Home /

Expert Answers /

Economics /

question-2-this-question-uses-the-general-monetary-model-where-l-is-no-longer-assumed-constant-an-pa277

(Solved): Question 2. This question uses the general monetary model, where L is no longer assumed constant an ...

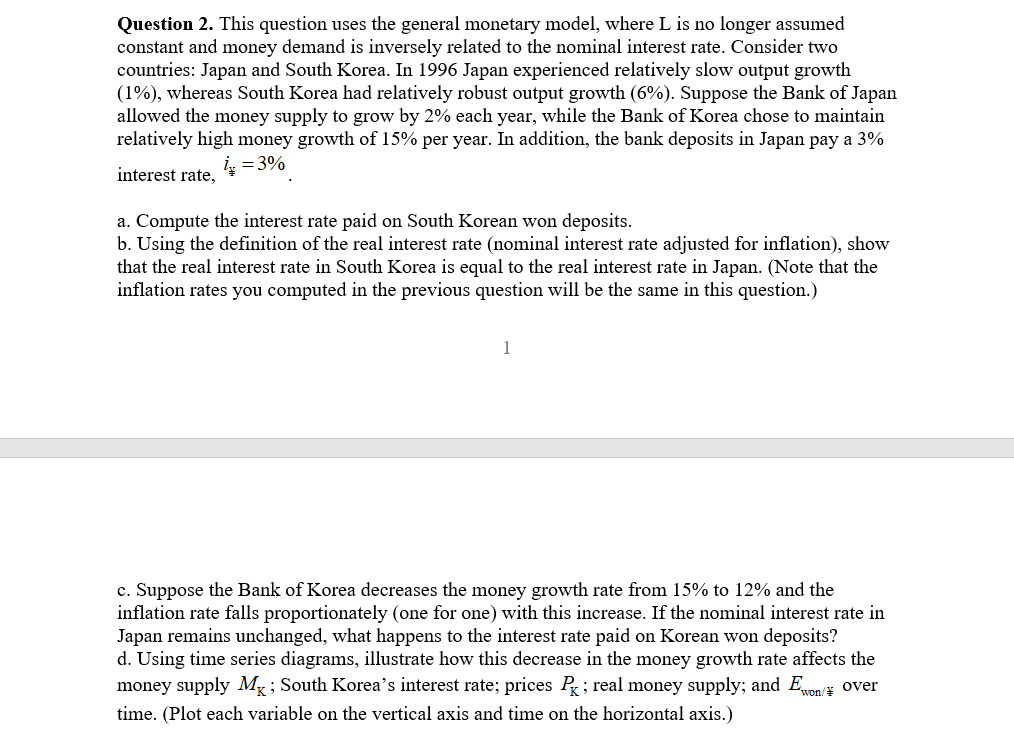

Question 2. This question uses the general monetary model, where is no longer assumed constant and money demand is inversely related to the nominal interest rate. Consider two countries: Japan and South Korea. In 1996 Japan experienced relatively slow output growth (1\%), whereas South Korea had relatively robust output growth (6\%). Suppose the Bank of Japan allowed the money supply to grow by each year, while the Bank of Korea chose to maintain relatively high money growth of per year. In addition, the bank deposits in Japan pay a 3\% interest rate, . a. Compute the interest rate paid on South Korean won deposits. b. Using the definition of the real interest rate (nominal interest rate adjusted for inflation), show that the real interest rate in South Korea is equal to the real interest rate in Japan. (Note that the inflation rates you computed in the previous question will be the same in this question.) 1 c. Suppose the Bank of Korea decreases the money growth rate from to and the inflation rate falls proportionately (one for one) with this increase. If the nominal interest rate in Japan remains unchanged, what happens to the interest rate paid on Korean won deposits? d. Using time series diagrams, illustrate how this decrease in the money growth rate affects the money supply ; South Korea's interest rate; prices ; real money supply; and over time. (Plot each variable on the vertical axis and time on the horizontal axis.)