(Solved): QUESTION 2 (20 MARKS) REQUIRED 2.1 Use the information provided below to prepare the Income Statemen ...

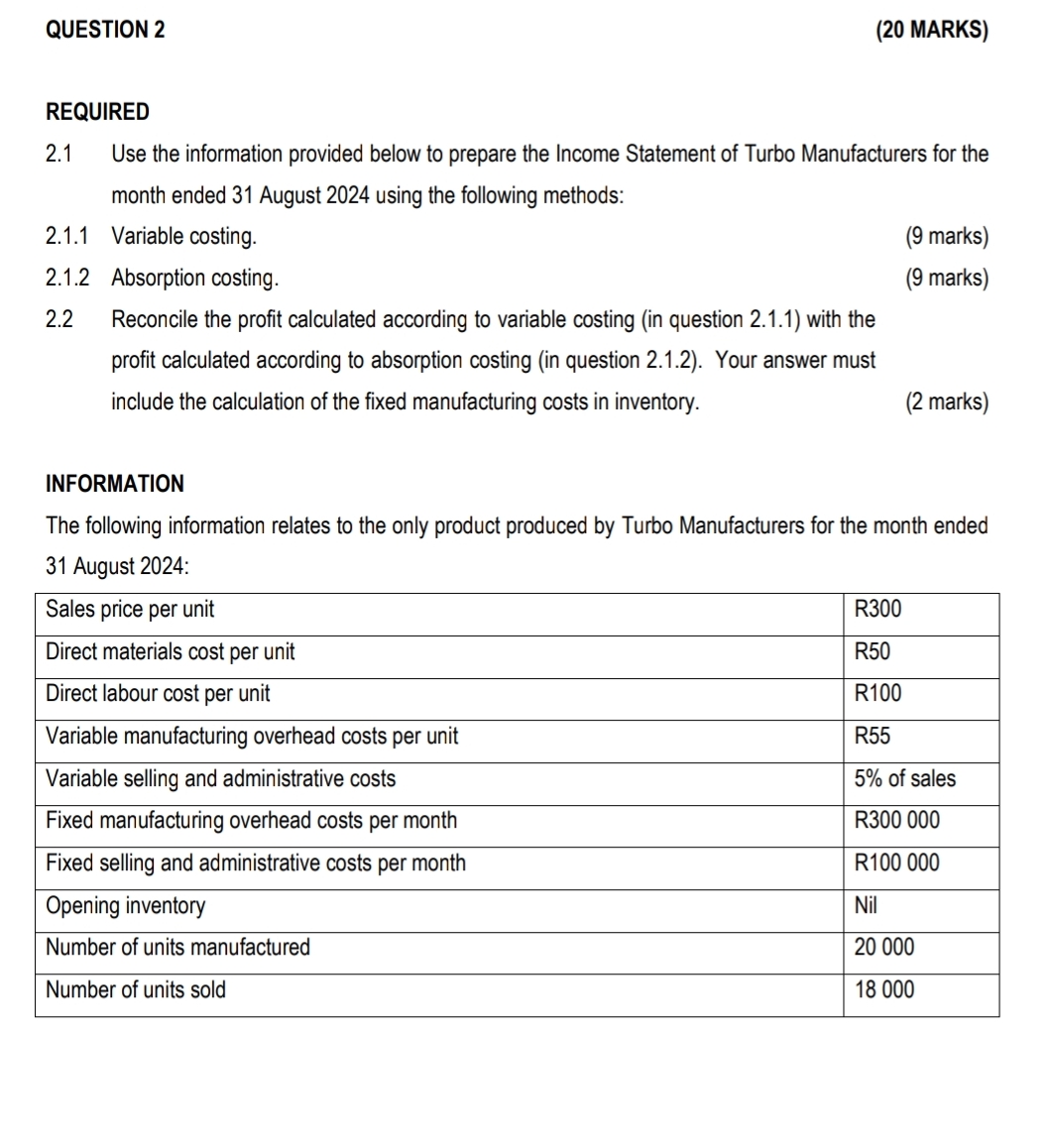

QUESTION 2 (20 MARKS) REQUIRED 2.1 Use the information provided below to prepare the Income Statement of Turbo Manufacturers for the month ended 31 August 2024 using the following methods: 2.1.1 Variable costing. (9 marks) 2.1.2 Absorption costing. (9 marks) 2.2 Reconcile the profit calculated according to variable costing (in question 2.1.1) with the profit calculated according to absorption costing (in question 2.1.2). Your answer must include the calculation of the fixed manufacturing costs in inventory. (2 marks) INFORMATION The following information relates to the only product produced by Turbo Manufacturers for the month ended 31 August 2024: \table[[Sales price per unit,R300],[Direct materials cost per unit,R50],[Direct labour cost per unit,R100],[Variable manufacturing overhead costs per unit,R55],[Variable selling and administrative costs,

5%of sales],[Fixed manufacturing overhead costs per month,R300 000],[Fixed selling and administrative costs per month,R100 000],[Opening inventory,Nil],[Number of units manufactured,20000],[Number of units sold,18000]]