Home /

Expert Answers /

Accounting /

lopez-cruz-and-perez-are-partners-and-share-net-income-and-loss-in-a-6-4-1-ratio-in-rat-pa854

(Solved): Lopez, Cruz, and Perez are partners and share net income and loss in a \( 6: 4: 1 \) ratio (in rat ...

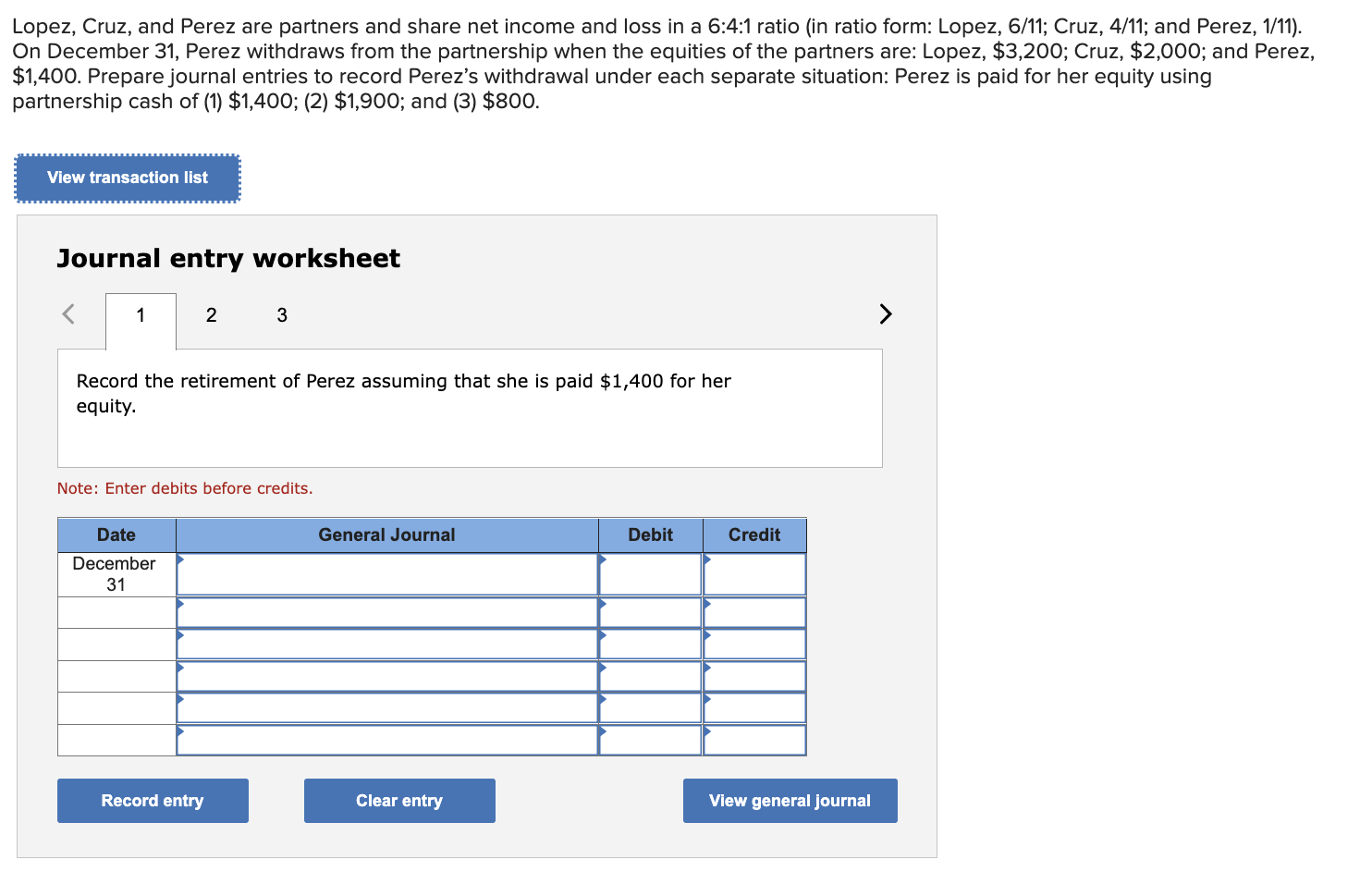

Lopez, Cruz, and Perez are partners and share net income and loss in a \( 6: 4: 1 \) ratio (in ratio form: Lopez, \( 6 / 11 ; \) Cruz, \( 4 / 11 ; \) and Perez, \( 1 / 11 \) ). On December 31, Perez withdraws from the partnership when the equities of the partners are: Lopez, \( \$ 3,200 ; \) Cruz, \( \$ 2,000 ; \) and Perez, \( \$ 1,400 \). Prepare journal entries to record Perez's withdrawal under each separate situation: Perez is paid for her equity partnership cash of (1) \( \$ 1,400 ;(2) \$ 1,900 ; \) and \( (3) \$ 800 . \) Journal entry worksheet Record the retirement of Perez assuming that she is paid \( \$ 1,400 \) for her equity. Note: Enter debits before credits.

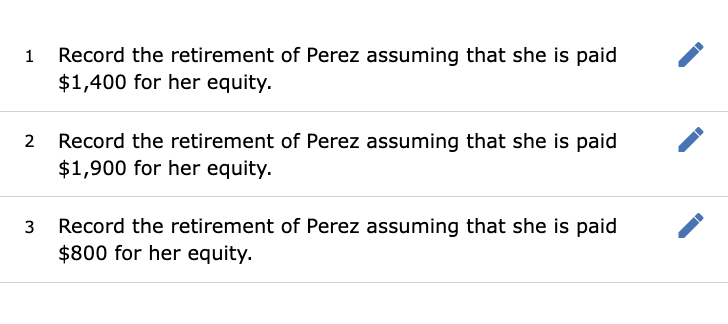

1 Record the retirement of Perez assuming that she is paid \( \$ 1,400 \) for her equity. 2 Record the retirement of Perez assuming that she is paid \( \$ 1,900 \) for her equity. 3 Record the retirement of Perez assuming that she is paid \( \$ 800 \) for her equity.

Expert Answer

Solution: Journal Entries Event Date Particulars Debit Credit 1 31-Dec Perez's Capital $1,400.00 Ca