Home /

Expert Answers /

Accounting /

quasam-marufacturing-lld-has-three-asseta-quasarnis-your-end-is-june-30-the-assets-39-costs-eatim-pa358

(Solved): Quasam Marufacturing Lld. has three asseta: Quasarnis your-end is June 30. The assets' costs, eatim ...

Quasam Marufacturing Lld. has three asseta: Quasarnis your-end is June 30. The assets' costs, eatimaled reaidual value, useful INo, and thoir carrying valve on July 1, 2015 are listed in the following table: (Cickicon lo view the asseta ). During 2015, Guasam oumdelend the following transactons relaled to suset ratenmect: (Cirksthe ioon to view the trankactions) Refirrmersh

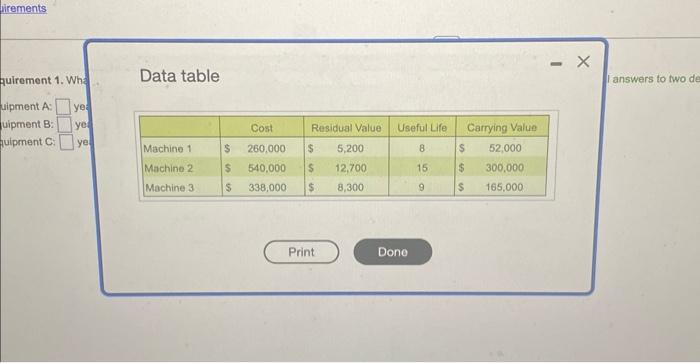

quirement 1. Wha - Data table I answers to two uipment ye: uipment ye quipment C: ye Print Done

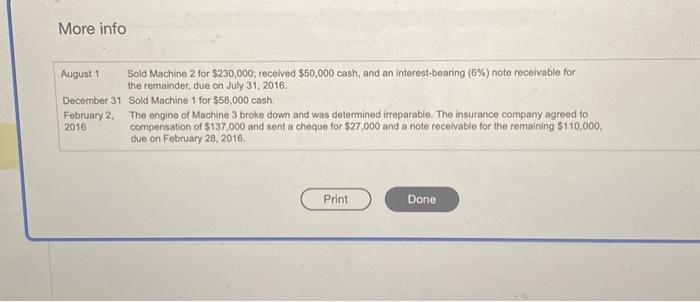

More info August 1 Sold Machine 2 for ; received cash, and an interest-bearing note receivable for the remainder, due on July . December 31 Sold Machine 1 for cash. February 2, The engine of Machine 3 broke down and was determined irreparable. The insurance company agreed to 2016 compensation of and sent a cheque for and a note rocelvable for the remaining , due en February 28, 2016.

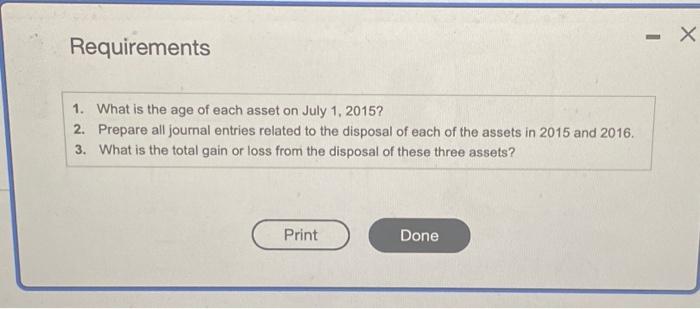

Requirements 1. What is the age of each asset on July 2. Prepare all journal entries related to the disposal of each of the assets in 2015 and 2016. 3. What is the total gain or loss from the disposal of these three assets?

Expert Answer

1) What is the age of each asset on July 1, 2015?Machine 1 depreciation value = (cost - scrap)/useful life(260000-5200)/8 = 254800/8 = 31850GIVEN THE CARRYING VALUE IS 52000Age = (cost - carrying value)/ depreciation value260000 - 52000 = 208000 208000/31850 = 6.5therefore the age of machine 1 is 6 years 5 months.Machine 2 depreciation value =(cost - scrap)/useful life(540000 - 12700)/15 =527300/15 = 35,153.33Age = (cost - carrying value)/ depreciation value=(540000-300000)/35153.33 = 240000/35153.33= 6.8therefore age of machine 2 is 6 years 8 monthsMachine 3 depreciation value = (cost - scrap)/useful life(338000 - 8300)/9 = 36633.33Age = (cost - carrying value)/ depreciation value=(338000-165000)/36633.33 = 173000/36633.33 =4.7Therefore the age of machine 3 is 4 years 7 months appro