Home /

Expert Answers /

Economics /

need-help-feeling-in-the-blanks-i-will-rate-great-suppose-that-dmitn-is-preparing-to-file-his-taxes-pa931

(Solved): need help feeling in the blanks, i will rate Great Suppose that Dmitn is preparing to file his taxes ...

need help feeling in the blanks, i will rate Great

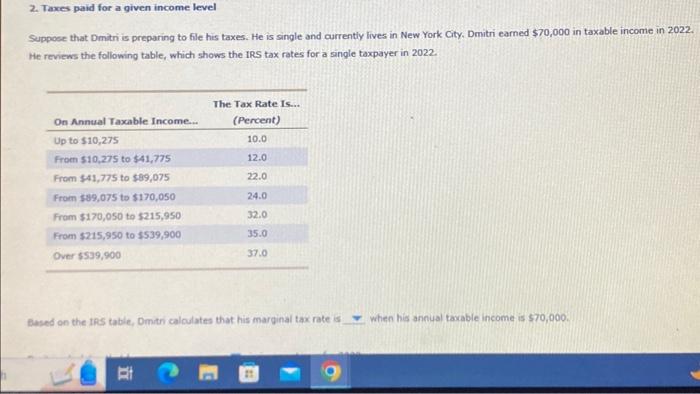

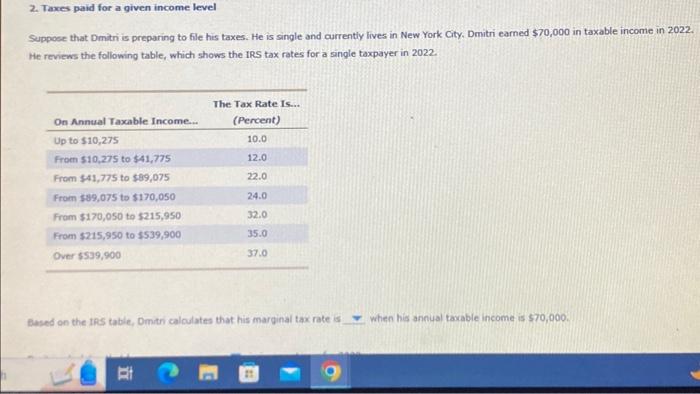

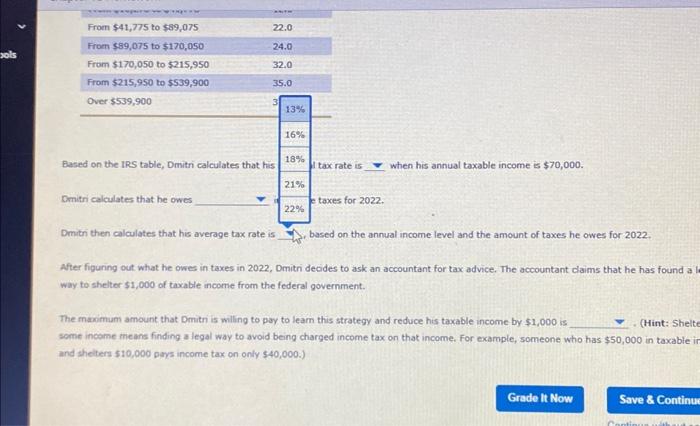

Suppose that Dmitn is preparing to file his taxes. He is single and currently lives in New York City, Dmitri earned in taxable income in 2022. He reviews the following table, which shows the IRS tax rates for a single taxpayer in 2022. Dased on the ths table, Dmitri calnulates that his marginal tax rate id when his annual taxable income is .

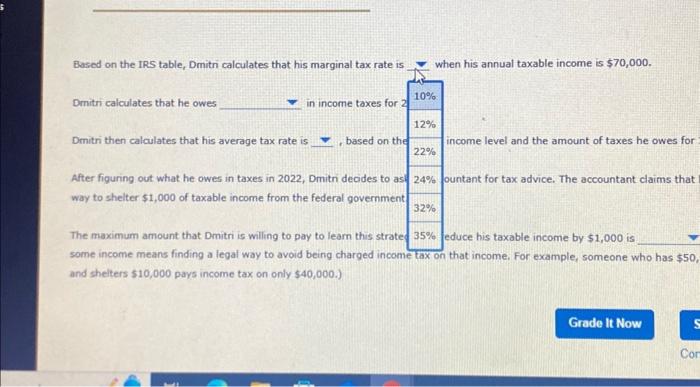

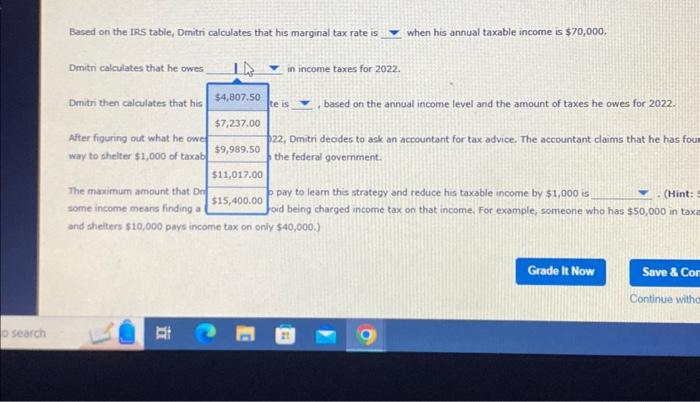

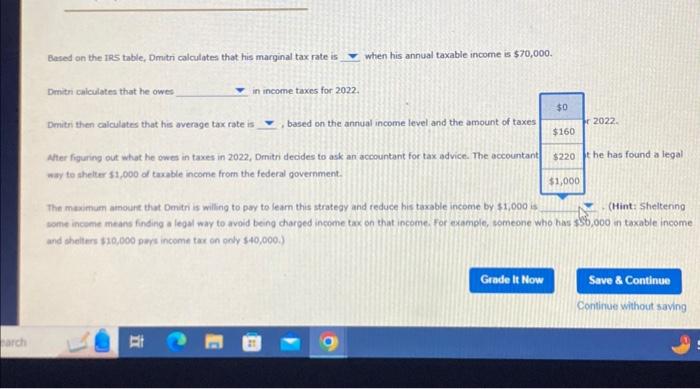

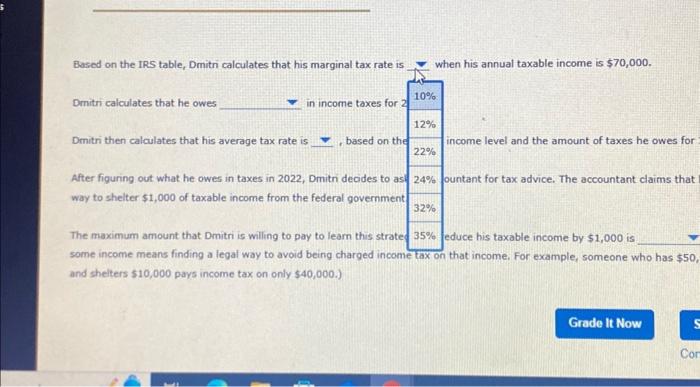

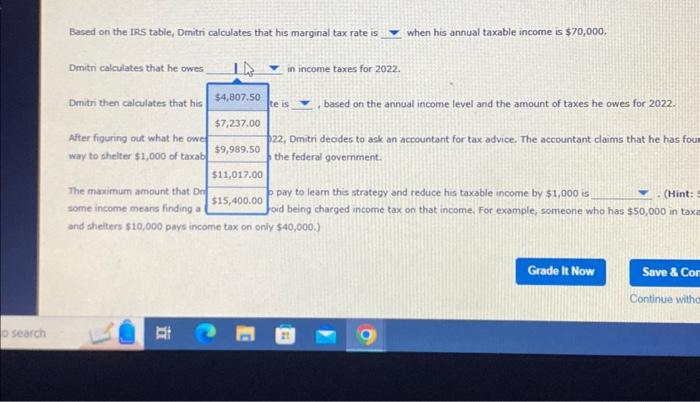

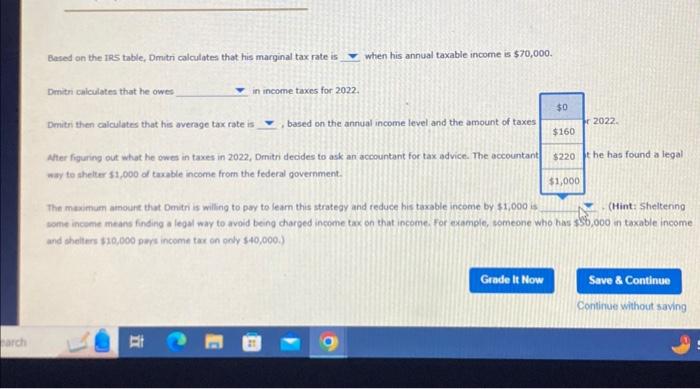

Based on the IRS table, Dmitn calculates that his marginal tax rate is when his annual taxable income is . Drnitri calculates that he owes in income taxes for 2 Dmitri then calculates that his average tax rate is , based on the income level and the amount of taxes he owes for After figuring out what he owes in taxes in 2022, Dmitn decides to as way to shelter of taxable income from the federal government The maximum amount that Dmitri is wiling to pay to leam this strated ]educe his taxable income by is some income means finding a legal way to avoid being charged income tax on that income, For example, someone who has , and shelters pays income tax on only .) Grade It Now

Based on the IRS table, Dmitri calculates that his marginal tax rate is when his annual taxable incorne is . Dmitn calculates that he owes Dmitri calculates that he owes Dmitri then calculates that his After figuring out what he owe in income taxes for 2022 . te is , based on the annual income level and the amount of taxes he owes for 2022. The maximum amount that Dr some income means finding a 22, D p pay to learn this strategy and reduce his taxable income by is (Hint: and shelters pays income tax on only .

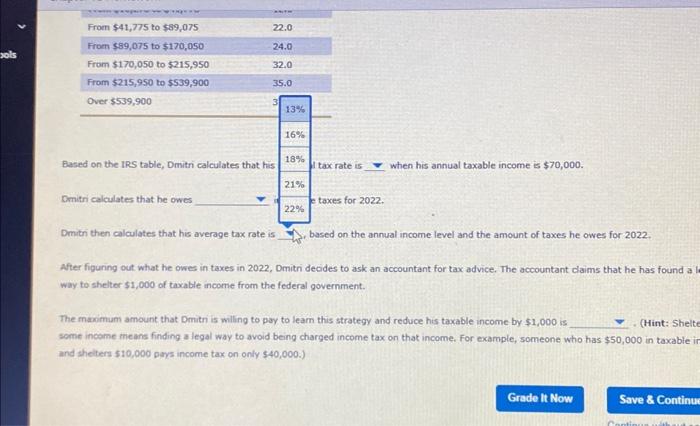

Dmitn then calculates that his average tax rate is based on the annual income level and the amount of taxes he owes for 2022 . After figuring out what he owes in taxes in 2022 , Dmitri decides to ask an accountant for tax advice. The accountant claims that he has found a way to shelter of taxable income from the federal government. The maximum amount that Dmitr is wiling to pay to leam this strategy and reduce his taxable income by is (Hint: Shelt some income theans finding a legal way to avoid being charged income tax on that income. For example, someone who has in taxable and sheiters pors income tax on only

Bared on the IRS table, Dmitri calculates that his marginal tax rate is when his annual taxable income is . Denitn calculates that he owes in income taxes for 2022. Denitri then calculates that his average tax rate is , based on the annual income level and the amount of taxes 2022. Aher figuring out what he owes in taxes in 2022, Drnitri decides to ask an accountant for tax advice. The accountan he has found a legal war to shelter of tasable income from the federal government. The maximum amoure that Denitri is willing to pay to learn this strategy and reduce his taxable income by is (Hint: Shelterng some income means finding a legal way to avoid being charged income tax on that income. for exiample, someone who has lso, ooo an taxable income