Home /

Expert Answers /

Accounting /

on-november-1-20y9-lexi-martin-established-an-interior-decorating-business-heritage-designs-du-pa155

(Solved): On November 1, 20Y9, Lexi Martin established an interior decorating business, Heritage Designs. Du ...

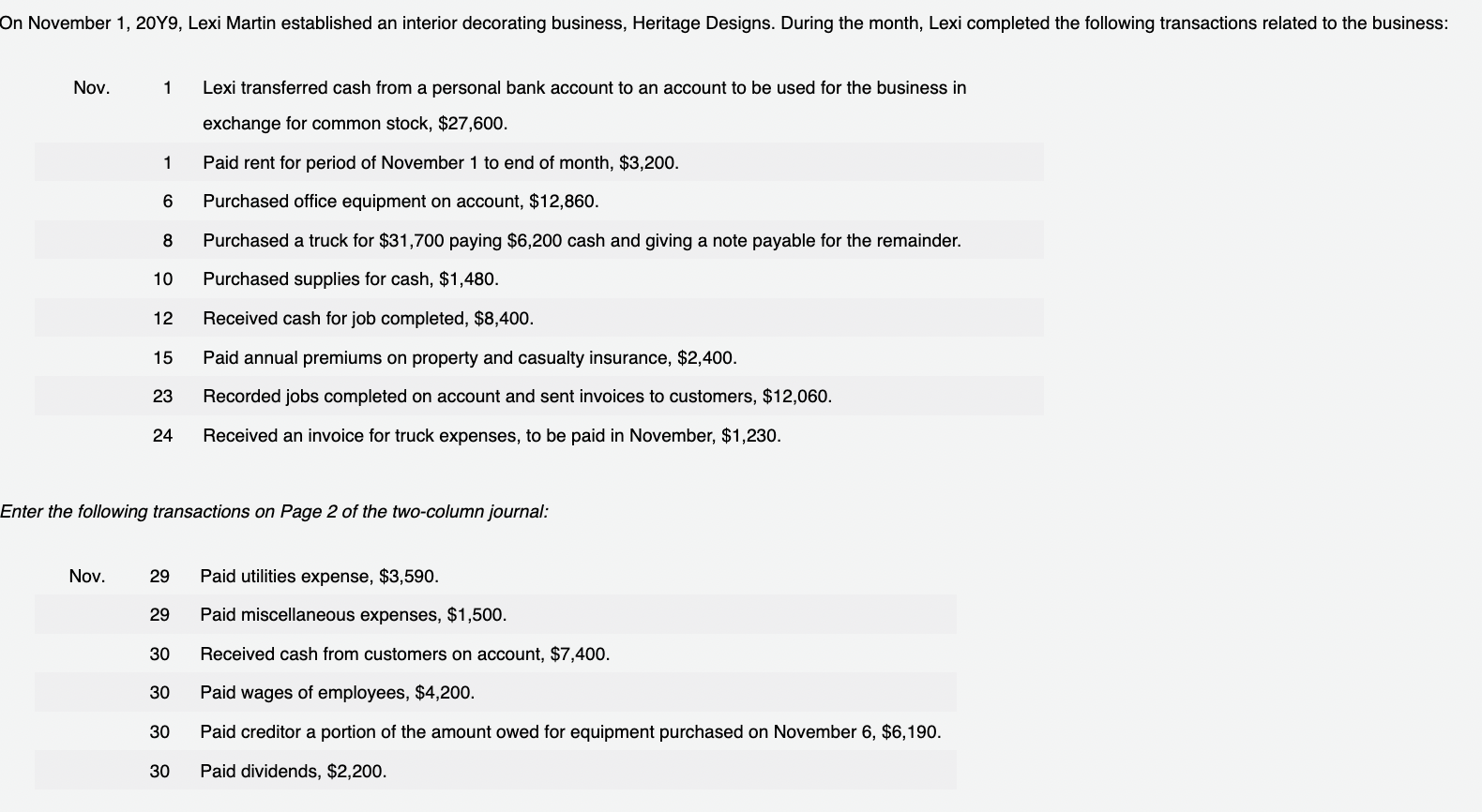

On November 1, 20Y9, Lexi Martin established an interior decorating business, Heritage Designs. During the month, Lexi completed the following transactions related to the business: Nov. 1 Lexi transferred cash from a personal bank account to an account to be used for the business in exchange for common stock, . Paid rent for period of November 1 to end of month, . 6 Purchased office equipment on account, . i Purchased a truck for paying cash and giving a note payable for the remainder. 10 Purchased supplies for cash, . Received cash for job completed, . 15 Paid annual premiums on property and casualty insurance, . 3 Recorded jobs completed on account and sent invoices to customers, . 24 Received an invoice for truck expenses, to be paid in November, . Enter the following transactions on Page 2 of the two-column journal: Nov. 29 Paid utilities expense, . 29 Paid miscellaneous expenses, . 30 Received cash from customers on account, . 0 Paid wages of employees, . 30 Paid creditor a portion of the amount owed for equipment purchased on November . Paid dividends, .

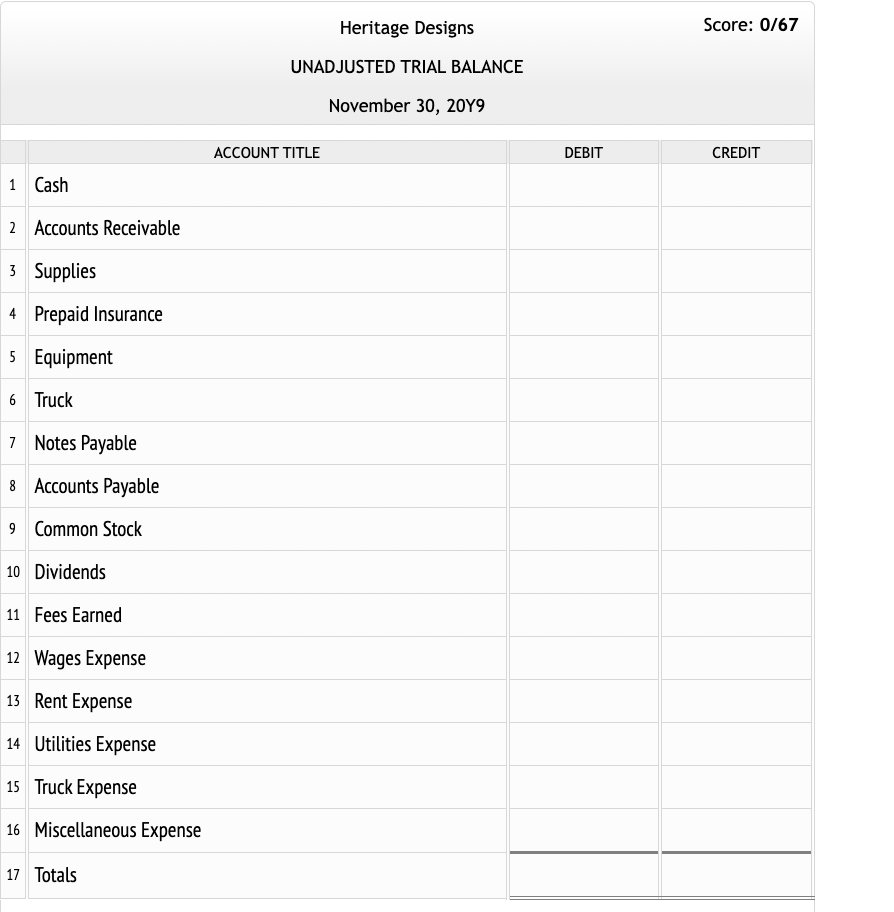

Heritage Designs Score: UNADJUSTED TRIAL BALANCE November 30, 20 Y9 ACCOUNT TITLE CREDIT 1 Cash 2 Accounts Receivable 3 Supplies 4 Prepaid Insurance 5 Equipment 6 Truck 7 Notes Payable 8 Accounts Payable 9 Common Stock 10 Dividends 11 Fees Earned 12 Wages Expense 13 Rent Expense 14 Utilities Expense 15 Truck Expense 16 Miscellaneous Expense 17 Totals

Expert Answer

The following transactions are put in two column journal :DateAccountDrCrCash$27,600Common Stock$27,600transferred cash to business bank account in ex