Home /

Expert Answers /

Accounting /

operating-section-of-statement-of-cash-flows-indirect-method-assume-following-are-the-income-sta-pa188

(Solved): Operating Section of Statement of Cash Flows (Indirect Method) Assume following are the income sta ...

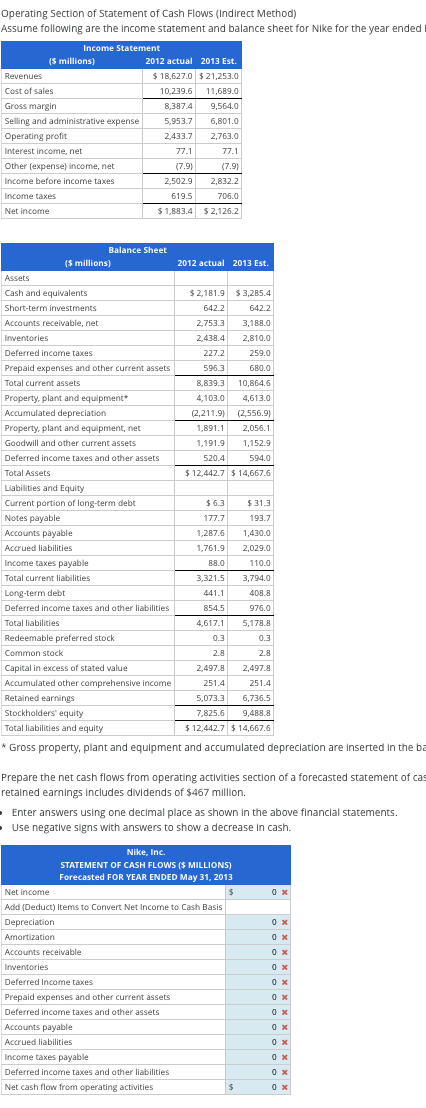

Operating Section of Statement of Cash Flows (Indirect Method) Assume following are the income statement and balance sheet for Nike for the year ended \begin{tabular}{|l|r|r|} \hline \multicolumn{2}{|c|}{ Income Statement } \\ \multicolumn{1}{|c|}{ (5 millions) } & 2012 actual & 2013 Est. \\ \hline Revenues & & \\ \hline Cost of sales & & \\ \hline Gross margin & & \\ \hline Selling and administrative expense & & \\ \hline Operating profit & & \\ \hline Interest income, net & & \\ \hline Other (expense) income, net & & \\ \hline Income before income taxes & & \\ \hline Income taxes & & \\ \hline Net income & & \\ \hline \end{tabular} Gross property, plant and equipment and accumulated depreclation are inserted in the ba Prepare the net cash flows from operating activities section of a forecasted statement of cas retained earnings includes dividends of million. Enter answers using one decimal place as shown in the above financial statements. Use negative signs with answers to show a decrease in cash.

Expert Answer

Statement of cash flow forecasted for the year ended 31 May 2023 :NIKE incSTATTEMENT OF CASH FLOWS($ Millions)Forecast