Home /

Expert Answers /

Finance /

nbsp-nbsp-through-a-comparable-company-analysis-for-alibaba-you-determined-a-pa968

(Solved): Through a comparable company analysis for Alibaba, you determined a \( ...

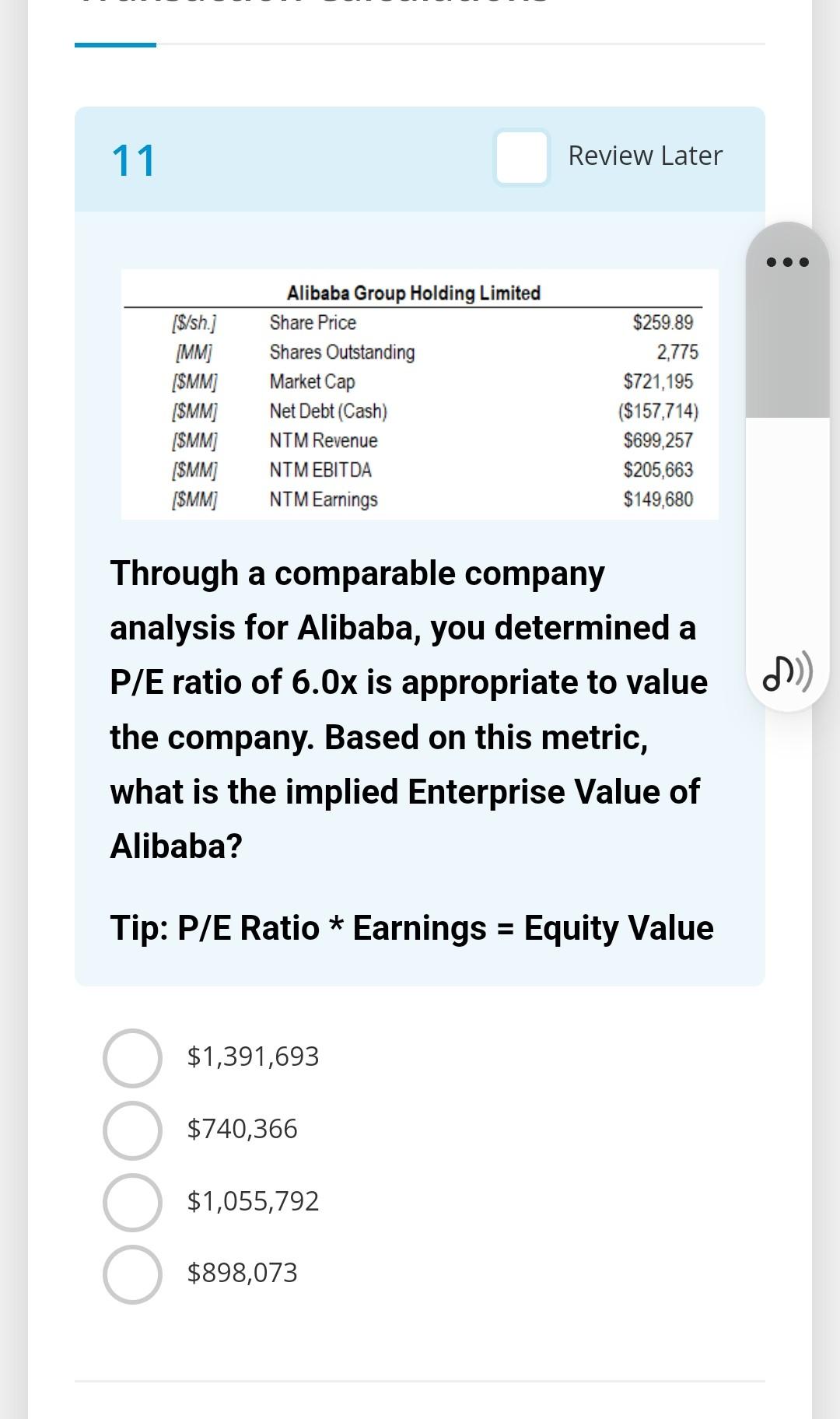

Through a comparable company analysis for Alibaba, you determined a \( P / E \) ratio of \( 6.0 \mathrm{x} \) is appropriate to value the company. Based on this metric, what is the implied Enterprise Value of Alibaba? Tip: P/E Ratio * Earnings = Equity Value \( \$ 1,391,693 \) \( \$ 740,366 \) \( \$ 1,055,792 \) \( \$ 898,073 \)

Comparable Company \& Precedent Transaction Calculations 11 Review Later Through a comparable company analysis for Alibaba, you determined a \( P / E \) ratio of \( 6.0 x \) is appropriate to value the company. Based on this metric, what is the implied Enterprise Value of Alibaba? Tip: P/E Ratio * Earnings = Equity Value \( \$ 1,391,693 \) \( \$ 740,366 \) \( \$ 1,055,792 \) \( \$ 898,073 \)