Home /

Expert Answers /

Accounting /

on-october-31-2021-damon-company-39-s-general-ledger-shows-a-checking-account-balance-of-8-448-the-pa849

(Solved): On October 31, 2021, Damon Company's general ledger shows a checking account balance of $8,448. The ...

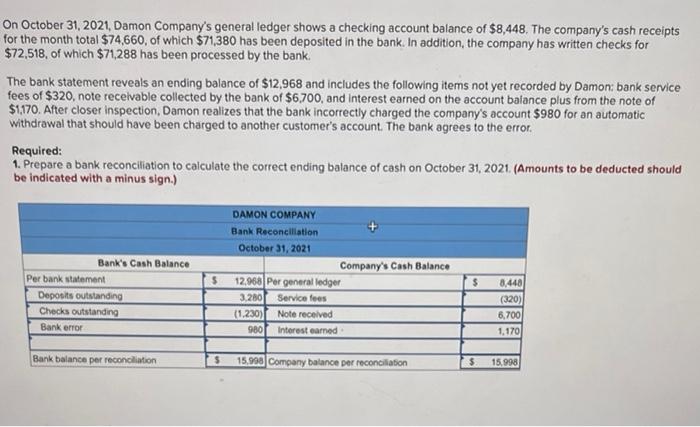

On October 31, 2021, Damon Company's general ledger shows a checking account balance of $8,448. The company's cash receipts for the month total $74,660, of which $71,380 has been deposited in the bank. In addition, the company has written checks for $72,518, of which $71,288 has been processed by the bank. The bank statement reveals an ending balance of $12,968 and includes the following items not yet recorded by Damon: bank service fees of $320, note receivable collected by the bank of $6,700, and interest earned on the account balance plus from the note of $1,170. After closer inspection, Damon realizes that the bank incorrectly charged the company's account $980 for an automatic withdrawal that should have been charged to another customer's account. The bank agrees to the error. Required: 1. Prepare a bank reconciliation to calculate the correct ending balance of cash on October 31, 2021. (Amounts to be deducted should be indicated with a minus sign.) Bank's Cash Balance Per bank statement Deposits outstanding Checks outstanding Bank error Bank balance per reconciliation DAMON COMPANY Bank Reconciliation October 31, 2021 S Company's Cash Balance $ 12.968 Per general ledger 3,280 Service fees (1.230) 980 Note received Interest earned 15.998 Company balance per reconciliation $ $ 8,448 (320) 6,700 1,170 15.998

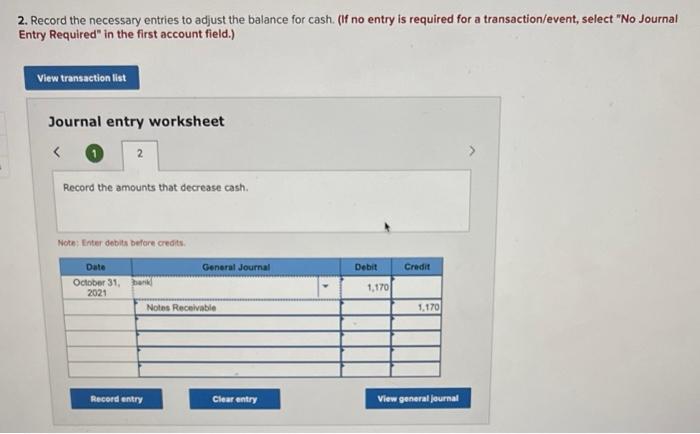

2. Record the necessary entries to adjust the balance for cash. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet < 2 Record the amounts that decrease cash. Note: Enter debits before credits. Date October 31, bank 2021 Record entry General Journal Notes Receivable Clear entry Debit 1,170 Credit 1,170 View general journal

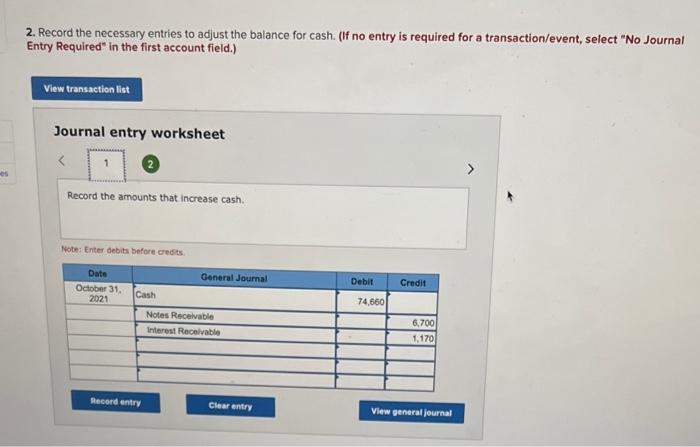

2. Record the necessary entries to adjust the balance for cash. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 1 Record the amounts that increase cash. Note: Enter debits before credits. Date October 31, Cash 2021 Record entry General Journal Notes Receivable Interest Receivable Clear entry Debit 74,660 Credit 6,700 1,170 View general journal