Home /

Expert Answers /

Accounting /

prepare-a-statement-of-retained-earnings-for-the-year-ended-december-31-tip-assume-the-balance-in-r-pa153

(Solved): prepare a statement of retained earnings for the year ended December 31 TIP: Assume the balance in R ...

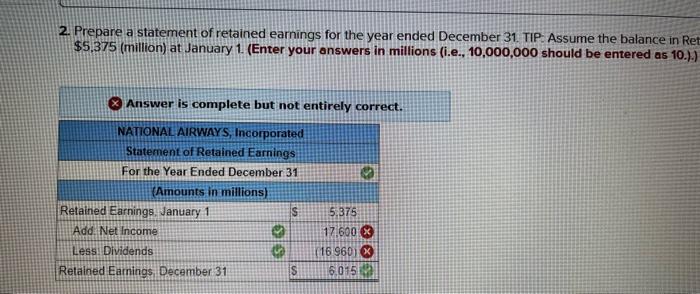

prepare a statement of retained earnings for the year ended December 31 TIP: Assume the balance in Retained Earnings was $5,375 (million) at January 1. (Enter your answers in millions (i.e., 10,000,000 should be entered as 10.).)

please help me with answers i got wrong

![Required information

[The following information applies to the questions displayed below.]

The following information was repo](https://media.cheggcdn.com/study/2b0/2b0a519a-cbb5-4e05-9923-544cccb35018/image)

![Required information

[The following information applies to the questions displayed below.]

The following information was repo](https://media.cheggcdn.com/study/2b0/2b0a519a-cbb5-4e05-9923-544cccb35018/image)

Required information [The following information applies to the questions displayed below.] The following information was reported in the December 31 financial statements of Nat alphabetically, amounts in millions). Accounts Payable $4,550 Accounts Receivable Aircraft Fuel Expense 590 8,800 Cash 2,980 Common Stock 1,225 Dividends 25 Equipment 14,490 Income Tax Expense 200 Interest Expense 140 Landing Fees Expense 3,200 Notes Payable 6,955 Repairs and Maintenance Expense 1,300 Retained Earnings (as of December 31) Salaries and Wages Expense 6,015 3,295 Supplies 685 Ticket Revenues 17,600 incomber 21. TIP Assume th Prepare a statem SISA

2. Prepare a statement of retained earnings for the year ended December 31. TIP: Assume the balance in Ret $5,375 (million) at January 1. (Enter your answers in millions (i.e., 10,000,000 should be entered as 10.).) Answer is complete but not entirely correct. NATIONAL AIRWAYS, Incorporated Statement of Retained Earnings For the Year Ended December 31 (Amounts in millions) 5.375 17.600 x (16 960) X 6.015 M Retained Earnings, January 1 Add. Net Income Less: Dividends Retained Earnings, December 31