Home /

Expert Answers /

Finance /

nbsp-a-calculate-npv-for-each-project-do-not-round-intermediate-calculations-round-your-an-pa525

(Solved): a. Calculate NPV for each project. Do not round intermediate calculations. Round your an ...

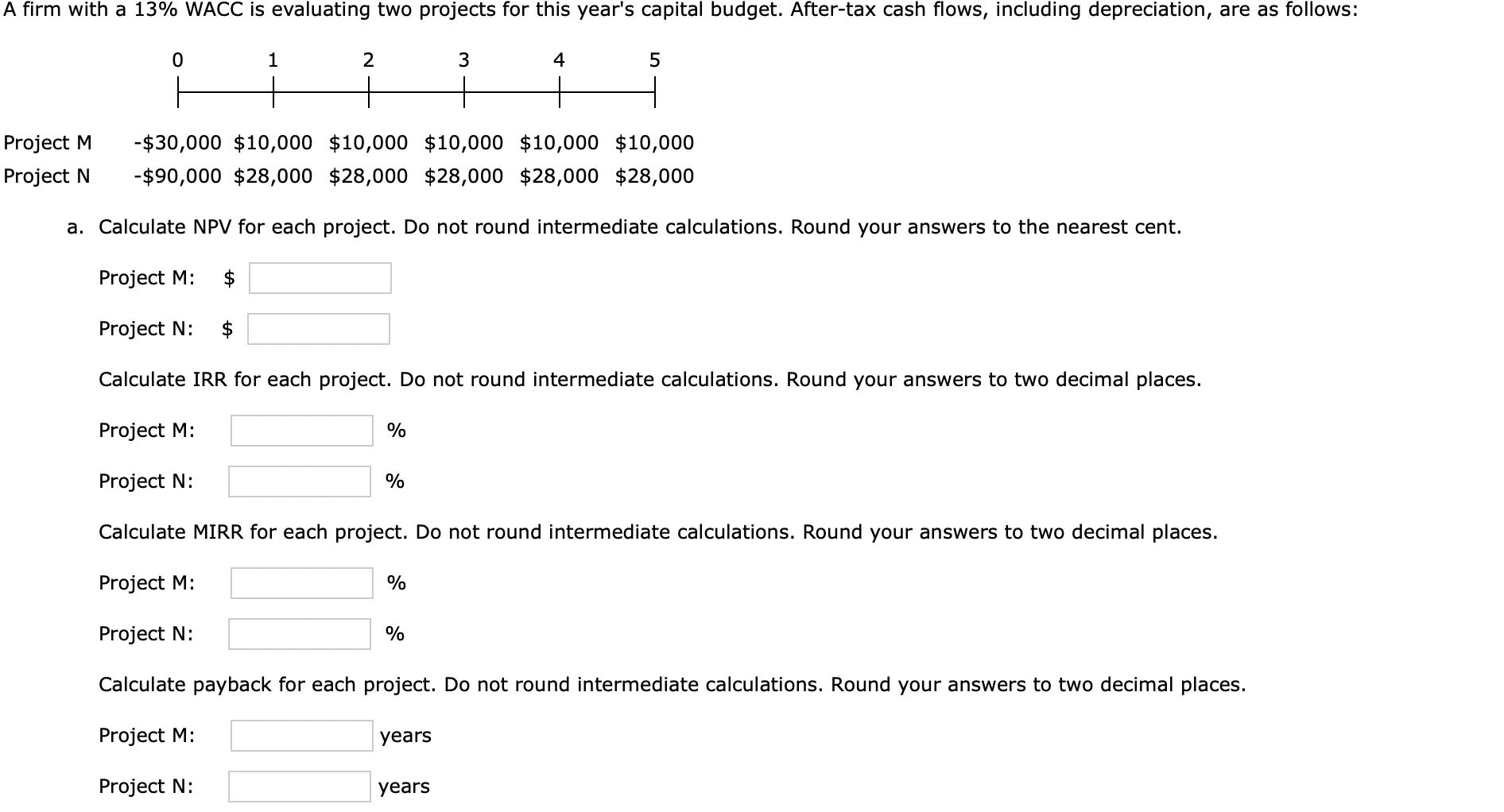

a. Calculate NPV for each project. Do not round intermediate calculations. Round your answers to the nearest cent. Project M: \( \quad \$ \) Project \( \mathrm{N}: \quad \$ \) Calculate IRR for each project. Do not round intermediate calculations. Round your answers to two decimal places. Project M: \( \quad \% \) Project \( \mathrm{N}: \quad \% \) Calculate MIRR for each project. Do not round intermediate calculations. Round your answers to two decimal places. Project M: \( \quad \% \) Project \( \mathrm{N}: \quad \% \) Calculate payback for each project. Do not round intermediate calculations. Round your answers to two decimal places. Project M: \( \quad \) years Project N: years

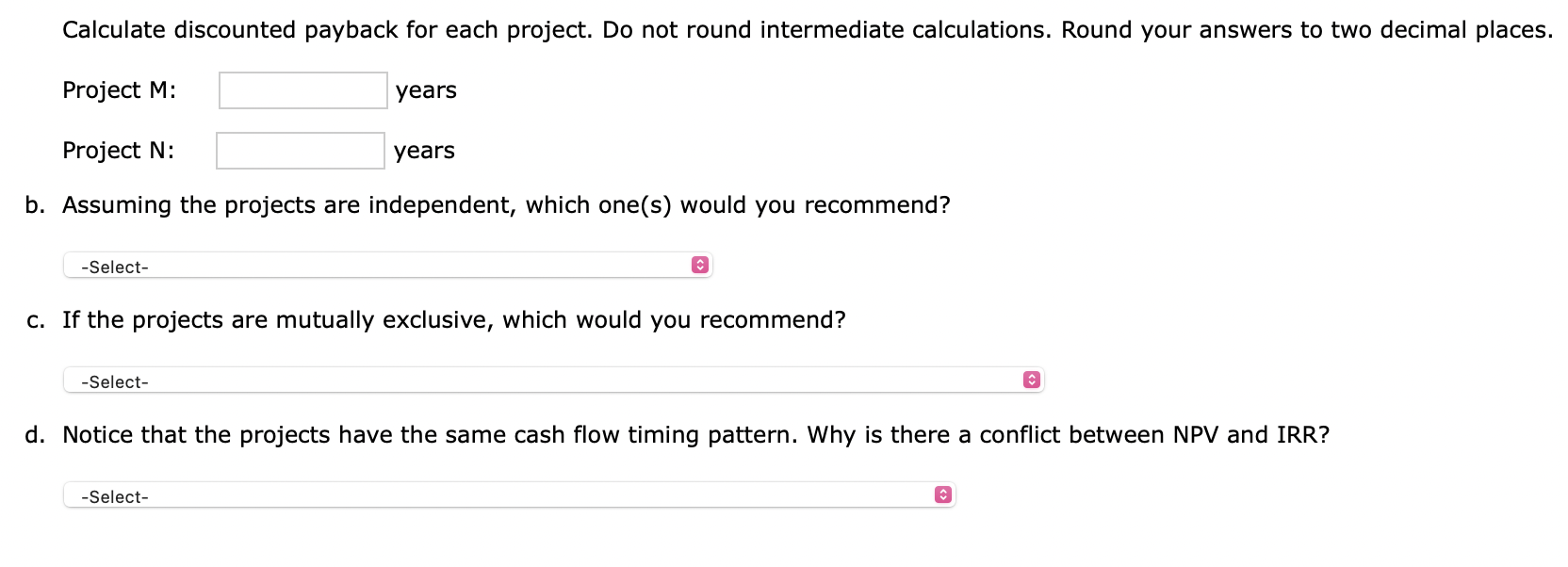

Calculate discounted payback for each project. Do not round intermediate calculations. Round your answers to two decimal places. Project M: \( \quad \) years Project N: years b. Assuming the projects are independent, which one(s) would you recommend? c. If the projects are mutually exclusive, which would you recommend? d. Notice that the projects have the same cash flow timing pattern. Why is there a conflict between NPV and IRR?