Home /

Expert Answers /

Accounting /

quick-fix-lt-corporation-was-organized-at-the-beginning-of-this-year-to-operate-several-car-repair-pa690

(Solved): Quick Fix-lt Corporation was organized at the beginning of this year to operate several car repair ...

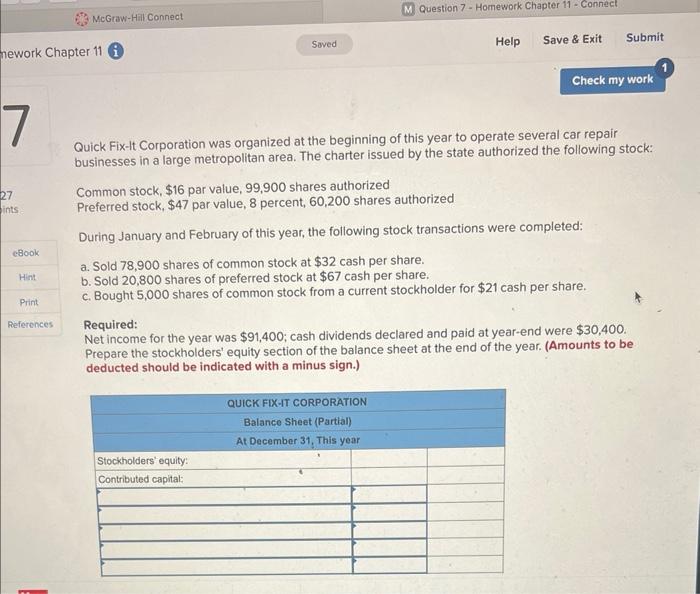

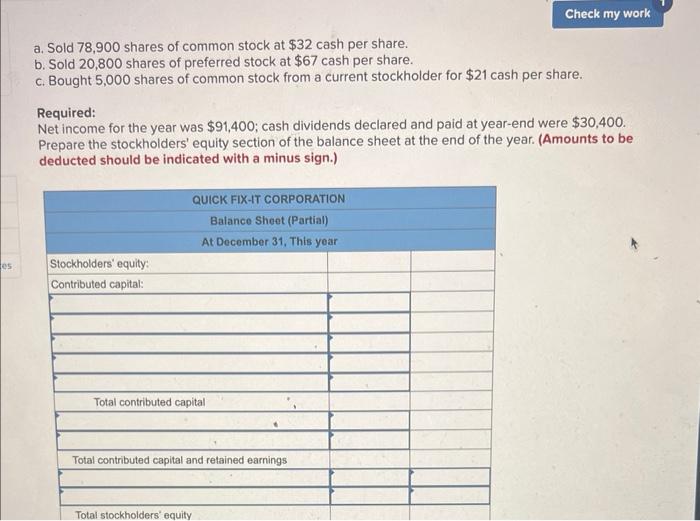

Quick Fix-lt Corporation was organized at the beginning of this year to operate several car repair businesses in a large metropolitan area. The charter issued by the state authorized the following stock: Common stock, \( \$ 16 \) par value, 99,900 shares authorized Preferred stock, \( \$ 47 \) par value, 8 percent, 60,200 shares authorized During January and February of this year, the following stock transactions were completed: a. Sold 78,900 shares of common stock at \( \$ 32 \) cash per share. b. Sold 20,800 shares of preferred stock at \( \$ 67 \) cash per share. c. Bought 5,000 shares of common stock from a current stockholder for \( \$ 21 \) cash per share. Required: Net income for the year was \( \$ 91,400 \); cash dividends declared and paid at year-end were \( \$ 30,400 \). Prepare the stockholders' equity section of the balance sheet at the end of the year. (Amounts to be deducted should be indicated with a minus sign.)

a. Sold 78,900 shares of common stock at \( \$ 32 \) cash per share. b. Sold 20,800 shares of preferred stock at \( \$ 67 \) cash per share. c. Bought 5,000 shares of common stock from a current stockholder for \( \$ 21 \) cash per share. Required: Net income for the year was \( \$ 91,400 \); cash dividends declared and paid at year-end were \( \$ 30,400 \). Prepare the stockholders' equity section of the balance sheet at the end of the year. (Amounts to be deducted should be indicated with a minus sign.)

Expert Answer

Introduction The shareholders' equity se