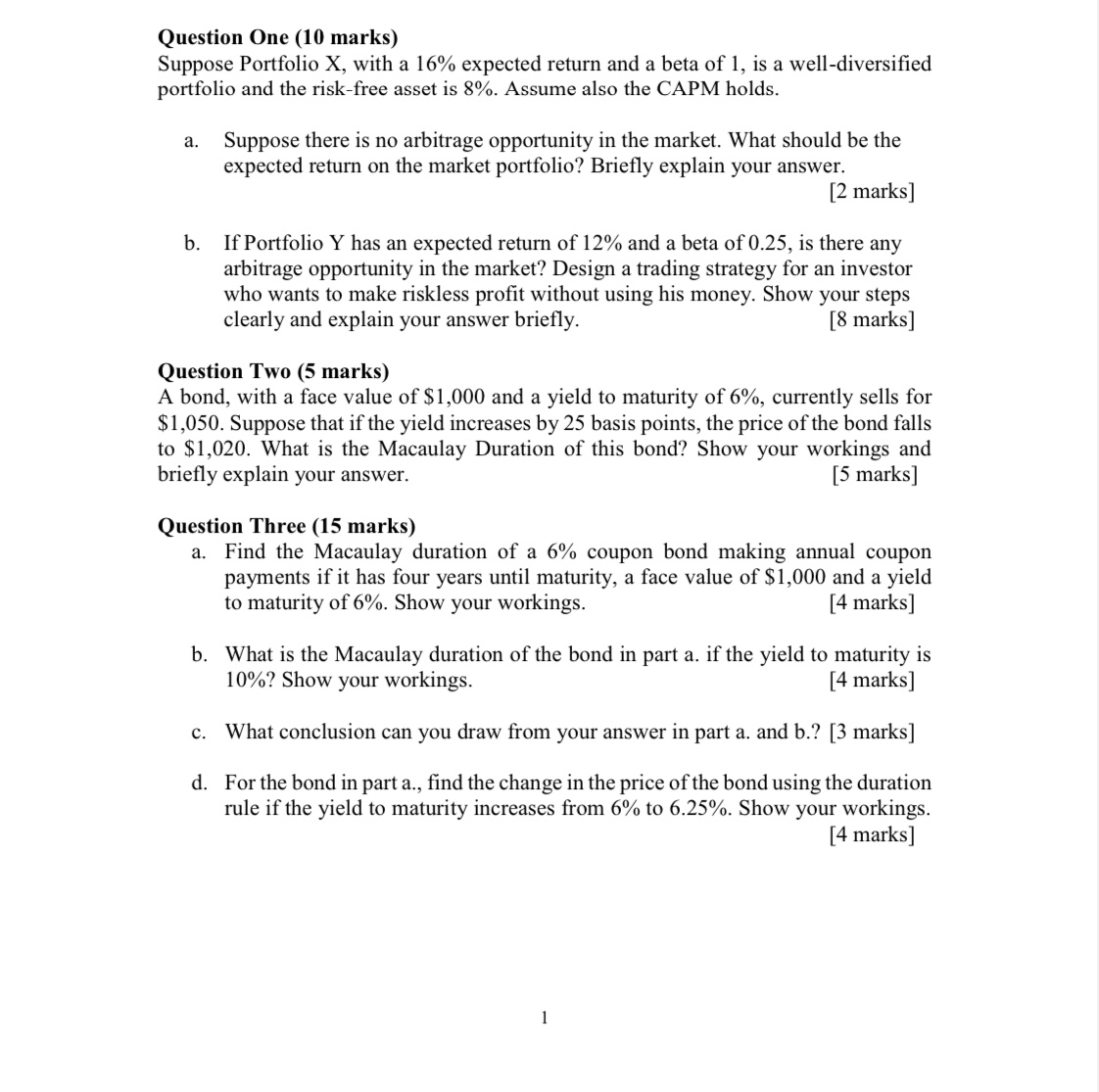

(Solved): Question One (10 marks) Suppose Portfolio X, with a 16% expected return and a beta of 1 , is a well- ...

Question One (10 marks) Suppose Portfolio X, with a

16%expected return and a beta of 1 , is a well-diversified portfolio and the risk-free asset is

8%. Assume also the CAPM holds. a. Suppose there is no arbitrage opportunity in the market. What should be the expected return on the market portfolio? Briefly explain your answer. [2 marks] b. If Portfolio Y has an expected return of

12%and a beta of 0.25 , is there any arbitrage opportunity in the market? Design a trading strategy for an investor who wants to make riskless profit without using his money. Show your steps clearly and explain your answer briefly. [8 marks] Question Two (5 marks) A bond, with a face value of

$1,000and a yield to maturity of

6%, currently sells for

$1,050. Suppose that if the yield increases by 25 basis points, the price of the bond falls to

$1,020. What is the Macaulay Duration of this bond? Show your workings and briefly explain your answer. [5 marks] Question Three (15 marks) a. Find the Macaulay duration of a

6%coupon bond making annual coupon payments if it has four years until maturity, a face value of

$1,000and a yield to maturity of

6%. Show your workings. [4 marks] b. What is the Macaulay duration of the bond in part a. if the yield to maturity is

10%? Show your workings. [4 marks] c. What conclusion can you draw from your answer in part a. and b.? [3 marks] d. For the bond in part a., find the change in the price of the bond using the duration rule if the yield to maturity increases from

6%to

6.25%. Show your workings. [4 marks] 1