Home /

Expert Answers /

Accounting /

presented-here-are-the-comparative-balance-sheets-of-hames-incorporated-at-december-31-2023-and-2-pa302

(Solved): Presented here are the comparative balance sheets of Hames Incorporated at December 31,2023 and 2 ...

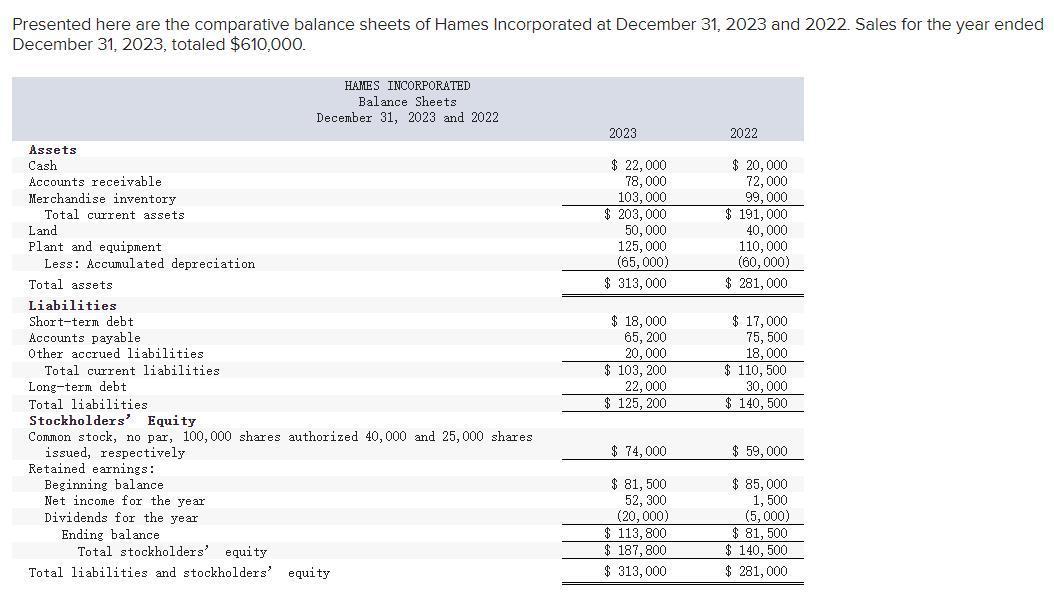

Presented here are the comparative balance sheets of Hames Incorporated at December 31,2023 and 2022 . Sales for the year ended December 31,2023 , totaled \( \$ 610,000 \)

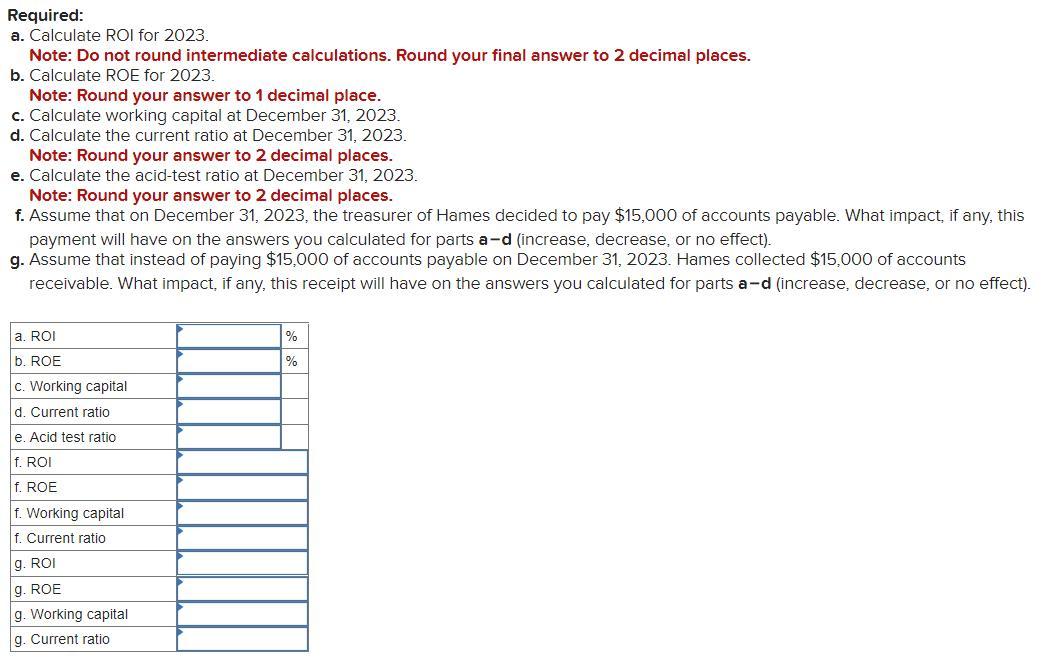

Required: a. Calculate ROI for \( 2023 . \) Note: Do not round intermediate calculations. Round your final answer to 2 decimal places. b. Calculate ROE for 2023 . Note: Round your answer to 1 decimal place. c. Calculate working capital at December 31, 2023 . d. Calculate the current ratio at December 31,2023 . Note: Round your answer to 2 decimal places. e. Calculate the acid-test ratio at December 31,2023 . Note: Round your answer to 2 decimal places. f. Assume that on December 31,2023 , the treasurer of Hames decided to pay \( \$ 15,000 \) of accounts payable. What impact, if any, this payment will have on the answers you calculated for parts a-d (increase, decrease, or no effect). g. Assume that instead of paying \( \$ 15,000 \) of accounts payable on December 31,2023 . Hames collected \( \$ 15,000 \) of accounts receivable. What impact, if any, this receipt will have on the answers you calculated for parts a-d (increase, decrease, or no effect).