Home /

Expert Answers /

Accounting /

problem-1-29-a-brief-overview-of-capital-gains-and-losses-lo-1-8-compute-the-realized-and-recogni-pa693

(Solved): Problem 1-29 A Brief Overview of Capital Gains and Losses (LO 1.8) Compute the realized and recogni ...

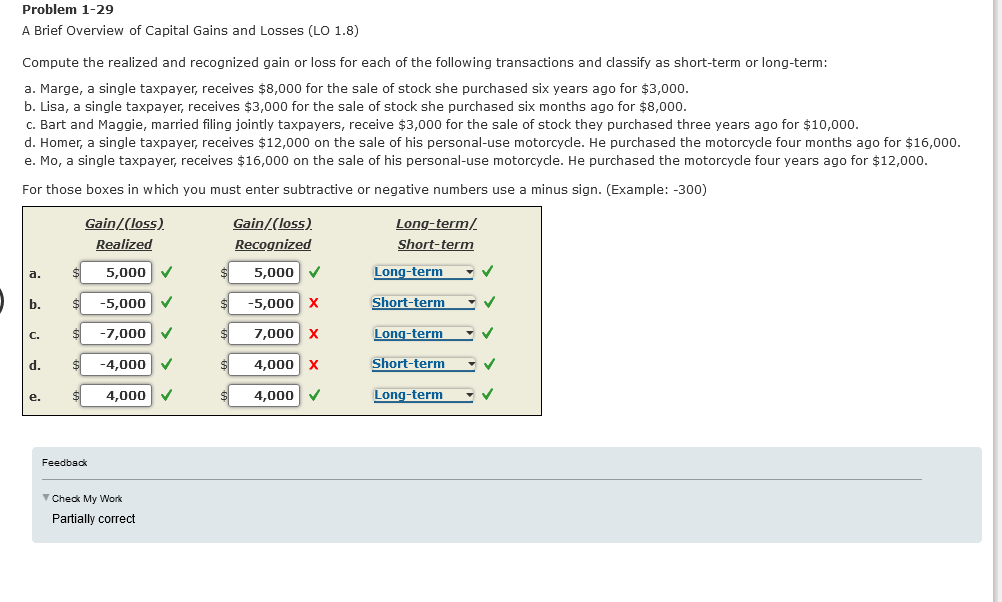

Problem 1-29 A Brief Overview of Capital Gains and Losses (LO 1.8) Compute the realized and recognized gain or loss for each of the following transactions and classify as short-term or long-term: a. Marge, a single taxpayer, receives for the sale of stock she purchased six years ago for . b. Lisa, a single taxpayer, receives for the sale of stock she purchased six months ago for . c. Bart and Maggie, married filing jointly taxpayers, receive for the sale of stock they purchased three years ago for . d. Homer, a single taxpayer, receives on the sale of his personal-use motorcycle. He purchased the motorcycle four months ago for . e. Mo, a single taxpayer, receives on the sale of his personal-use motorcycle. He purchased the motorcycle four years ago for . For those boxes in which you must enter subtractive or negative numbers use a minus sign. (Example: -300 )