Home /

Expert Answers /

Civil Engineering /

please-show-all-steps-nbsp-an-old-duplex-was-bought-for-200-000-cash-both-sides-were-rent-pa580

(Solved): please show all steps An old duplex was bought for \( \$ 200,000 \) cash. Both sides were rent ...

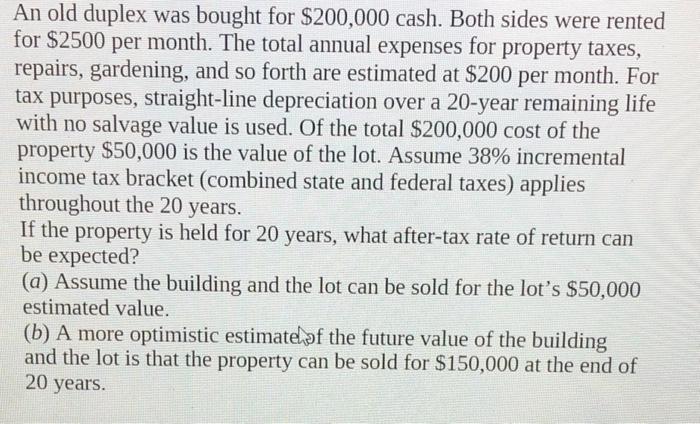

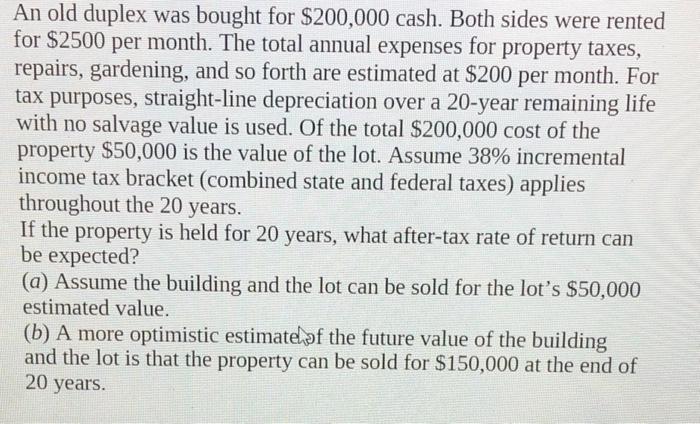

please show all steps

An old duplex was bought for \( \$ 200,000 \) cash. Both sides were rented for \( \$ 2500 \) per month. The total annual expenses for property taxes, repairs, gardening, and so forth are estimated at \$200 per month. For tax purposes, straight-line depreciation over a 20-year remaining life with no salvage value is used. Of the total \( \$ 200,000 \) cost of the property \( \$ 50,000 \) is the value of the lot. Assume \( 38 \% \) incremental income tax bracket (combined state and federal taxes) applies throughout the 20 years. If the property is held for 20 years, what after-tax rate of return can be expected? (a) Assume the building and the lot can be sold for the lot's \( \$ 50,000 \) estimated value. (b) A more optimistic estimatelof the future value of the building and the lot is that the property can be sold for \( \$ 150,000 \) at the end of 20 years.

Expert Answer

Given that, An old duplex was bought for= $200,000 cash. Both sides were rented for =$2500 per month. The total annual expenses for property taxes, re