Home /

Expert Answers /

Accounting /

quatro-company-issues-bonds-dated-january-1-2021-with-a-par-value-of-870-000-the-bonds-39-annual-pa897

(Solved): Quatro Company issues bonds dated January 1, 2021, with a par value of $870,000. The bonds' annual ...

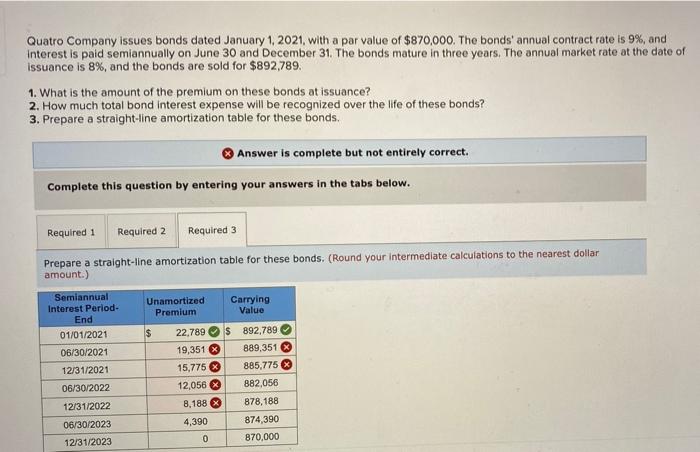

Quatro Company issues bonds dated January 1, 2021, with a par value of $870,000. The bonds' annual contract rate is 9%, and interest is paid semiannually on June 30 and December 31. The bonds mature in three years. The annual market rate at the date of issuance is 8%, and the bonds are sold for $892,789. 1. What is the amount of the premium on these bonds at issuance? 2. How much total bond interest expense will be recognized over the life of these bonds? 3. Prepare a straight-line amortization table for these bonds. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare a straight-line amortization table for these bonds. (Round your intermediate calculations to the nearest dollar amount.) Semiannual Interest Period- End Unamortized Premium Carrying. Value 01/01/2021 $ 22,789 $ 892,789 06/30/2021 19,351 x 889,351 x 12/31/2021 15,775 885,775 06/30/2022 12,056 882,056 12/31/2022 878,188 06/30/2023 874,390 12/31/2023 870,000 8,188 X 4,390 0