Home /

Expert Answers /

Accounting /

merle-gives-stock-to-her-daughter-lucy-the-stock-has-a-basis-to-merle-of-200-000-and-a-v-pa908

(Solved): Merle gives stock to her daughter Lucy. The stock has a basis to Merle of \( \$ 200,000 \) and a v ...

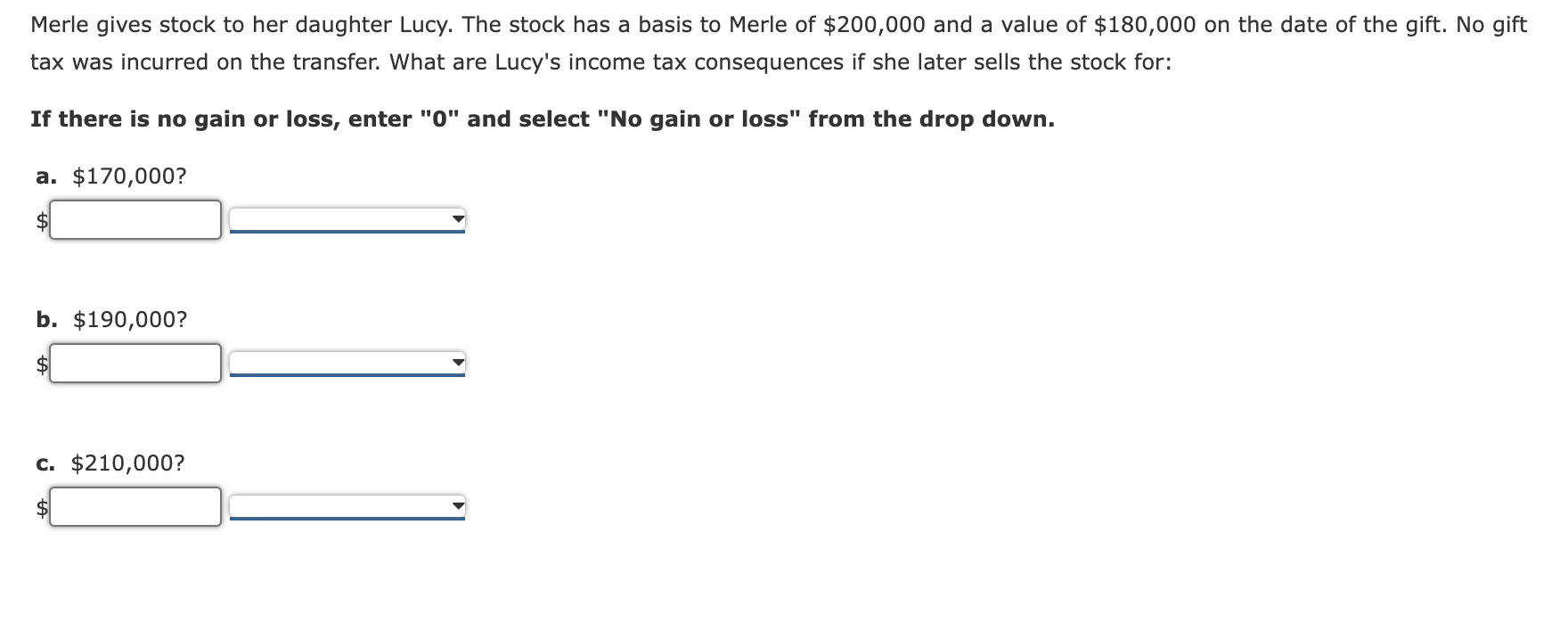

Merle gives stock to her daughter Lucy. The stock has a basis to Merle of \( \$ 200,000 \) and a value of \( \$ 180,000 \) on the date of the gift. No gift tax was incurred on the transfer. What are Lucy's income tax consequences if she later sells the stock for: If there is no gain or loss, enter "0" and select "No gain or loss" from the drop down. a. \( \$ 170,000 \) ? \( \$ \) b. \( \$ 190,000 \) ? \( \$ \) C. \( \$ 210,000 \) ? \( \$ \)

Expert Answer

Answer a. In the given case, stock reduces to the value of $170,000 which is lower than the original cost of $200,000, so Lucy's basis is the fair market valu