Home /

Expert Answers /

Accounting /

prepare-an-unadjusted-trial-balance-required-information-the-following-information-applies-to-the-pa390

(Solved): prepare an unadjusted trial balance. Required information [The following information applies to the ...

prepare an unadjusted trial balance.

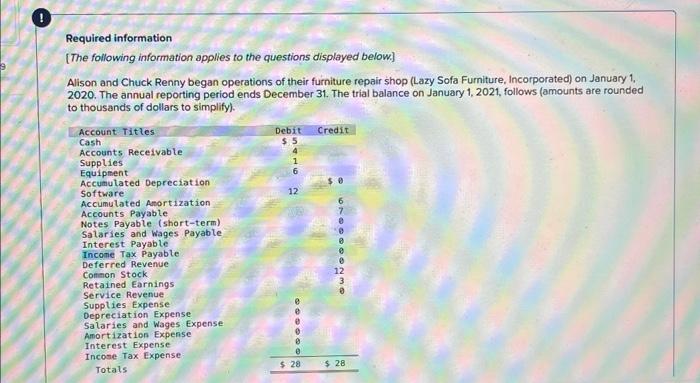

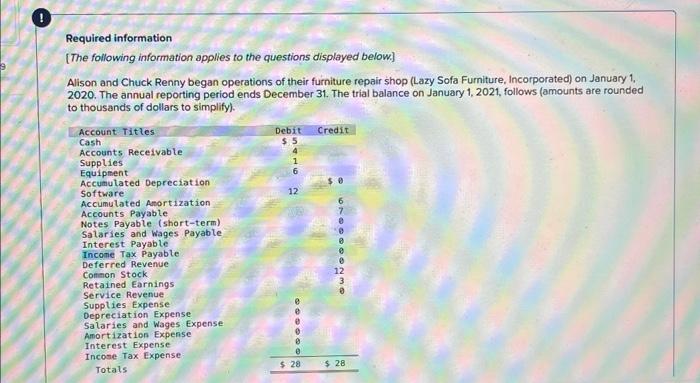

Required information [The following information applies to the questions displayed below] Alison and Chuck Renny began operations of their furniture repair shop (Lazy Sofa Furniture, Incorporated) on January 1. 2020. The annual reporting period ends December 31 . The trial balance on January 1,2021, follows (amounts are rounded to thousands of dollars to simplify).

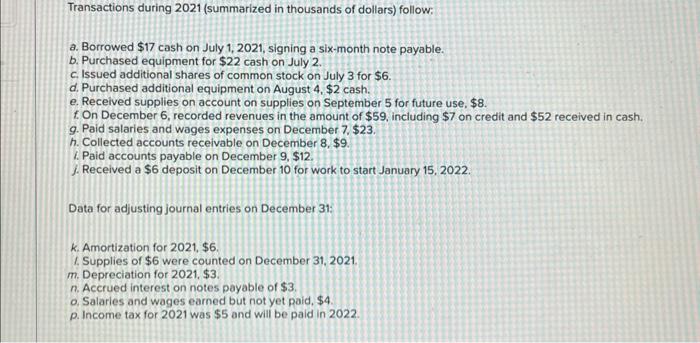

Transactions during 2021 (summarized in thousands of dollars) follow: a. Borrowed cash on July 1,2021, signing a six-month note payable. b. Purchased equipment for cash on July 2 . c. Issued additional shares of common stock on July 3 for . d. Purchased additional equipment on August 4, \$2 cash. e. Received supplies on account on supplies on September 5 for future use, . f. On December 6 , recorded revenues in the amount of , including on credit and received in cash. g. Paid salaries and wages expenses on December . h. Collected accounts receivable on December . 1. Paid accounts payable on December . 7. Received a deposit on December 10 for work to start January 15, 2022. Data for adjusting journal entries on December 31: k. Amortization for . 1. Supplies of were counted on December 31, 2021. m. Depreciation for 2021, \$3. n. Accrued interest on notes payable of . , Salaries and wages earned but not yet paid, \$4 p. Income tax for 2021 was and will be paid in 2022 .

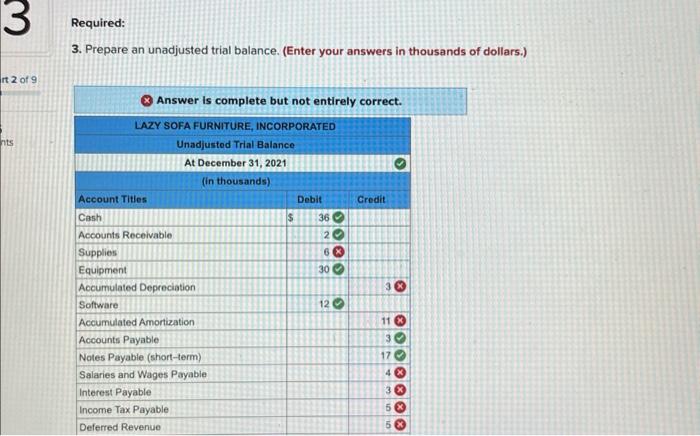

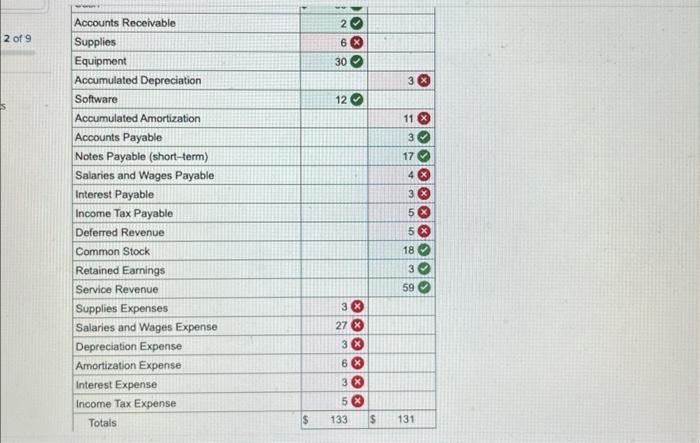

3. Prepare an unadjusted trial balance. (Enter your answers in thousands of dollars.)

2 of 9 \begin{tabular}{|c|c|c|} \hline Accounts Receivable & 20 & \\ \hline Supplies & & \\ \hline Equipment & 300 & \\ \hline Accumulated Depreciation & & \\ \hline Software & 120 & \\ \hline Accumulated Amortization & & \\ \hline Accounts Payable & & 30 \\ \hline Notes Payable (short-term) & & 170 \\ \hline Salaries and Wages Payable & & \\ \hline Interest Payable & & \\ \hline Income Tax Payable & & \\ \hline Deferred Revenue & & \\ \hline Common Stock & & 180 \\ \hline Retained Earnings & & 30 \\ \hline Service Revenue & & 590 \\ \hline Supplies Expenses & & \\ \hline Salaries and Wages Expense & & \\ \hline Depreciation Expense & 38 & \\ \hline Amortization Expense & 68 & \\ \hline Interest Expense & 38 & \\ \hline Income Tax Expense & & \\ \hline Totals & 133 & 131 \\ \hline \end{tabular}