two days driving the 1,426 miles to Georgia. Reba rented a home in Georgia. Heather decided to continue living at home with her mom, but she started attending school full-time in January and throughout the rest of the year at a nearby university. She was awarded a \( \$ 3,000 \) partial tuition scholarship this year, and Reba helped out by paying the remaining \( \$ 500 \) tuition cost. If possible, Reba thought it would be best to claim the education credit for these expenses. Reba wasn't sure if she would have enough items to help her benefit from itemizing on her tax retum. However, she kep track of several expenses this year that she thought might qualify if she was able to itemize. Reba paid \( \$ 5,800 \) in state income taxes and \( \$ 12.500 \) in charitable contributions during the year. She also paid the following medical-related expenses for herself and Heather:

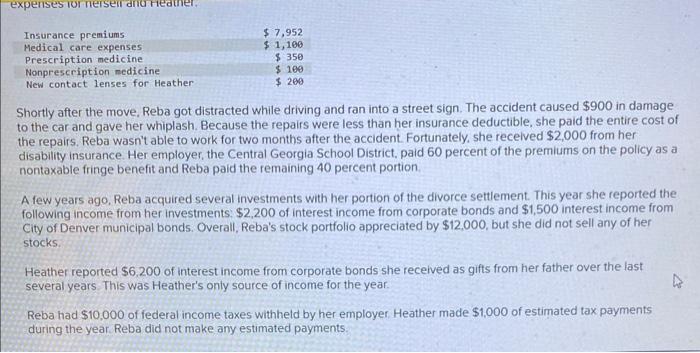

Shortly after the move, Reba got distracted while driving and ran into a street sign. The accident caused \( \$ 900 \) in damage to the car and gave her whiplash. Because the repairs were less than her insurance deductible, she paid the entire cost of the repairs. Reba wasn't able to work for two months after the accident. Fortunately, she recelved \( \$ 2,000 \) from her disability insurance. Her employer, the Central Georgia School District. paid 60 percent of the premiums on the policy as a nontaxable fringe benefit and Reba paid the remaining 40 percent portion. A few years ago, Reba acquired several investments with her portion of the divorce settlement. This year she reported the following income from her investments: \( \$ 2,200 \) of interest income from corporate bonds and \( \$ 1,500 \) interest income from City of Denver municipal bonds. Overall, Reba's stock portfolio appreciated by \( \$ 12,000 \), but she did not sell any of her stocks. Heather reported \( \$ 6.200 \) of interest income from corporate bonds she recelved as gifts from her father over the last several years. This was Heather's only source of income for the year. Reba had \( \$ 10,000 \) of federal income taxes withheld by her employer. Heather made \( \$ 1,000 \) of estimated tax payments during the year. Reba did not make any estimated payments.

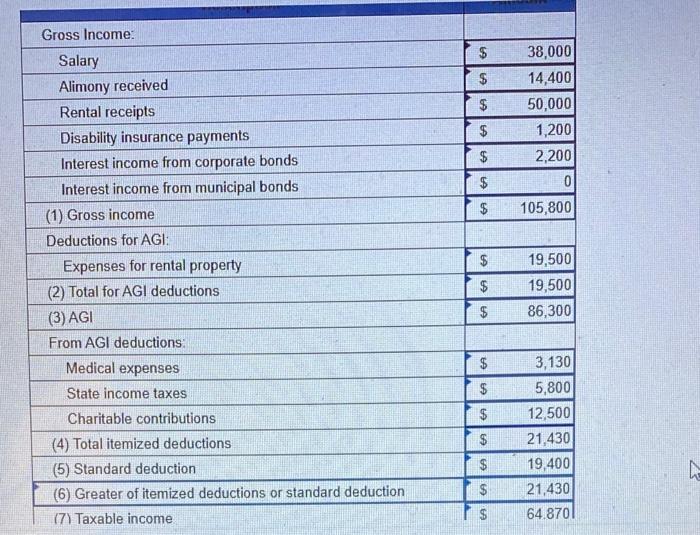

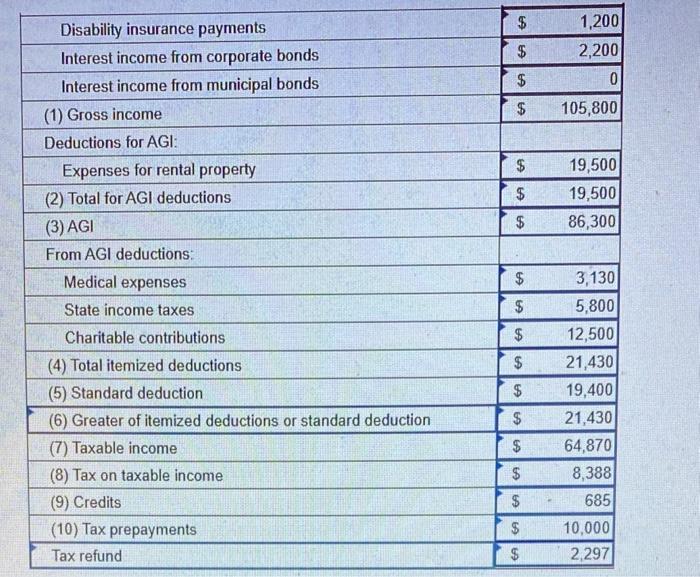

\begin{tabular}{|l|rr|} \hline Gross Income: & & \\ \hline Salary & \( \$ \) & 38,000 \\ \hline Alimony received & \( \$ \) & 14,400 \\ \hline Rental receipts & \( \$ \) & 50,000 \\ \hline Disability insurance payments & \( \$ \) & 1,200 \\ \hline Interest income from corporate bonds & \( \$ \) & 2,200 \\ \hline Interest income from municipal bonds & \( \$ \) \\ \hline (1) Gross income & \( \$ \) & 105,800 \\ \hline Deductions for AGl: & & \\ \hline Expenses for rental property & \( \$ \) & 19,500 \\ \hline (2) Total for AGI deductions & \( \$ \) & 19,500 \\ \hline (3) AGI & 86,300 \\ \hline From AGI deductions: & \( \$ \) & 3,130 \\ \hline Medical expenses & \( \$ \) & 5,800 \\ \hline State income taxes & \( \$ \) & 12,500 \\ \hline Charitable contributions & \( \$ \) & 21,430 \\ \hline (4) Total itemized deductions & \( \$ \) & 19,400 \\ \hline (5) Standard deduction & \( \$ \) & 21,430 \\ \hline (6) Greater of itemized deductions or standard deduction & \( 64.870 \) \\ \hline (7) Taxable income & \( \$ \) & \( \$ \) \\ \hline \end{tabular}

\begin{tabular}{|l|rr|} \hline Disability insurance payments & \( \$ \) & 1,200 \\ \hline Interest income from corporate bonds & \( \$ \) & 2,200 \\ \hline Interest income from municipal bonds & \( \$ \) & 105,800 \\ \hline (1) Gross income & & \\ \hline Deductions for AGI: & \( \$ \) & 19,500 \\ \hline Expenses for rental property & \( \$ \) & 19,500 \\ \hline (2) Total for AGI deductions & \( \$ \) & 86,300 \\ \hline (3) AGI & \( \$ \) & 3,130 \\ \hline From AGI deductions: & \( \$ \) & 5,800 \\ \hline Medical expenses & \( \$ \) & 12,500 \\ \hline State income taxes & \( \$ \) & 21,430 \\ \hline Charitable contributions & \( \$ \) & 19,400 \\ \hline (4) Total itemized deductions & \( \$ \) & 21,430 \\ \hline (5) Standard deduction & \( \$ \) & 64,870 \\ \hline (6) Greater of itemized deductions or standard deduction & 8,388 \\ \hline (7) Taxable income & \( \$ \$ 85 \) \\ \hline (8) Tax on taxable income & \( \$ \$, 297 \) \\ \hline (9) Credits & \( \$ \) & \( \$ \) \\ \hline (10) Tax prepayments & \( \$ \) & \( \$ \) \\ \hline Tax refund & \( \$ \) & \( \$ \) \\ \hline \end{tabular}

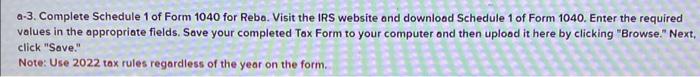

a-3. Complete Schedule 1 of Form 1040 for Rebo. Visit the IRS website and download Schedule 1 of Form 1040. Enter the required volues in the appropriate fields. Save your completed Tox Form to your computer and then uplood it here by clicking "Browse." Next, click "Save." Note: Use 2022 tax rules regardless of the year on the form.

1 Taxable refunds, credits, or offsets of state and local income taxes. 2a Alimony received. b Date of original divorce or separation agreement (see instructions) 3 Business income or (loss). Attach Schedule C 4 Other gains or (losses). Attach Form 4797 5 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E 6 Farm income or (loss). Attach Schedule F 7 Unemployment compensation. 8 Other income: a Net operating loss b Gambling income. c Cancellation of debt. d Foreign earned income exclusion from Form 2555 e Taxable Health Savings Account distribution . 1 Alaska Permanent Fund dividends g Jury duty pay h Prizes and awards i Activity not engaged in for profit income j Stock options \( \frac{1}{2 a} \) \( k \) Income from the rental of personal property if you engaged in the rental for profit but were not in the business of renting such property I Olympic and Paralympic medals and USOC.prize money (see instructions) m Section 951(a) inclusion (see instructions) n Section 951A(a) inclusion (see instructions) - Section 461(i) excess business loss adjustment. p Taxable distributions from an ABLE account (see instructions) . z. Other income. List type and amount

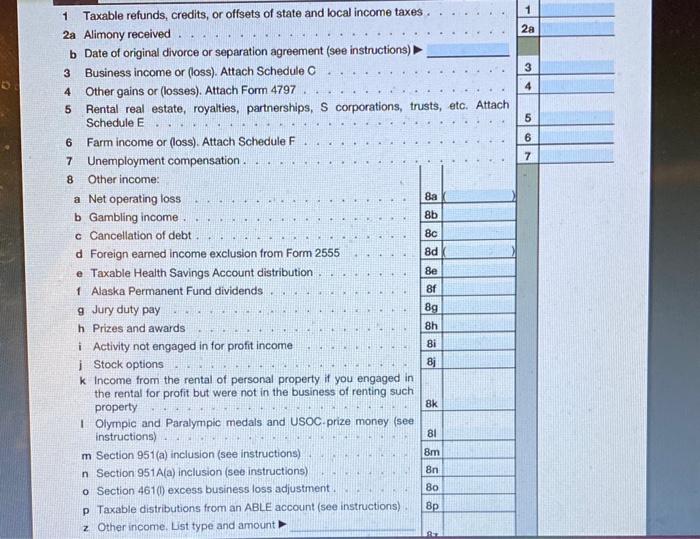

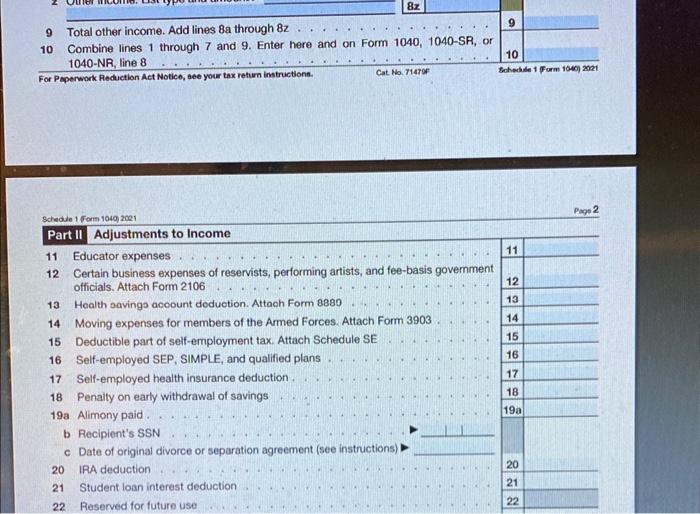

9 Total other income. Add lines 8 a through \( 8 z \). 10 Combine lines 1 through 7 and 9. Enter here and on Form 1040, 1040-SR, or 1040-NR, line 8 For Paperwork Reduction Act Notice, aee your tax retum instructiona. 10 Schable 1 Fram 1000) 2021 Schedie 1 Form 1040 2001 Pape 2 Part II Adjustments to Income 11 Educator expenses 12 Certain business expenses of reservists, performing artists, and fee-basis govemment officials. Attach Form 2106 13 Health savings acoount doduction. Attach Form 8880 14 Moving expenses for members of the Armed Forces. Attach Form 3903 15 Deductible part of self-employment tax. Attach Schedule SE 16 Self-employed SEP, SIMPLE, and qualified plans 17 Self-employed health insurance deduction. 18 Penaity on early withdrawal of savings 19 a Alimony paid. b Recipient's \( \mathrm{SSN} \) c Date of original divorce or separation agreement (see instructions) 20 IRA deduction 21 Student loan interest deduction 22 Reserved for future use \begin{tabular}{|l|l} \hline 11 & \\ \hline 12 & \\ \hline 13 & \\ \hline 14 & \\ \hline 15 & \\ \hline 16 & \\ \hline 17 & \\ \hline 18 & \\ \hline \( 19 a \) & \\ \hline & \\ \hline 20 & \\ \hline 21 & \\ \hline 22 & \\ \hline \end{tabular}

toog lobor uno A i ajpayos

Expert Answer

Reba Dixon is a fifth-grade school teacher who earned a salary of$38,000in 2022 She is 45 years old a