Home /

Expert Answers /

Accounting /

malcolm-figueroa-is-a-sales-employee-of-carefree-pools-and-spas-incorporated-in-2021-he-was-issue-pa870

(Solved): Malcolm Figueroa is a sales employee of Carefree Pools and Spas, Incorporated. In 2021, he was issue ...

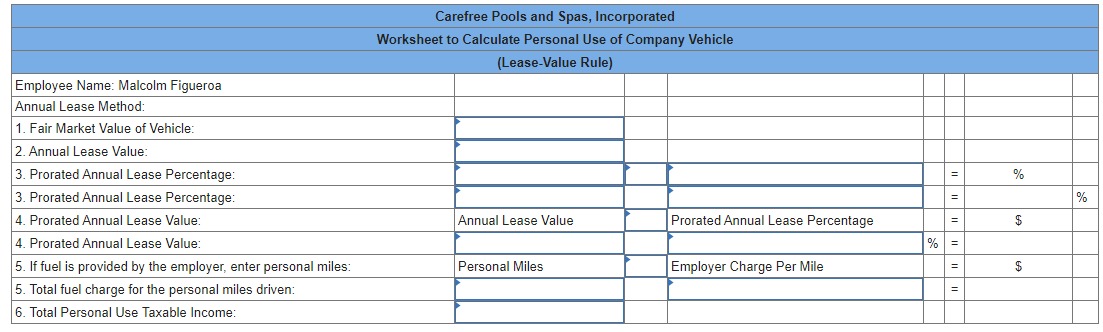

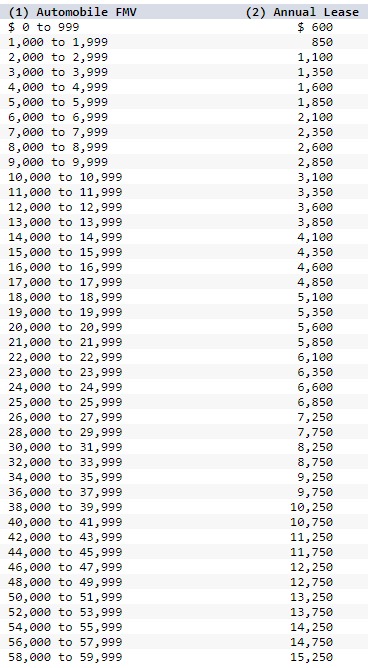

Malcolm Figueroa is a sales employee of Carefree Pools and Spas, Incorporated. In 2021, he was issued a company car with a fair market value of $35,000. He drove a total of 22,000 miles; used the car for 3,000 miles for personal use; and his employer paid for fuel, charging Malcolm 5.5 cents per mile.

Required: MUST BE IN TABLE FORMAT!!!!!!!!

Under the lease-value rule, what is the amount that must be added to Malcolm’s gross pay for 2021? (Round "Employer Charge Per Mile" to 3 decimal places. Round other intermediate calculations and final answers to 2 decimal place.)

Answer must be written in table format to recieve like.

Expert Answer

As per publication 15-b Of employers tax guide fringe benefits provides you how to use lease value ...