Home /

Expert Answers /

Accounting /

march-1-ownerborrowed-125-000-to-fund-start-the-business-the-loan-term-is-5-years-m-pa431

(Solved): - March 1: Ownerborrowed \( \$ 125,000 \) to fund/start the business. The loan term is 5 years. - M ...

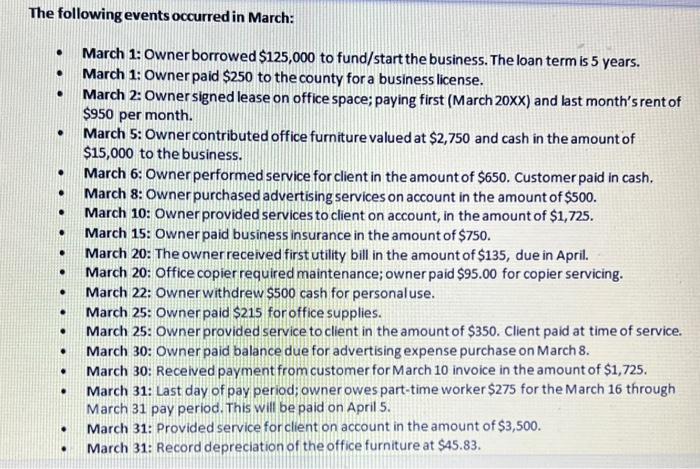

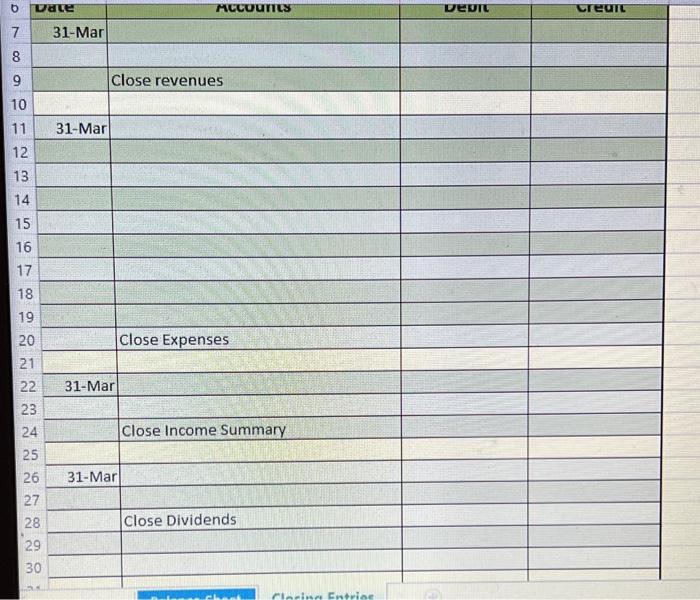

- March 1: Ownerborrowed \( \$ 125,000 \) to fund/start the business. The loan term is 5 years. - March 1: Owner paid \( \$ 250 \) to the county for a business license. - March 2: Owner signed lease on office space; paying first (March 20XX) and last month's rent of \( \$ 950 \) per month. - March 5: Ownercontributed office furniture valued at \( \$ 2,750 \) and cash in the amount of \( \$ 15,000 \) to the business. - March 6: Owner performed service for client in the amount of \( \$ 650 \). Customer paid in cash. - March 8: Owner purchased advertising services on account in the amount of \( \$ 500 . \) - March 10: Owner provided services to client on account, in the amount of \( \$ 1,725 \). - March 15: Owner paid business insurance in the amount of \( \$ 750 \). - March 20: The owner received first utility bill in the amount of \( \$ 135 \), due in April. - March 20: Office copier required maintenance; owner paid \( \$ 95.00 \) for copier servicing. - March 22: Ownerwithdrew \( \$ 500 \) cash for personaluse. - March 25: Ownerpaid \( \$ 215 \) for office supplies. - March 25: Owner provided service to client in the amount of \( \$ 350 \). Client paid at time of service. - March 30: Owner paid balance due for advertising expense purchase on March \( 8 . \) - March 30: Received payment from customer for March 10 invoice in the amount of \( \$ 1,725 . \) - March 31: Last day of pay period; owner owes part-time worker \( \$ 275 \) for the March 16 through March 31 pay period. This will be paid on April \( 5 . \) - March 31: Provided service for client on account in the amount of \( \$ 3,500 . \) - March 31: Record depreciation of the office furniture at \( \$ 45.83 . \) \begin{tabular}{|l|l|l|l|l|} \hline 7 & Male & Mccuuries & Devit & creuil \\ \hline 7 & \( 31-\mathrm{Mar} \) & & & \\ \hline 8 & & & & \\ \hline 9 & & Close revenues & & \\ \hline 10 & & & & \\ \hline 11 & \( 31-\mathrm{Mar} \) & & & \\ \hline 12 & & & & \\ 13 & & & & \\ \hline 14 & & & & \\ \hline 15 & & & & \\ \hline 16 & & & & \\ \hline 17 & & & & \\ \hline 18 & & & & \\ \hline 19 & & & & \\ \hline 20 & & Close Expenses & & \\ \hline 21 & & & & \\ \hline 22 & \( 31-M a r \) & & & \\ \hline 23 & & & & \\ \hline 24 & & Close Income Summary & & \\ \hline 25 & & & & \\ \hline 26 & \( 31-M a r \) & & & \\ \hline 27 & & & & \\ \hline 28 & & & & \\ \hline 29 & & & & \\ \hline 30 & & & & \\ \hline \end{tabular} Non-Current Assets:

Expert Answer

Closing Entries Date Accounts Debit Credit 31-Mar Revenues $ 6,225 Income Summary $ 6,225 (close Revenue) 31-Mar Income Summary $ 3,951 Business License $ 250 Rent Exp. $ 1,900 Advertising Exp. $ 500 Insu