Home /

Expert Answers /

Accounting /

on-january-3-2026-benton-corp-owned-a-machine-that-had-cost-400-000-the-accumulated-depreciatio-pa897

(Solved): On January 3, 2026, Benton Corp. owned a machine that had cost $400,000. The accumulated depreciatio ...

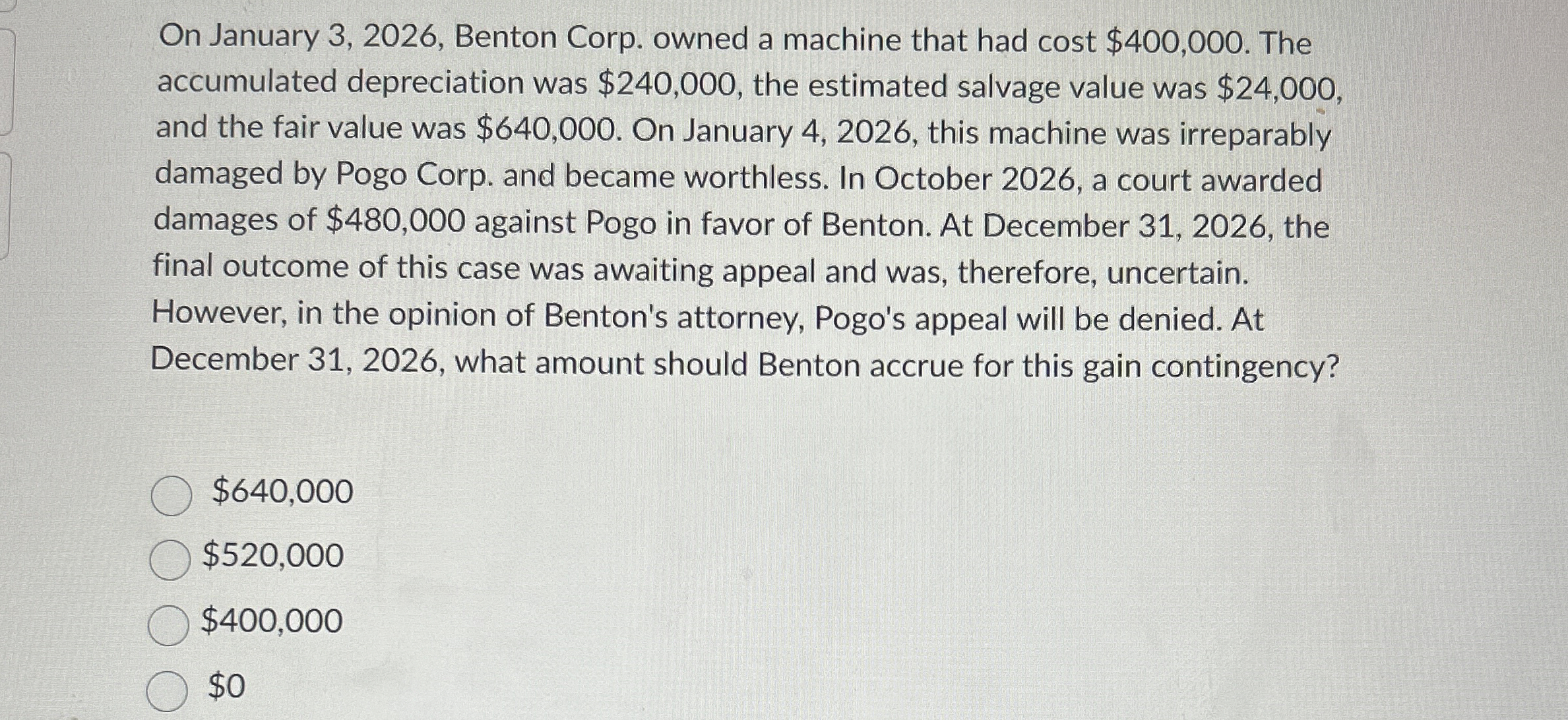

On January 3, 2026, Benton Corp. owned a machine that had cost

$400,000. The accumulated depreciation was

$240,000, the estimated salvage value was

$24,000, and the fair value was

$640,000. On January 4,2026 , this machine was irreparably damaged by Pogo Corp. and became worthless. In October 2026, a court awarded damages of

$480,000against Pogo in favor of Benton. At December 31, 2026, the final outcome of this case was awaiting appeal and was, therefore, uncertain. However, in the opinion of Benton's attorney, Pogo's appeal will be denied. At December 31, 2026, what amount should Benton accrue for this gain contingency? $640,000 $520,000 $400,000

$0