Home /

Expert Answers /

Economics /

nbsp-using-the-2019-marginal-tax-rates-provided-in-the-table-below-find-the-marginal-and-avera-pa757

(Solved): Using the 2019 marginal tax rates provided in the table below, find the marginal and avera ...

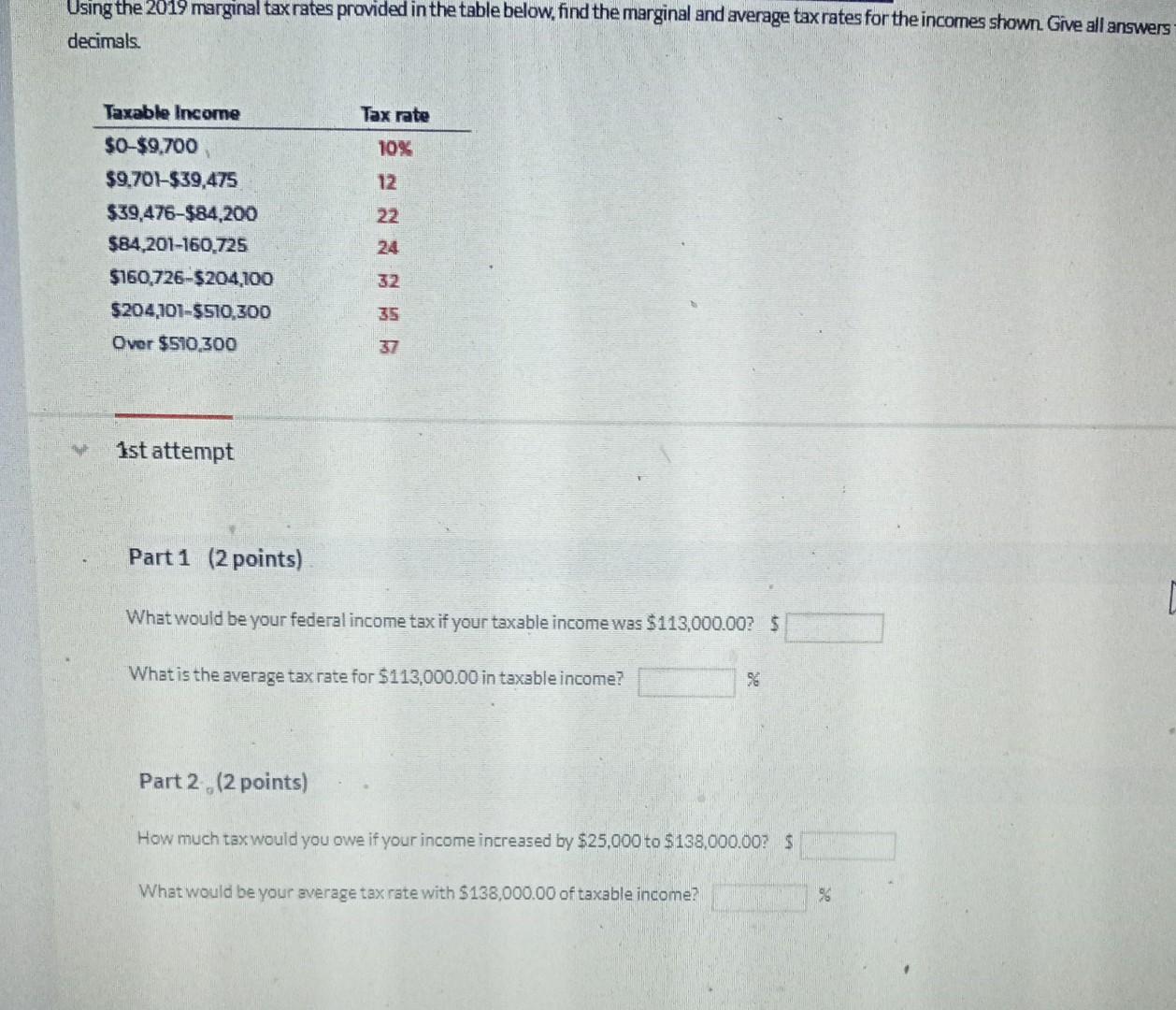

Using the 2019 marginal tax rates provided in the table below, find the marginal and average tax rates for the incomes shown. Give all answers decimals. Taxable Incorne Tax rate $0-$9,700 10% $9,701-$39,475 12 $39,476-$84,200 22 $84,201-160,725 24 $160,726-$204,100 32 $204,101-$510,300 35 Over $510,300 37 1st attempt Part 1 (2 points) What would be your federal income tax if your taxable income was $113,000.00? $ What is the average tax rate for $113,000.00 in taxable income? 58 Part 2 (2 points) How much tax would you owe if your income increased by $25,000 to $138,000.00? $ What would be your average tax rate with $138,000.00 of taxable income? 90

Expert Answer

Federal tax is calculated as per the schedule given by IRS. Average rate of tax mea