Home /

Expert Answers /

Accounting /

paloma-company-has-four-employees-fica-social-security-taxes-are-6-2-of-the-first-pa966

(Solved): Paloma Company has four employees. FICA Social Security taxes are \( 6.2 \% \) of the first \( \$ ...

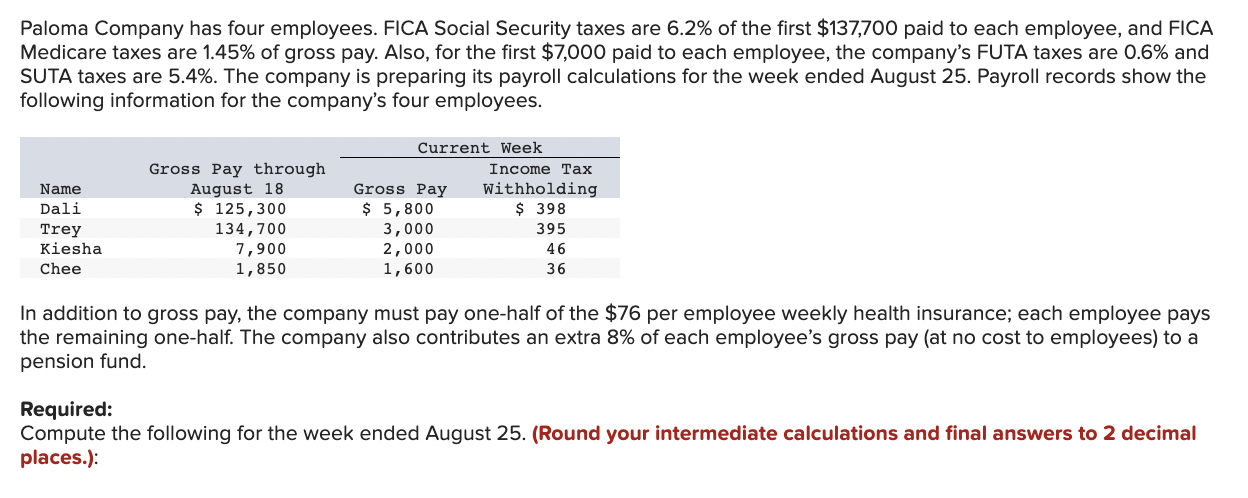

Paloma Company has four employees. FICA Social Security taxes are \( 6.2 \% \) of the first \( \$ 137,700 \) paid to each employee, and FICA Medicare taxes are \( 1.45 \% \) of gross pay. Also, for the first \( \$ 7,000 \) paid to each employee, the company's FUTA taxes are 0.6\% and SUTA taxes are 5.4\%. The company is preparing its payroll calculations for the week ended August 25 . Payroll records show the following information for the company's four employees. In addition to gross pay, the company must pay one-half of the \( \$ 76 \) per employee weekly health insurance; each employee pays the remaining one-half. The company also contributes an extra \( 8 \% \) of each employee's gross pay (at no cost to employees) to a pension fund. Required: Compute the following for the week ended August 25. (Round your intermediate calculations and final answers to 2 decimal places.):

Expert Answer

1) Employees' FICA Withholdings for Social Security Employee Earnings Subject Tax Rate Tax Amount to Tax Dali $5,800 6.20% $359.60 Trey ($137,700-$134