Home /

Expert Answers /

Accounting /

question-b-how-to-do-statutory-business-income-in-format-b-statutory-business-income-of-daisy-ca-pa782

(Solved): Question b how to do statutory business income in format B) Statutory Business Income of Daisy Ca ...

Question b how to do statutory business income in format

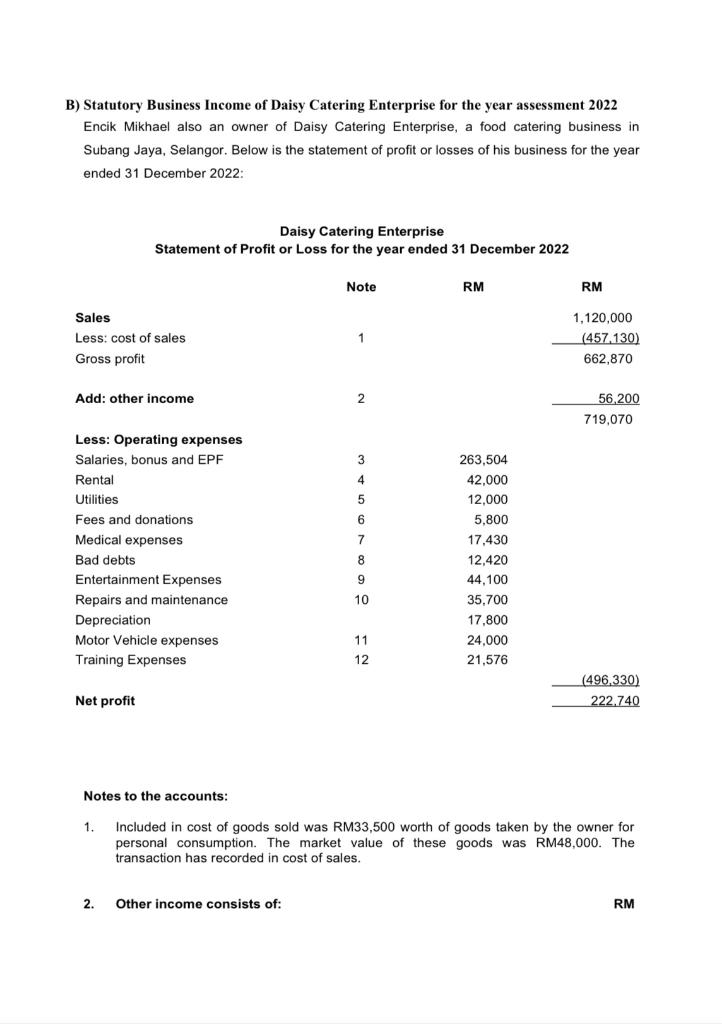

B) Statutory Business Income of Daisy Catering Enterprise for the year assessment 2022 Encik Mikhael also an owner of Daisy Catering Enterprise, a food catering business in Subang Jaya, Selangor. Below is the statement of profit or losses of his business for the year ended 31 December 2022: Daisy Catering Enterprise Statement of Profit or Loss for the year ended 31 December 2022 Notes to the accounts: 1. Included in cost of goods sold was RM33,500 worth of goods taken by the owner for personal consumption. The market value of these goods was RM48,000. The transaction has recorded in cost of sales.

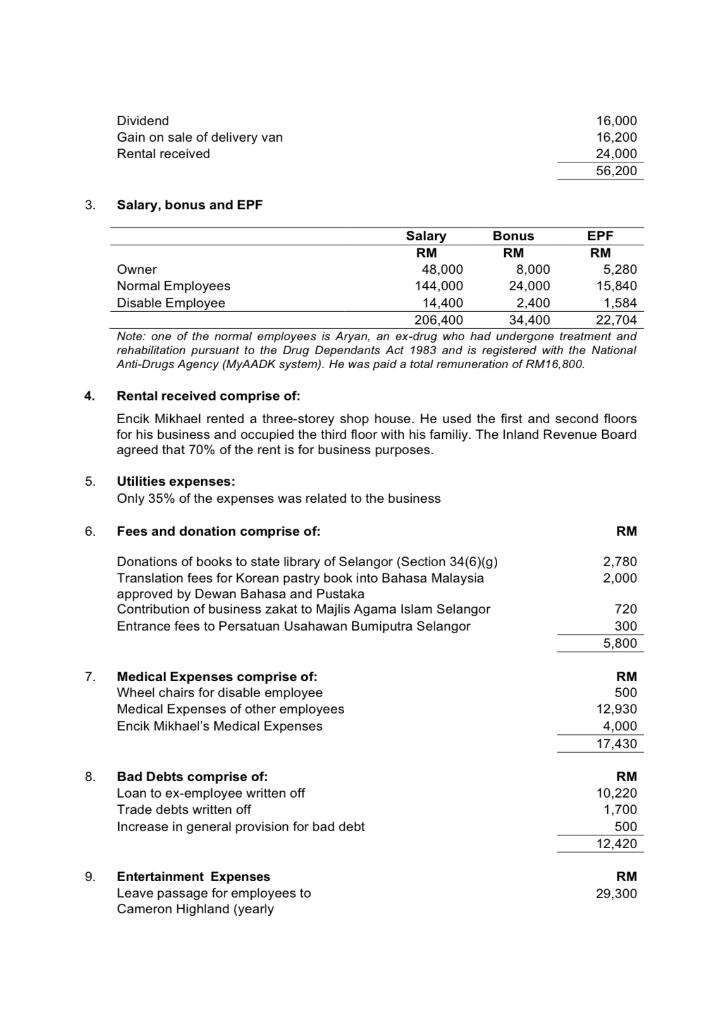

Dividend Gain on sale of delivery van Rental received 3. Salary, bonus and EPF Note: one of the normal employees is Aryan, an ex-drug who had undergone treatment and rehabilitation pursuant to the Drug Dependants Act 1983 and is registered with the National Anti-Drugs Agency (MyAADK system). He was paid a total remuneration of RM16,800. 4. Rental received comprise of: Encik Mikhael rented a three-storey shop house. He used the first and second floors for his business and occupied the third floor with his familiy. The Inland Revenue Board agreed that \( 70 \% \) of the rent is for business purposes. 5. Utilities expenses: Only \( 35 \% \) of the expenses was related to the business

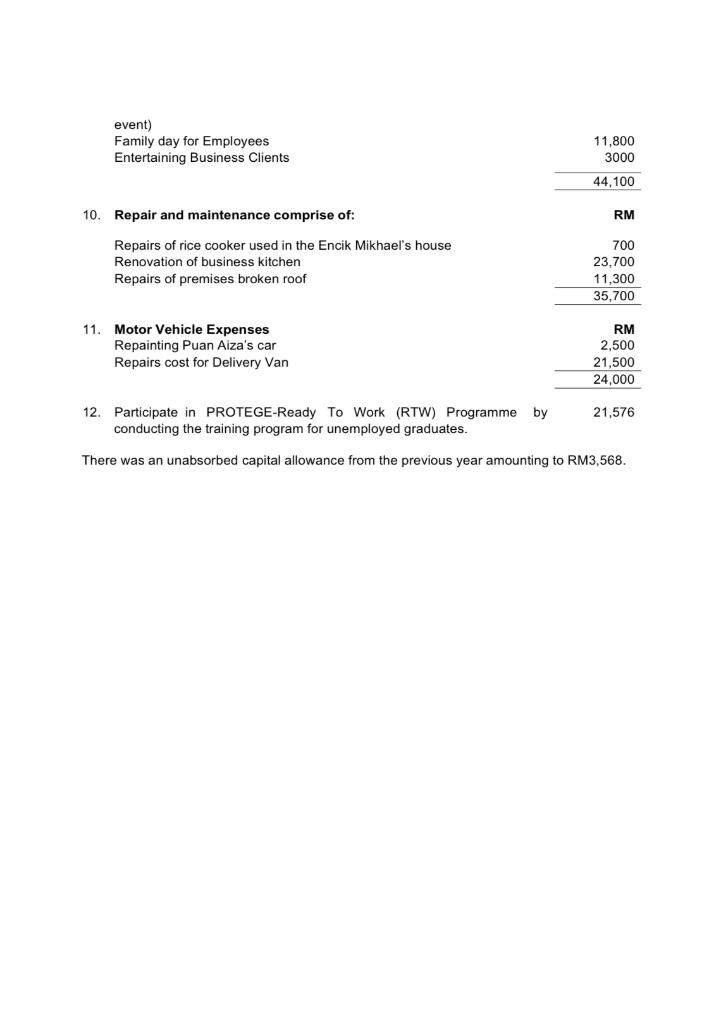

conducting the training program for unemployed graduates. There was an unabsorbed capital allowance from the previous year amounting to RM3,568.

Expert Answer

1 General direction The response gave beneath has been created in a reasonable bit by bit way. 2 Bit by bit Stage 1 Calculation of