Home /

Expert Answers /

Accounting /

questions-811-are-based-on-the-following-infornation-patriet-corporation-acquired-80-pertent-exm-pa481

(Solved): Questions 811 are based on the following infornation Patriet Corporation acquired 80 pertent exm ...

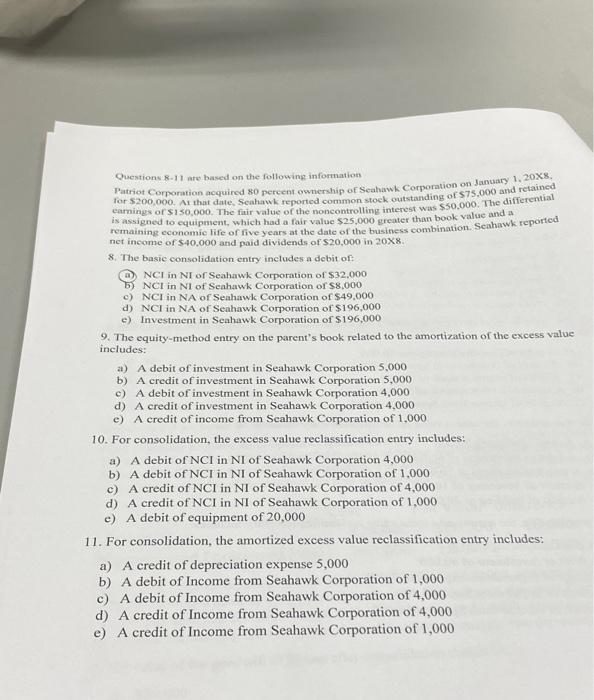

Questions are based on the following infornation Patriet Corporation acquired 80 pertent exmenhip of Seahawk Corporation on January . for . As that date, Seahawk reported common stock outstanding of and retained. earnings of . The fair value of the nopcontrolling interest was , The differential is assigned to equipment, which had a fair value greater than book value and a remaising economie fife of five years at the date of the business combination. Scahawk reported net income of and paid dividends of in 8. The basic consolidation entry includes a debit of: (a) in of Seahawk Corporation of b) in of Seahawk Corporation of c) in NA of Seahawk Corporation of d) in of Seahawk Corporation of e) Investment in Seahawk Corporation of 9. The equity-method entry on the parent's book related to the amortization of the excess value includes: a) A debit of investment in Seahawk Corporation 5,000 b) A credit of investment in Seahawk Corporation 5,000 c) A debit of investment in Seahawk Corporation 4,000 d) A credit of investment in Seahawk Corporation 4,000 e) A credit of income from Seahawk Corporation of 1,000 10. For consolidation, the excess value reclassification entry includes: a) A debit of in NI of Seahawk Corporation 4,000 b) A debit of NCI in NI of Seahawk Corporation of 1,000 c) A credit of NCI in NI of Seahawk Corporation of 4,000 d) A credit of NCI in NI of Seahawk Corporation of 1,000 c) A debit of equipment of 20,000 11. For consolidation, the amortized excess value reclassification entry includes: a) A credit of depreciation expense 5,000 b) A debit of Income from Seahawk Corporation of 1,000 c) A debit of Income from Seahawk Corporation of 4,000 d) A credit of Income from Seahawk Corporation of 4,000 e) A credit of Income from Seahawk Corporation of 1,000