Home /

Expert Answers /

Finance /

mary-39-s-nursery-uses-a-perpetual-inventory-system-at-december-31-the-perpetual-inventory-records-pa362

(Solved): Mary's Nursery uses a perpetual inventory system. At December 31 , the perpetual inventory records ...

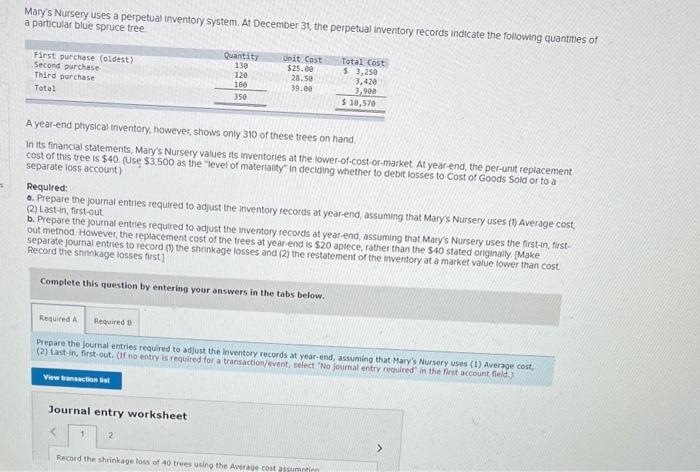

Mary's Nursery uses a perpetual inventory system. At December 31 , the perpetual inventory records indicate the following quantities of a parbcular blue spruce tree A year-end physical inventory, however, shows only 310 of these trees on hand In its financial statements, Marys Nursery values its inventories at the lower-of-cost-or-market. Atyear-end, the per-unit replacement. cost of this tree is \( \$ 40 \). (Use \( \$ 3,500 \) as the "level of materiaity" in deciding whether to debit losses to Cost of Goods Sold or to a separate ioss account) Required: o. Prepare the journal entries requtred to adjust the inventory records at year-end, assuming that Mary's Nursery uses (1) Average cost: (2) Last-in, first-out b. Prepare the journal entries required to adjust the inventory records at year-end, assuming that Marys Nursery uses the Arst-in, first. out method. However, the replacement cost of the trees at year-end is \( \$ 20 \) apiece, rather than the \( \$ 40 \) stated onginally, [Make Piecord the shninkage losses first] Complete this question by entering your answers in the tabs below. Prepare the fournal entries required to adjust the inventory records at year-end, assuming that Mary's Nursory uses (1) Average cost, (2) Last in, first-out. (If no entry is fegcired for a transaction/event, select 'No fournal entry reguired in the fint account field.) Journal entry worksheet

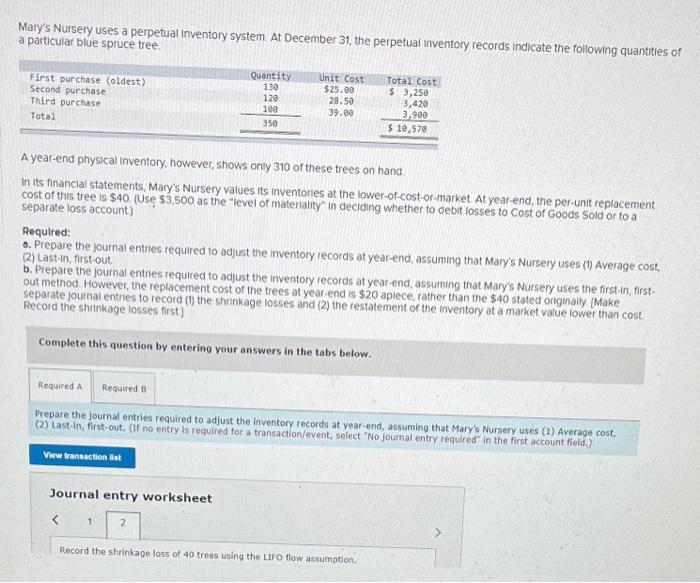

Mary's Nursery uses a perpetual Inventory system. At December 31 , the perpetual inventory records indicate the following quantities of a particular blue spruce tree. A year-end physical inventory, however, shows only 310 of these trees on hand. In its financlal statements, Mary's Nursery values its inventones at the lower-of-cost-or-market At year-end, the per-unit replacement cost of this tree is \( \$ 40 \). (Use \( \$ 3,500 \) as the "level of materiality" in deciding whether to debit losses to Cost of Goods Sold or to a separate loss account) Required: 0. Prepare the journal entries required to adjust the inventory records at year-end, assuming that Mary's Nursery uses (1) Average cost, (2) Last-in, first-out. b. Prepare the journal entries required to adjust the inventory records at year-end, assuming that Mary's Nursery uses the first-in, firstout method. However, the replacement cost of the trees at year-end is \( \$ 20 \) aplece, rather than the \( \$ 40 \) stated onginally. [Make. Record the shrinkage losses first] Recine the shinkage losses and (2) the restatement or the inventory ot a market value lower than cost. Complete this question by entering your answers in the tabs below. Prepare the journal entries required to adjust the inventory records at year-end, assuming that Mary's Nursery uses (1) Average cost, (2) Last-in, first-out. (If no entry is required for a transaction/event, select 'No Joumal entry required" in the first account field.) Journal entry worksheet Record the shrinkage loss of 40 trees using the uro flow assumption.

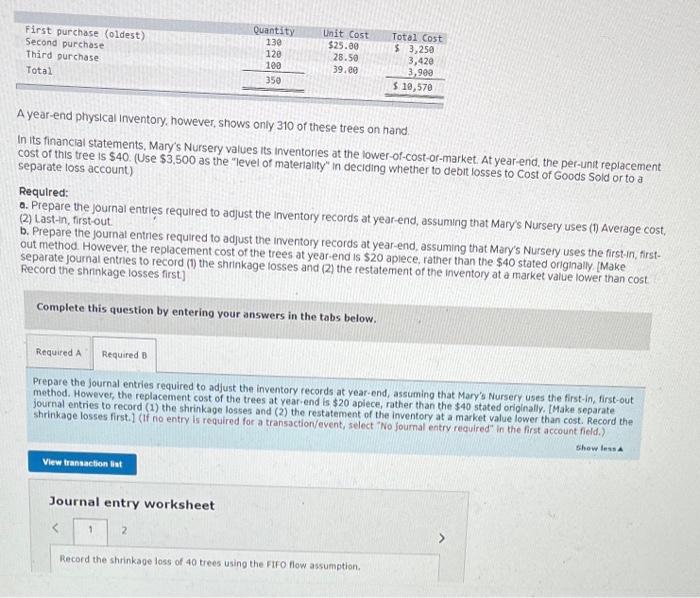

A year-end physical inventory, however, shows only 310 of these trees on hand. In its financial statements, Mary's Nursery values its inventories at the lower-of-cost-or-market. At year-end, the per-unit replacement. cost of this tree is \( \$ 40 \). (Use \( \$ 3,500 \) as the "level of materialty" in deciding whether to debit losses to Cost of Goods Sold or to a separate loss account) Required: o. Prepare the journal entries required to adjust the inventory records at year-end, assuming that Mary's Nursery uses (i) Average cost, (2) Last-in, first-out. b. Prepare the journat entries required to adjust the inventory records at year-end, assuming that Mary's Nursery uses the first-in, firstout method. However, the replacement cost of the trees at year-end is \( \$ 20 \) aplece, rather than the \( \$ 40 \) stated originally. IMake Record the shninkage losses first] Complete this question by entering your answers in the tabs below. Prepare the Journal entries required to adjust the inventory records at year-end, assuming that Mary's Nursery uses the first-in, first-out method. However, the replacement cost of the trees at year-end is \( \$ 20 \) apiece, rather than the \( \$ 40 \) stated originally. [Make separate journal entries to record (1) the shrinkage losses and (2) the restatement of the inventory at a market value lower than cost. Record the shrinkage losses first.) (If fio entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Show less a 2 Record the shrinkage loss of 40 trees using the FIfo flow assumption.

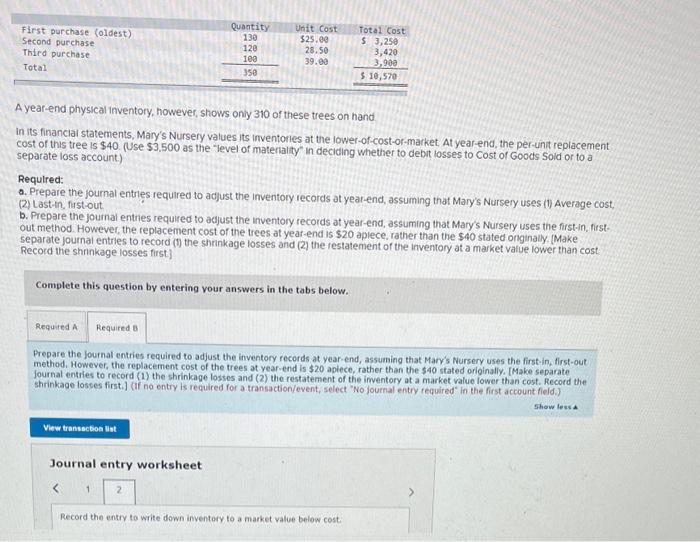

A year-end physical inventory, however, shows only 310 of these trees on hand. In its financial statements, Mary's Nursery values its inventonies at the iower-of-cost-or-market At year-end, the per-unt replacement cost of this tree is \( \$ 40 \). (Use \( \$ 3,500 \) as the "level of materiality' in deciding whether to debit losses to Cost of Goods Sold or to a separate loss account.) Required: a. Prepare the journal entries required to adjust the inventory records at year-end, assuming that Mary's Nursery uses (1) Average cost, (2) Last-in, fist-out b. Prepare the journal entnes required to adjust the inventory records at year-end, assuming that Mary's Nursery uses the first-in, firstout method. However, the replacement cost of the trees at year-end is \( \$ 20 \) aplece, rather than the \( \$ 40 \) stated onginally. [Make separate journal entries to record (1) the shninkage losses and (2) the restatement of the inventory at a market value lower than cost Record the shrinkage losses first.) Complete this question by entering vour answers in the tabs below. Prepare the journal entries required to adjust the inventory records at year-end, assuming that Mary's Nursery uses the first-in, first-out method. However, the replacement cost of the trees at year-end is \( \$ 20 \) apiece, rather than the \( \$ 40 \) stated orlginally. [Make separatefournal entries to record (1) the shrinkage losses and (2) the restatement of the imventory at a market value lower than cost. Record the shrinkage losses first.) (if no entry is required for a transaction/event, select " No journal entry required" in the first account field.) Shaw feas 4 Journal entry worksheet 1 Record the entry to write down inventory to a market value below cost:

Expert Answer

ANSWER- (a) Mary's Nursery has a perpetual inventory system, but its financial statement only shows that it had 310 of them on hand as of the year's e