Home /

Expert Answers /

Accounting /

on-march-31-2024-canseco-plumbing-fixtures-purchased-equipment-for-44-000-residual-value-at-the-pa173

(Solved): On March 31, 2024, Canseco Plumbing Fixtures purchased equipment for $44,000. Residual value at the ...

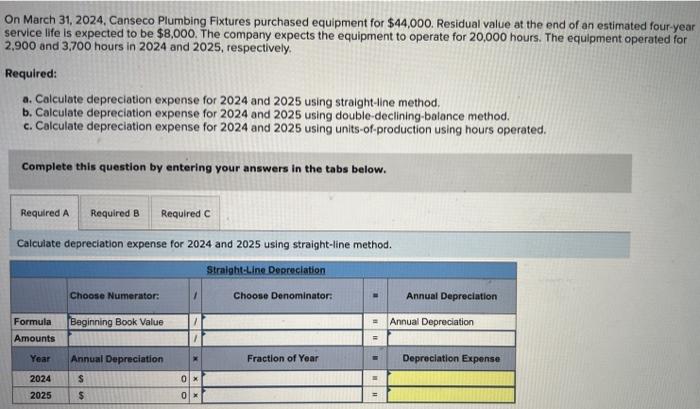

On March 31, 2024, Canseco Plumbing Fixtures purchased equipment for . Residual value at the end of an estimated four-year service life is expected to be . The company expects the equipment to operate for 20,000 hours. The equipment operated for 2,900 and 3,700 hours in 2024 and 2025, respectively. Required: a. Calculate depreciation expense for 2024 and 2025 using straight-line method. b. Calculate depreciation expense for 2024 and 2025 using double-declining-balance method. c. Calculate depreciation expense for 2024 and 2025 using units-of-production using hours operated. Complete this question by entering your answers in the tabs below. Calculate depreciation expense for 2024 and 2025 using straight-line method.

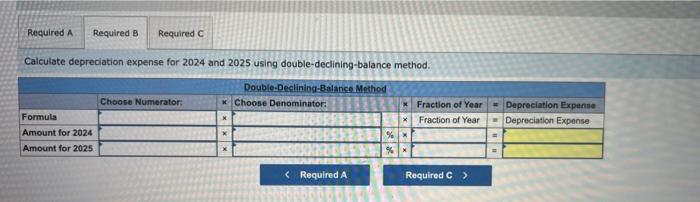

alculate depreciation expense for 2024 and 2025 using double-declining-balance method.

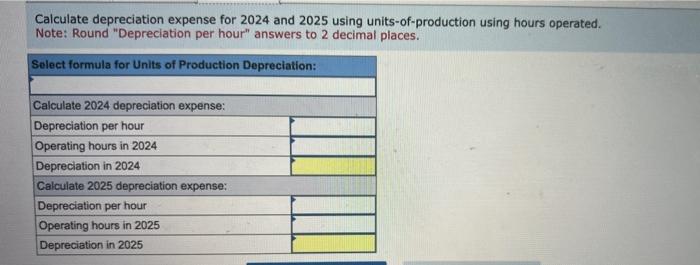

Calculate depreciation expense for 2024 and 2025 using units-of-production using hours operated. Note: Round "Depreciation per hour" answers to 2 decimal places.

Expert Answer

a. Straight-line method:The cost of the equipment is $44,000, and the residual value is $8,000, so the depreciable cost is $36,000 ($44,000 - $8,000).The annual depreciation expense using straight-line method is calculated by dividing the depreciable cost by the estimated service life, which is 4 years:Therefore, the depreciation expense for 2024 and 2025 using straight-line method is $9,000 for each year.Annual depreciation expense = Depreciable cost / Estimated service life