Home /

Expert Answers /

Accounting /

practical-question-1-accounting-for-income-tax-current-tax-worksheet-9-marks-the-profit-befor-pa344

(Solved): Practical Question 1 - Accounting for Income Tax - Current Tax Worksheet - 9 Marks The profit befor ...

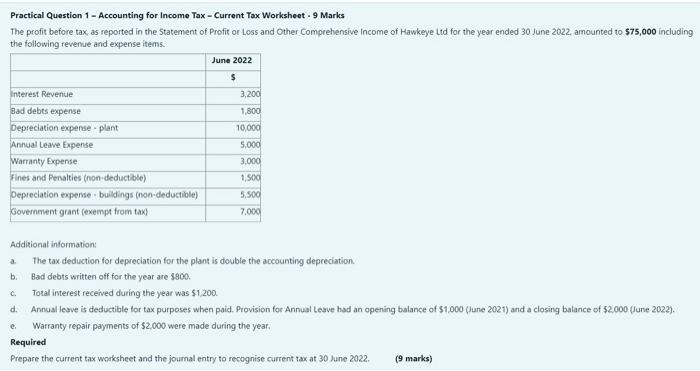

Practical Question 1 - Accounting for Income Tax - Current Tax Worksheet - 9 Marks The profit before tax, as reported in the Statement of Profit or Loss and Other Comprehensive income of Hawkeye tid for the year ended 30 June 2022 amounted to \( \$ 75,000 \) including the following revemue and expense items. Additional information: a. The tax deduction for depreciation for the plant is double the accounting depreciation. b. Bad debts written off for the year are \( \$ 900 \). c. Total interest received during the year was \( \$ 1,200 \) d. Annual leave is deductible for tax purposes when paid. Provision for Annual teave had an opening balance of \( \$ 1.000 \) (June 2021 ) and a closing balance of \( \$ 2.000 \) (June 2022). e. Warranty repair payments of \( \$ 2,000 \) were made during the year, Required Prepare the current tax worksheet and the journal entry to recognise current tax at 30 fune \( 2022 . \) (9 marks)