Home /

Expert Answers /

Accounting /

miller-company-39-s-contribution-format-income-statement-for-the-most-recent-month-is-shown-below-th-pa523

(Solved): Miller Company's contribution format income statement for the most recent month is shown below: Th ...

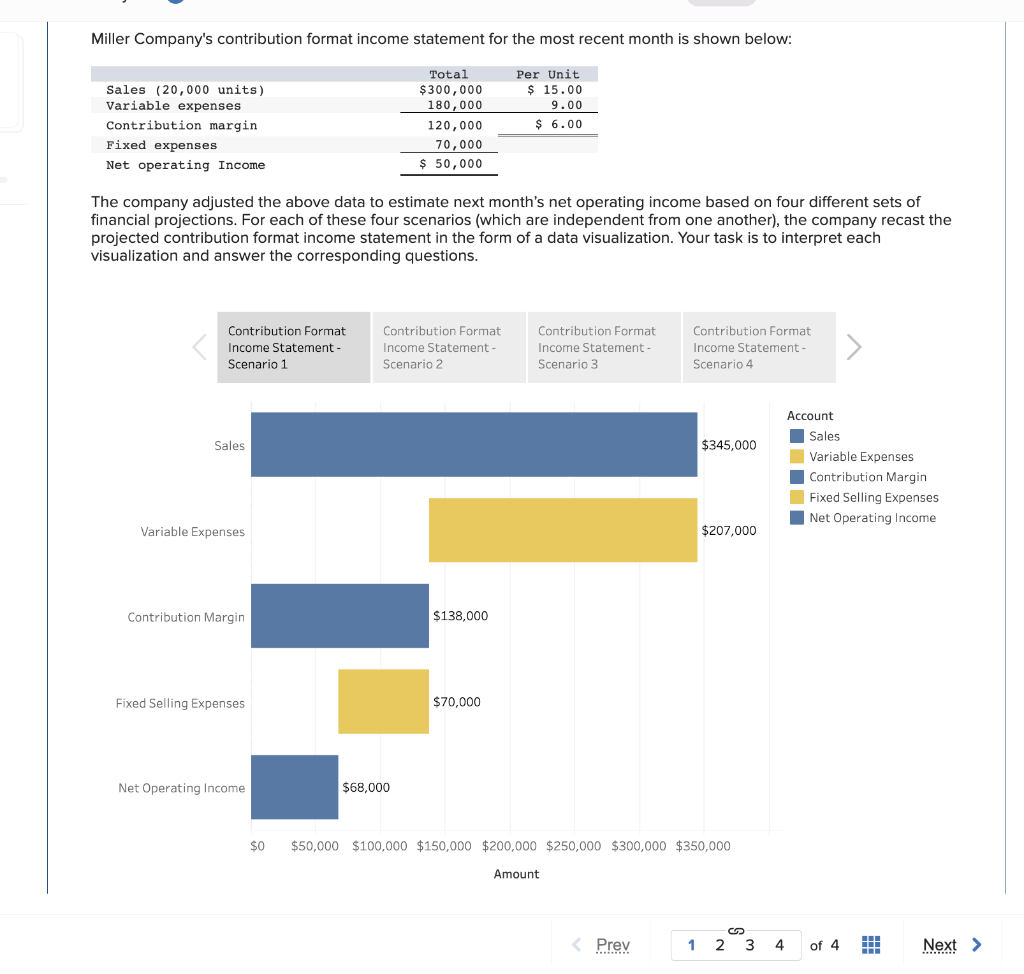

Miller Company's contribution format income statement for the most recent month is shown below: The company adjusted the above data to estimate next month's net operating income based on four different sets of financial projections. For each of these four scenarios (which are independent from one another), the company recast the projected contribution format income statement in the form of a data visualization. Your task is to interpret each visualization and answer the corresponding questions. \( \left.\begin{array}{l|l|l|l|}\hline \text { Contribution Format } & \text { Contribution Format } & \text { Contribution Format } & \text { Contribution Format } \\ \text { Income Statement - } & \text { Income Statement - } & \text { Income Statement - } & \text { Income Statement - } \\ \text { Scenario 1 } & \text { Scenario 2 } & \text { Scenario 3 } & \text { Scenario 4 }\end{array}\right\} \)

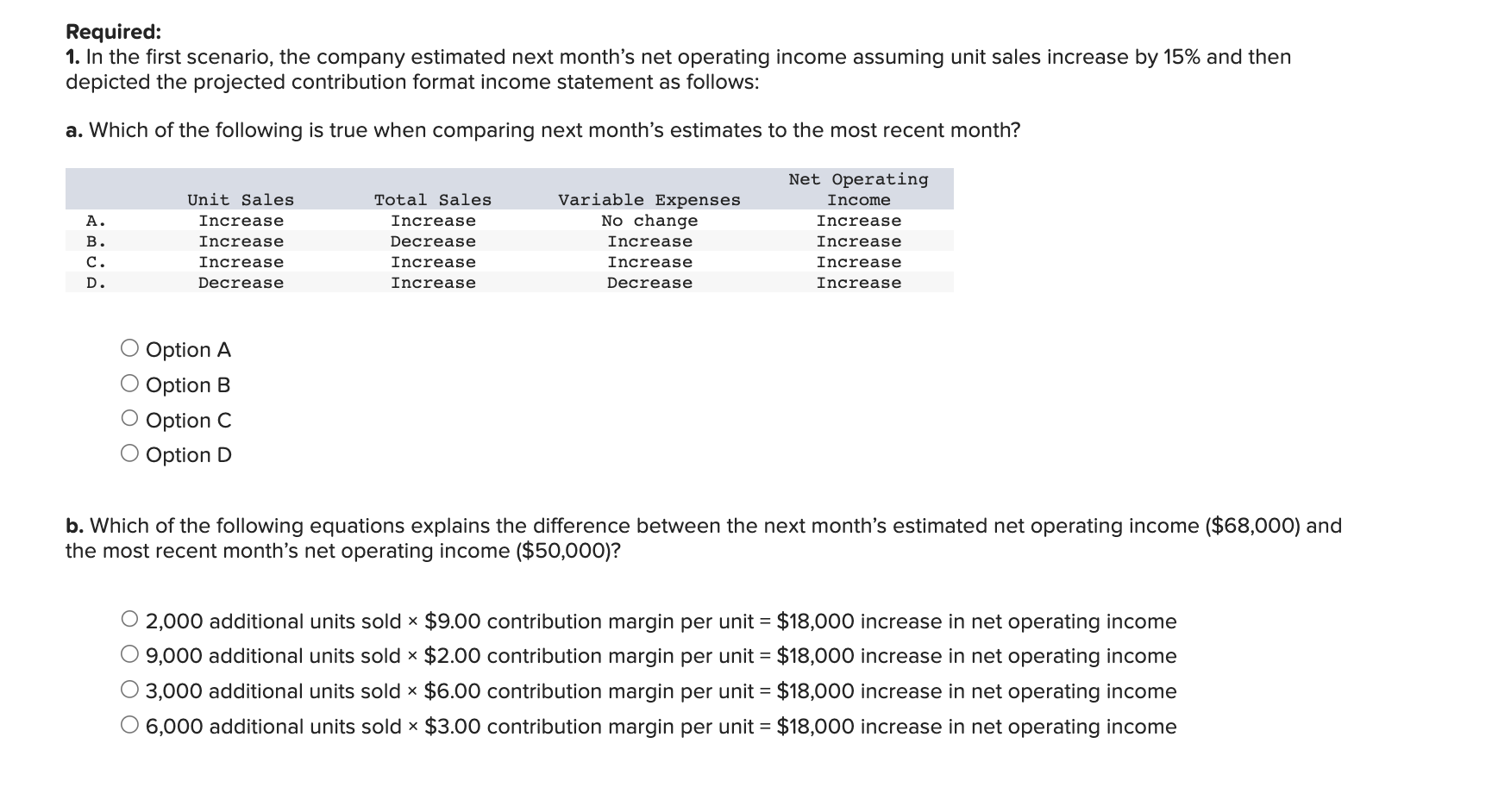

Required: 1. In the first scenario, the company estimated next month's net operating income assuming unit sales increase by \( 15 \% \) and then depicted the projected contribution format income statement as follows: a. Which of the following is true when comparing next month's estimates to the most recent month? Option A Option B Option C Option D b. Which of the following equations explains the difference between the next month's estimated net operating income \( (\$ 68,000) \) and the most recent month's net operating income \( (\$ 50,000) \) ? 2,000 additional units sold \( \times \$ 9.00 \) contribution margin per unit \( =\$ 18,000 \) increase in net operating income 9,000 additional units sold \( \times \$ 2.00 \) contribution margin per unit \( =\$ 18,000 \) increase in net operating income 3,000 additional units sold \( \times \$ 6.00 \) contribution margin per unit \( =\$ 18,000 \) increase in net operating income 6,000 additional units sold \( \times \$ 3.00 \) contribution margin per unit \( =\$ 18,000 \) increase in net operating income

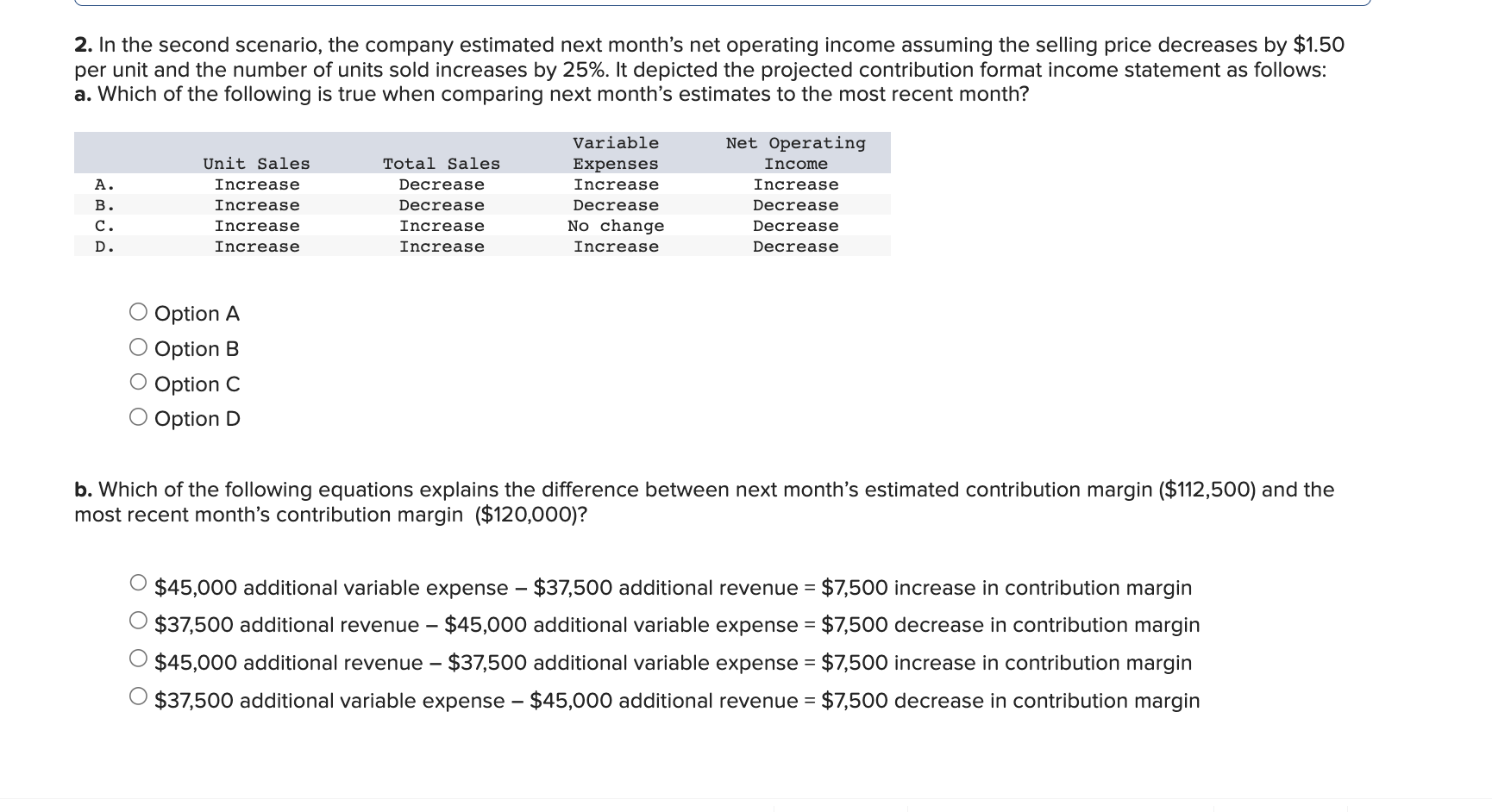

2. In the second scenario, the company estimated next month's net operating income assuming the selling price decreases by \( \$ 1.50 \) per unit and the number of units sold increases by \( 25 \% \). It depicted the projected contribution format income statement as follows: a. Which of the following is true when comparing next month's estimates to the most recent month? Option A Option B Option C Option D b. Which of the following equations explains the difference between next month's estimated contribution margin \( (\$ 112,500) \) and the most recent month's contribution margin \( (\$ 120,000) \) ? \( \$ 45,000 \) additional variable expense \( -\$ 37,500 \) additional revenue \( =\$ 7,500 \) increase in contribution margin \( \$ 37,500 \) additional revenue \( -\$ 45,000 \) additional variable expense \( =\$ 7,500 \) decrease in contribution margin \( \$ 45,000 \) additional revenue \( -\$ 37,500 \) additional variable expense \( =\$ 7,500 \) increase in contribution margin \( \$ 37,500 \) additional variable expense \( -\$ 45,000 \) additional revenue \( =\$ 7,500 \) decrease in contribution margin

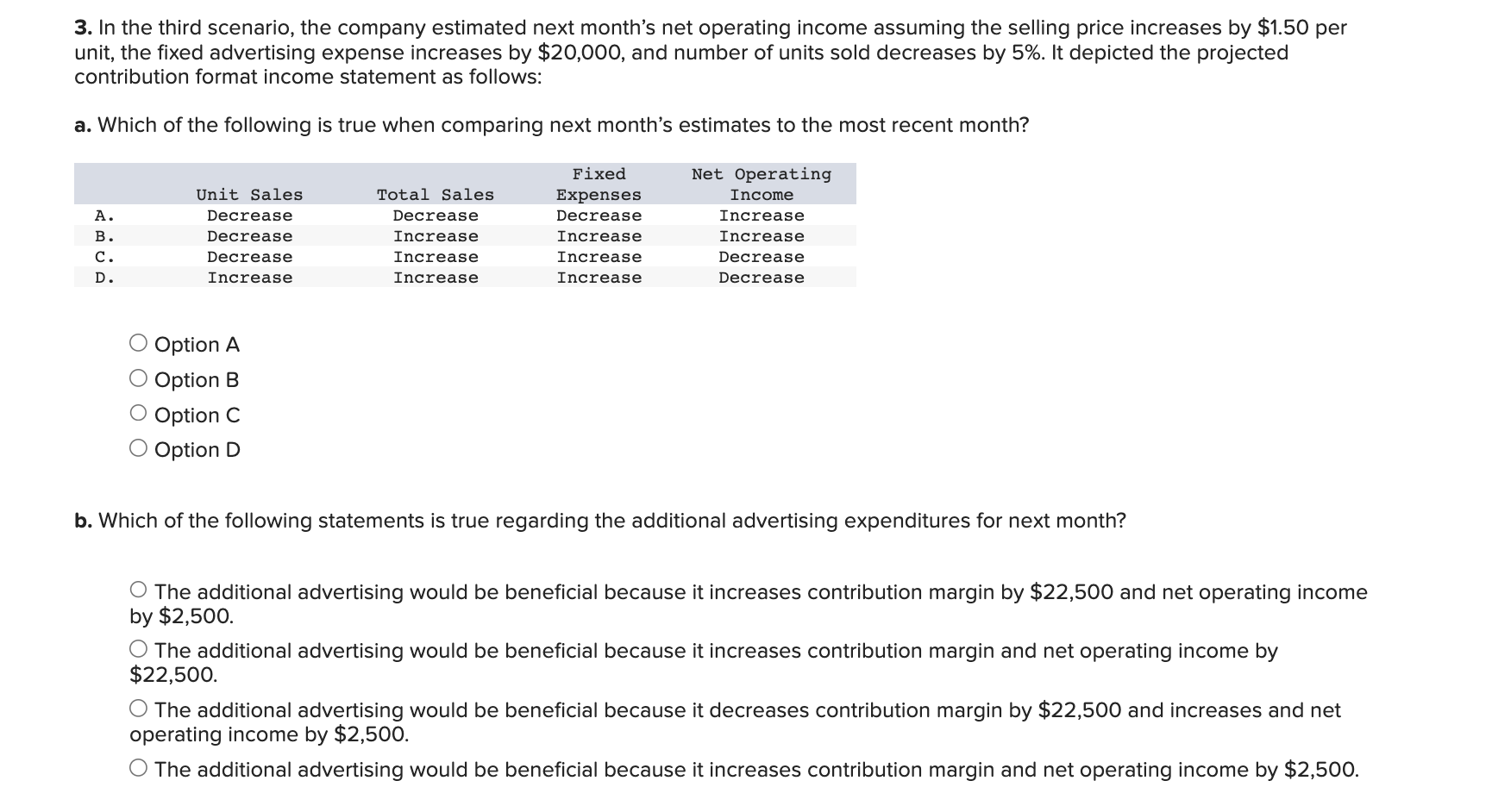

3. In the third scenario, the company estimated next month's net operating income assuming the selling price increases by \( \$ 1.50 \) per unit, the fixed advertising expense increases by \( \$ 20,000 \), and number of units sold decreases by \( 5 \% \). It depicted the projected contribution format income statement as follows: a. Which of the following is true when comparing next month's estimates to the most recent month? Option A Option B Option C Option D b. Which of the following statements is true regarding the additional advertising expenditures for next month? The additional advertising would be beneficial because it increases contribution margin by \( \$ 22,500 \) and net operating income by \( \$ 2,500 \). The additional advertising would be beneficial because it increases contribution margin and net operating income by \( \$ 22,500 \). The additional advertising would be beneficial because it decreases contribution margin by \( \$ 22,500 \) and increases and net operating income by \( \$ 2,500 \). The additional advertising would be beneficial because it increases contribution margin and net operating income by \( \$ 2,500 \).

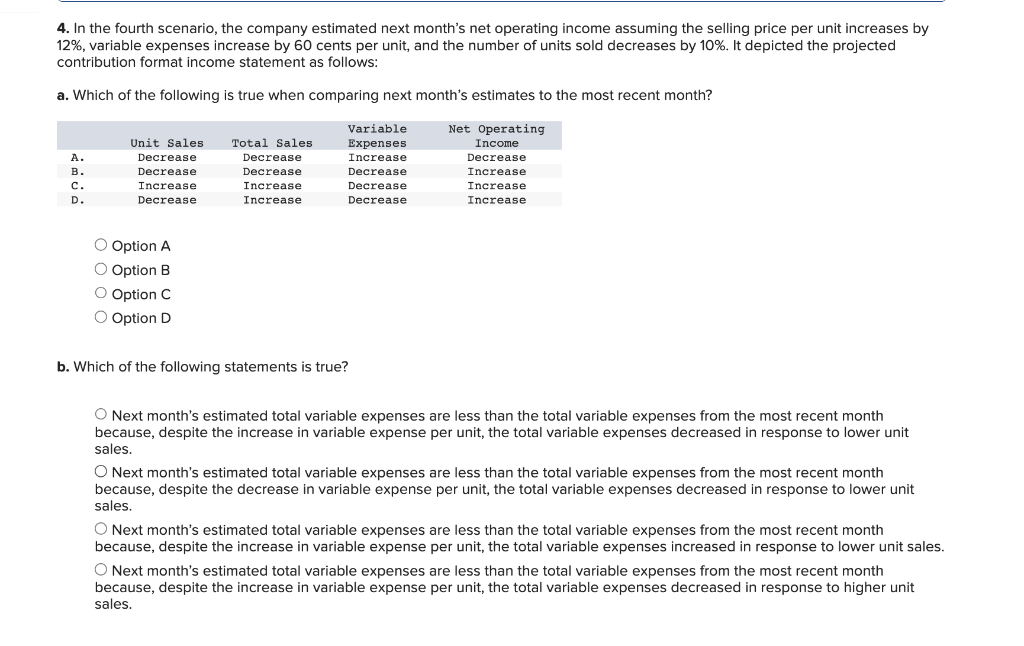

4. In the fourth scenario, the company estimated next month's net operating income assuming the selling price per unit increases by \( 12 \% \), variable expenses increase by 60 cents per unit, and the number of units sold decreases by \( 10 \% \). It depicted the projected contribution format income statement as follows: a. Which of the following is true when comparing next month's estimates to the most recent month? Option A Option B Option C Option D b. Which of the following statements is true? Next month's estimated total variable expenses are less than the total variable expenses from the most recent month because, despite the increase in variable expense per unit, the total variable expenses decreased in response to lower unit sales. Next month's estimated total variable expenses are less than the total variable expenses from the most recent month because, despite the decrease in variable expense per unit, the total variable expenses decreased in response to lower unit sales. Next month's estimated total variable expenses are less than the total variable expenses from the most recent month because, despite the increase in variable expense per unit, the total variable expenses increased in response to lower unit sales. Next month's estimated total variable expenses are less than the total variable expenses from the most recent month because, despite the increase in variable expense per unit, the total variable expenses decreased in response to higher unit sales.

Expert Answer

Independent Situation 1: Req 1 Units sold Perunit Total % Sales 23,000 $15 $345,000 100.00% Less: Variable cost 23,000 $9 $207,000 60.00% Contribution