Home /

Expert Answers /

Accounting /

managerial-accounting-marginal-and-absorption-costing-nbsp-question-3-marginal-costing-30-mar-pa300

(Solved): MANAGERIAL ACCOUNTING marginal and absorption costing QUESTION 3 MARGINAL COSTING 30 MAR ...

MANAGERIAL ACCOUNTING

marginal and absorption costing

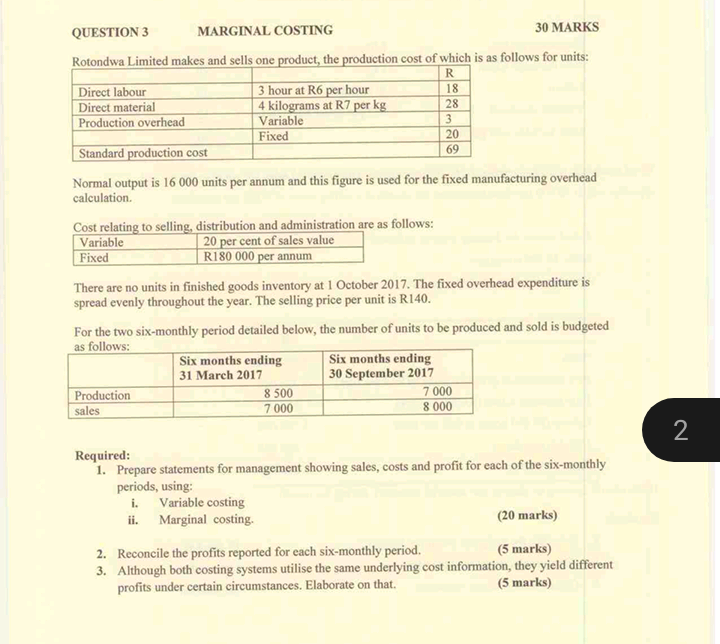

QUESTION 3 MARGINAL COSTING 30 MARKS Rotondwa Limited makes and sells one product, the production cost of which is as follows for units: R 18 Direct labour Direct material 3 hour at R6 per hour 4 kilograms at R7 per kg Variable 28 Production overhead 3 Fixed 20 Standard production cost 69 Normal output is 16 000 units per annum and this figure is used for the fixed manufacturing overhead calculation. Cost relating to selling, distribution and administration are as follows: Variable 20 per cent of sales value Fixed R180 000 per annum There are no units in finished goods inventory at 1 October 2017. The fixed overhead expenditure is spread evenly throughout the year. The selling price per unit is R140. For the two six-monthly period detailed below, the number of units to be produced and sold is budgeted as follows: Six months ending 31 March 2017 Six months ending 30 September 2017 Production 8 500 7 000 8 000 sales 7 000 Required: 1. Prepare statements for management showing sales, costs and profit for each of the six-monthly periods, using: i. Variable costing ii. Marginal costing. (20 marks) 2. Reconcile the profits reported for each six-monthly period. (5 marks) 3. Although both costing systems utilise the same underlying cost information, they yield different profits under certain circumstances. Elaborate on that. (5 marks) 2

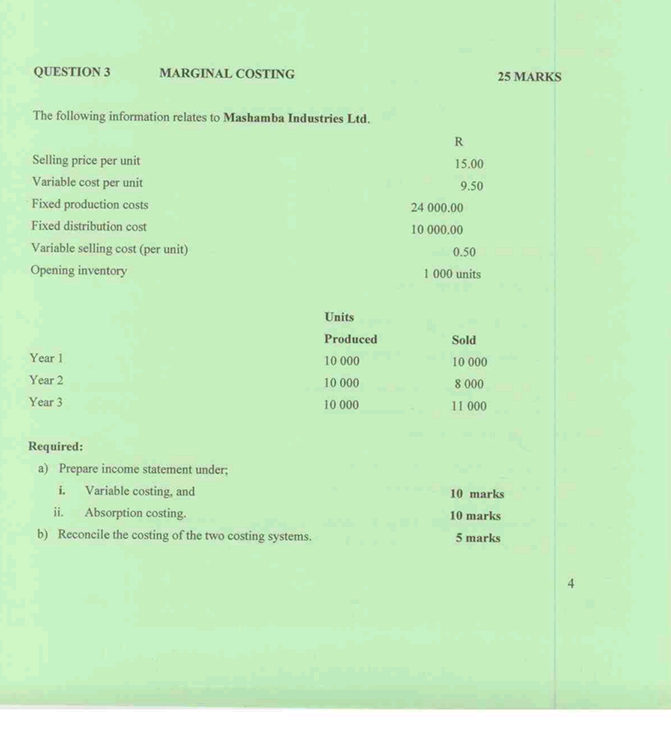

QUESTION 3 MARGINAL COSTING The following information relates to Mashamba Industries Ltd. Selling price per unit Variable cost per unit Fixed production costs Fixed distribution cost Variable selling cost (per unit) Opening inventory Year 1 Year 2 Year 3 Required: a) Prepare income statement under; i. Variable costing, and ii. Absorption costing. b) Reconcile the costing of the two costing systems. Units Produced 10 000 10 000 10 000 R 15.00 9.50 24 000.00 10 000.00 25 MARKS 0.50 1 000 units Sold 10 000 8.000 11 000 10 marks 10 marks 5 marks 4

Expert Answer

As per Chegg Guidelines, I need to answer 1 question, otherwise, strict action can be taken. As you have posted two different questions at one time. so I am answering the first question in which three parts are given. Please post the rest separately