(Solved): Please help me to get solve this Nat Crossman owns Appalachian Limited Home Design in Versailles, ...

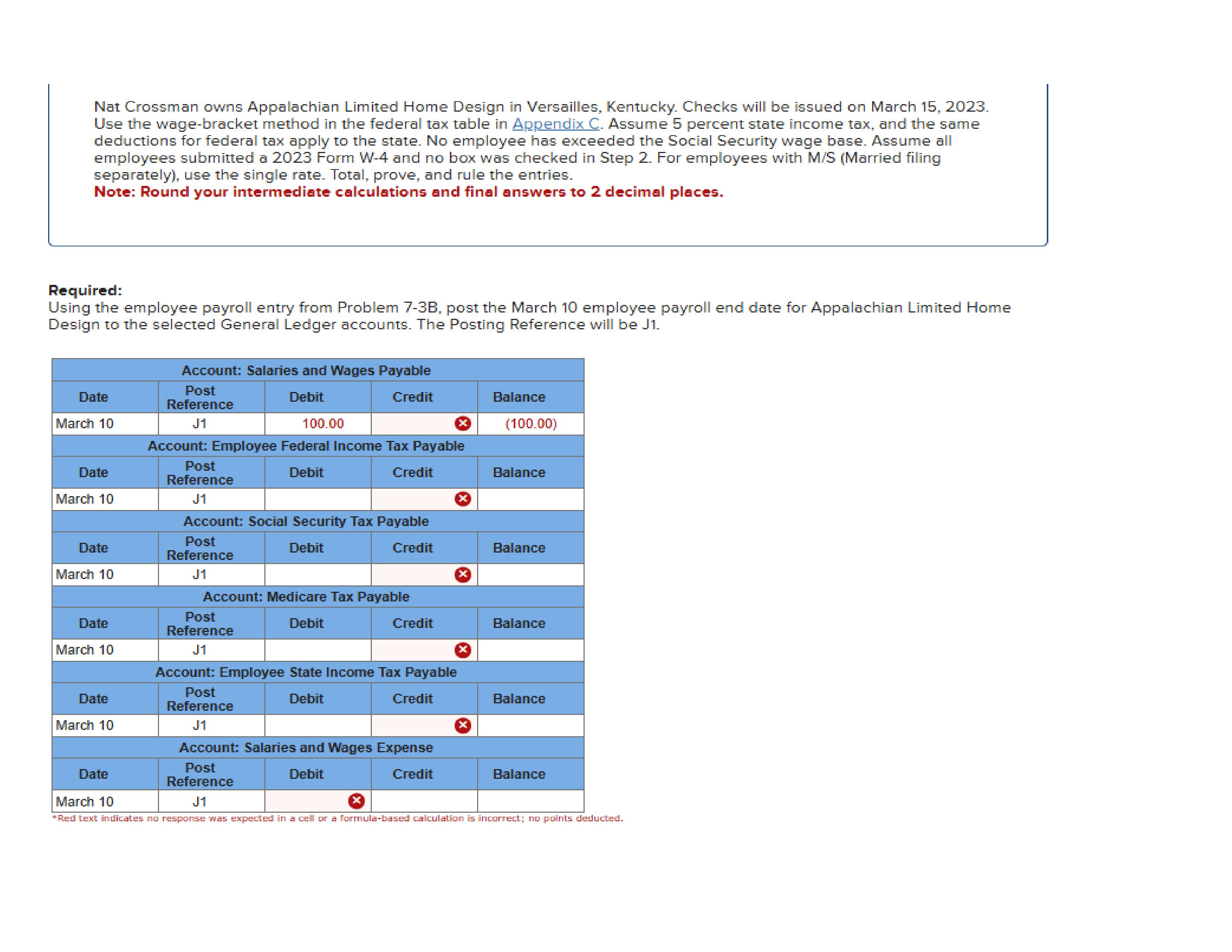

Please help me to get solve this Nat Crossman owns Appalachian Limited Home Design in Versailles, Kentucky. Checks will be issued on March 15, 2023. Use the wage-bracket method in the federal tax table in \( A \) ppendix C . Assume 5 percent state income tax, and the same deductions for federal tax apply to the state. No employee has exceeded the Social Security wage base. Assume all employees submitted a 2023 Form W-4 and no box was checked in Step 2 . For employees with M/S (Married filing separately), use the single rate. Total, prove, and rule the entries. Note: Round your intermediate calculations and final answers to \( \mathbf{2} \) decimal places. Required: Using the employee payroll entry from Problem 7-3B, post the March 10 employee payroll end date for Appalachian Limited Home Design to the selected General Ledger accounts. The Posting Reference will be J1. \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{Account: Salaries and Wages Payable} \\ \hline Date & Post Reference & Debit & Credit & Balance \\ \hline March 10 & J1 & 100.00 & \( \times \) & (100.00) \\ \hline \multicolumn{5}{|c|}{Account: Employee Federal Income Tax Payable} \\ \hline Date & Post Reference & Debit & Credit & Balance \\ \hline March 10 & J1 & & \( \times \) & \\ \hline \multicolumn{5}{|c|}{Account: Social Security Tax Payable} \\ \hline Date & Post Reference & Debit & Credit & Balance \\ \hline March 10 & J1 & & \( \times \) & \\ \hline \multicolumn{5}{|c|}{Account: Medicare Tax Payable} \\ \hline Date & Post Reference & Debit & Credit & Balance \\ \hline March 10 & J1 & & \( \times \) & \\ \hline \multicolumn{5}{|c|}{Account: Employee State Income Tax Payable} \\ \hline Date & Post Reference & Debit & Credit & Balance \\ \hline March 10 & J1 & & \( \times \) & \\ \hline \multicolumn{5}{|c|}{Account: Salaries and Wages Expense} \\ \hline Date & Post Reference & Debit & Credit & Balance \\ \hline March 10 & J1 & & & \\ \hline \end{tabular} * Red text indicates no response was expected in a cell or a formula-based calculation is incorrect; no points deducted.