Home /

Expert Answers /

Accounting /

problem-set-i-accounting-for-income-tax-problem-set-20-points-taxable-income-and-pretax-financi-pa560

(Solved): Problem Set I: Accounting for Income Tax Problem Set (20 points): Taxable income and pretax financi ...

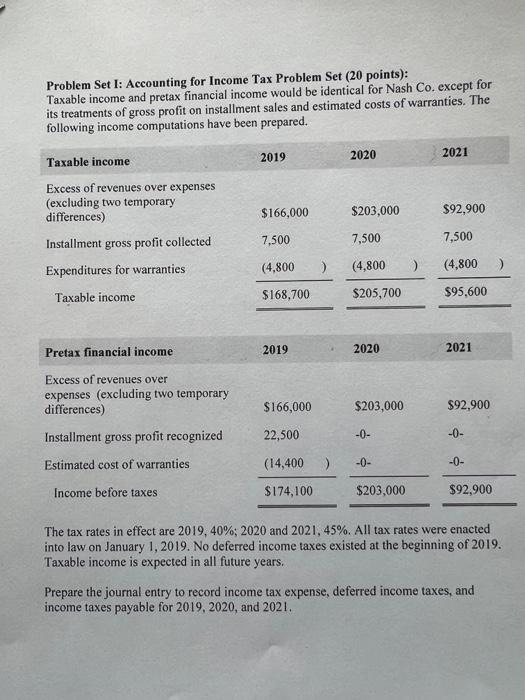

Problem Set I: Accounting for Income Tax Problem Set (20 points): Taxable income and pretax financial income would be identical for Nash Co. except for its treatments of gross profit on installment sales and estimated costs of warranties. The call...inn inonma enmnutations have been prepared. into law on January 1, 2019. No deferred income taxes existed at the beginning of 2019. Taxable income is expected in all future years. Prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2019,2020 , and 2021 .

Expert Answer

Prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2019,2020 , and 2021 :Working Note :Decemb