(Solved): QUESTION 2 (20 Marks) 2.1 REQUIRED Use the information provided below to prepare the Income Statemen ...

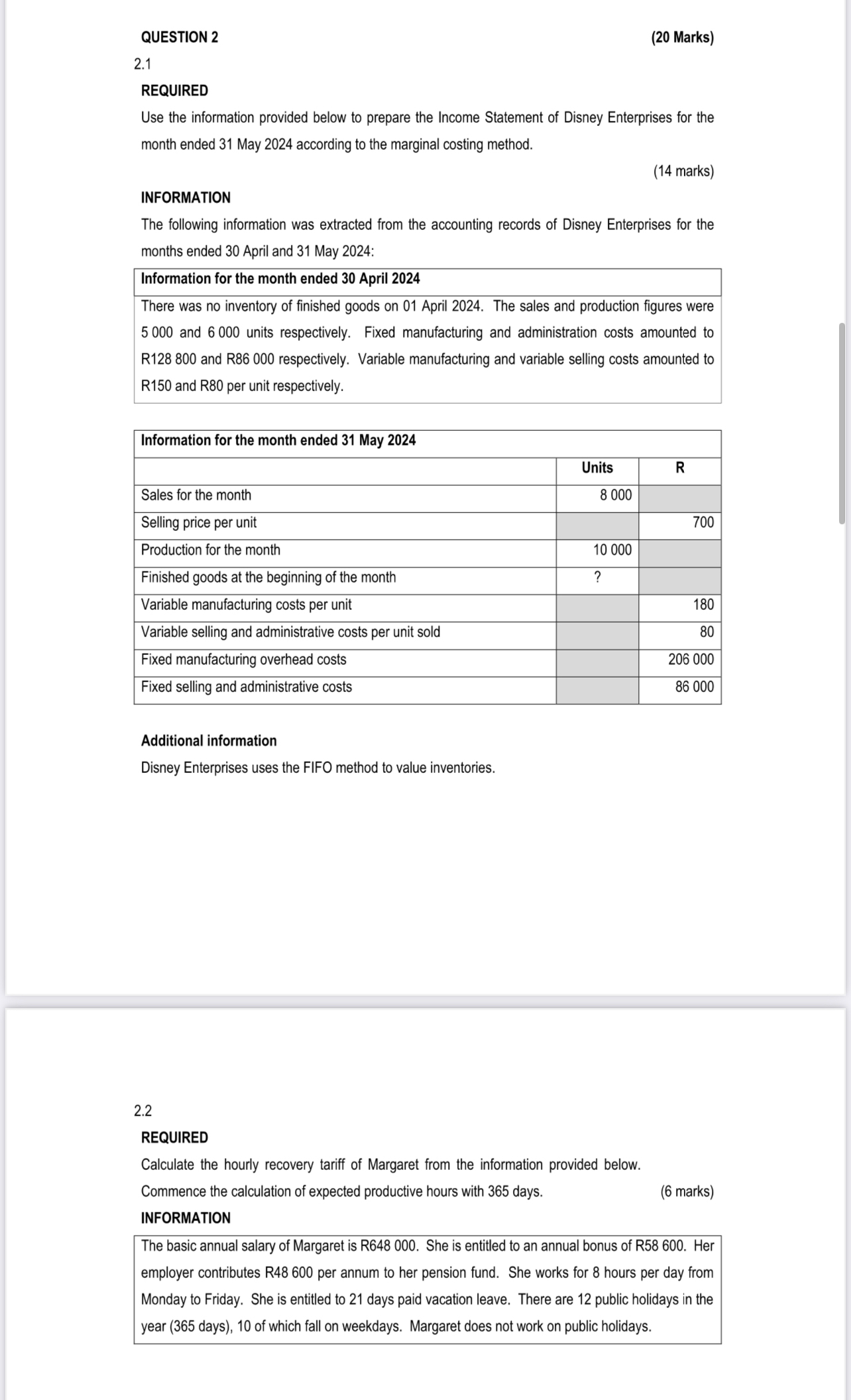

QUESTION 2 (20 Marks) 2.1 REQUIRED Use the information provided below to prepare the Income Statement of Disney Enterprises for the month ended 31 May 2024 according to the marginal costing method. (14 marks) INFORMATION The following information was extracted from the accounting records of Disney Enterprises for the months ended 30 April and 31 May 2024: Information for the month ended 30 April 2024 There was no inventory of finished goods on 01 April 2024. The sales and production figures were 5000 and 6000 units respectively. Fixed manufacturing and administration costs amounted to R128 800 and R86 000 respectively. Variable manufacturing and variable selling costs amounted to R150 and R80 per unit respectively. \table[[Information for the month ended 31 May 2024],[,Units,R],[Sales for the month,8000,],[Selling price per unit,,700],[Production for the month,10000,],[Finished goods at the beginning of the month,

?,],[Variable manufacturing costs per unit,,180],[Variable selling and administrative costs per unit sold,,80],[Fixed manufacturing overhead costs,,206000],[Fixed selling and administrative costs,,86000]] Additional information Disney Enterprises uses the FIFO method to value inventories. 2.2 REQUIRED Calculate the hourly recovery tariff of Margaret from the information provided below. Commence the calculation of expected productive hours with 365 days. (6 marks) INFORMATION The basic annual salary of Margaret is R648 000. She is entitled to an annual bonus of R58 600. Her employer contributes R48 600 per annum to her pension fund. She works for 8 hours per day from Monday to Friday. She is entitled to 21 days paid vacation leave. There are 12 public holidays in the year ( 365 days), 10 of which fall on weekdays. Margaret does not work on public holidays.