Home /

Expert Answers /

Accounting /

key-comparative-flgures-for-both-apple-and-google-follow-required-1-what-is-the-total-amount-of-pa542

(Solved): Key comparative flgures for both Apple and Google follow. Required: 1. What is the total amount of ...

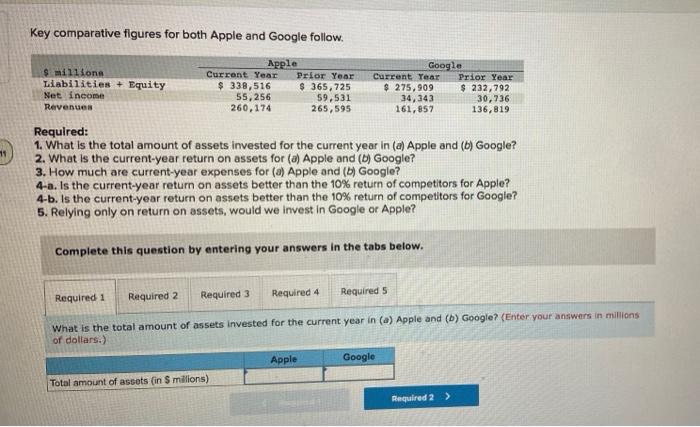

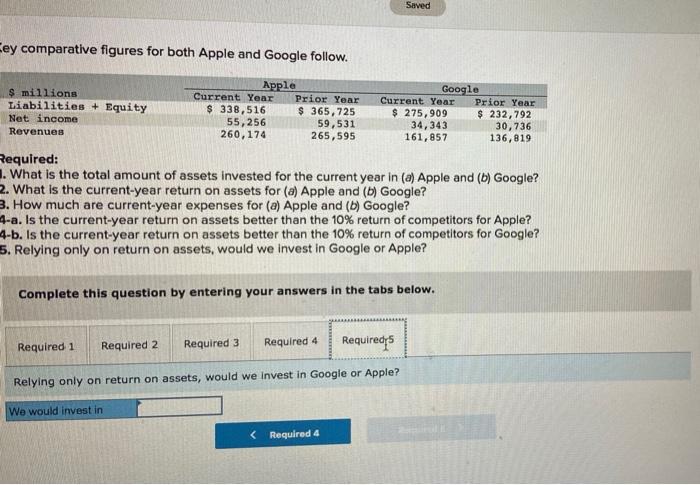

Key comparative flgures for both Apple and Google follow. Required: 1. What is the total amount of assets invested for the current year in (a) Apple and (b) Google? 2. What is the current-year return on assets for (d) Apple and (b) Google? 3. How much are current-year expenses for (a) Apple and (b) Google? 4-a. Is the current-year return on assets better than the \( 10 \% \) return of competitors for Apple? 4-b. Is the current-year return on assets better than the \( 10 \% \) return of competitors for Google? 5. Relying only on return on assets, would we invest in Google or Apple? Complete this question by entering your answers in the tabs below. What is the total amount of assets invested for the current year in \( (a) \) Apple and \( (b) \) Googie? (Enter your answers in millions of dollars.)

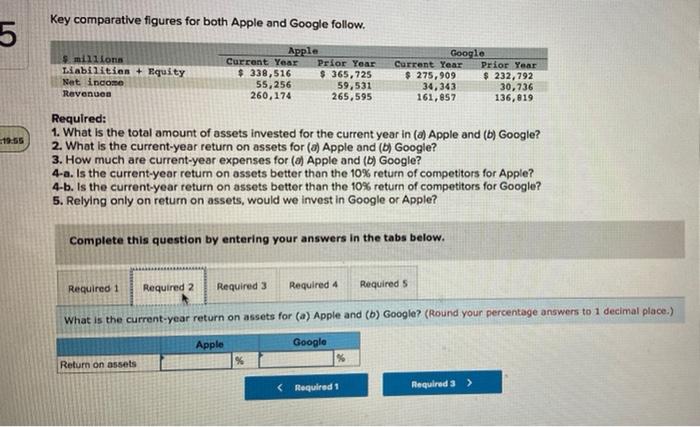

Key comparative figures for both Apple and Google follow. Required: 1. What is the total amount of assets invested for the current year in ( \( d \) Apple and \( (b) \) Google? 2. What is the current-year return on assets for (a) Apple and \( (b) \) Google? 3. How much are current-year expenses for \( (a) \) Apple and \( (b) \) Google? 4-a. Is the current-year retum on assets better than the 10\% return of competitors for Apple? 4-b. Is the current-year return on assets better than the \( 10 \% \) return of competitors for Google? 5. Relying only on return on assets, would we invest in Google or Apple? Complete this question by entering your answers in the tabs below. What is the current-year return on assets for \( (a) \) Apple and \( (b) \) Google? (Round your percentage answers to 1 decimal place.)

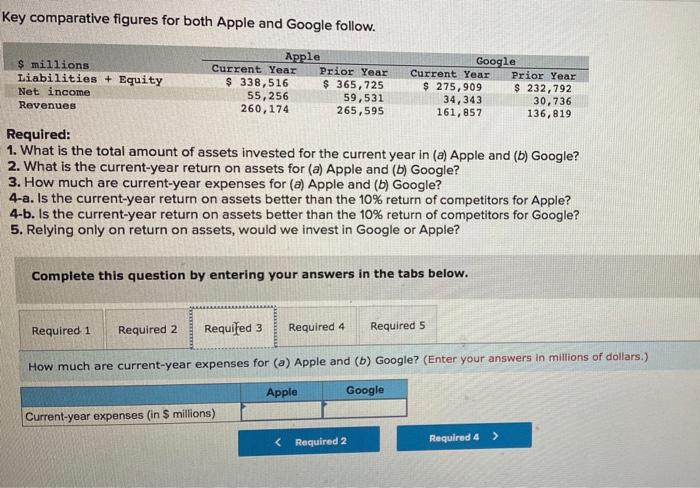

Key comparative figures for both Apple and Google follow. Required: 1. What is the total amount of assets invested for the current year in (a) Apple and (b) Google? 2. What is the current-year return on assets for (a) Apple and (b) Google? 3. How much are current-year expenses for \( (a) \) Apple and (b) Google? 4-a. Is the current-year return on assets better than the \( 10 \% \) return of competitors for Apple? 4-b. Is the current-year return on assets better than the \( 10 \% \) return of competitors for Google? 5. Relying only on return on assets, would we invest in Google or Apple? Complete this question by entering your answers in the tabs below. How much are current-year expenses for \( (a) \) Apple and \( (b) \) Google? (Enter your answers in millions of dollars.)

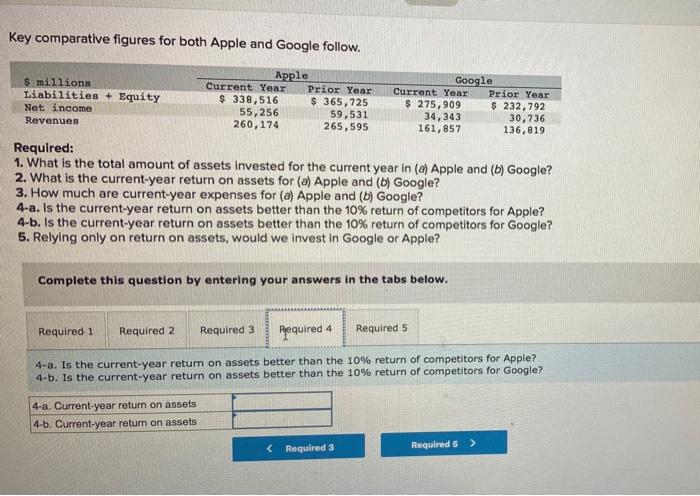

Key comparative figures for both Apple and Google follow. Required: 1. What is the total amount of assets invested for the current year in (a) Apple and (b) Google? 2. What is the current-year return on assets for (a) Apple and (b) Google? 3. How much are current-year expenses for (a) Apple and (b) Google? 4-a. Is the current-year return on assets better than the \( 10 \% \) return of competitors for Apple? 4-b. Is the current-year return on assets better than the \( 10 \% \) return of competitors for Google? 5. Relying only on return on assets, would we invest in Google or Apple? Complete this question by entering your answers in the tabs below. 4-a. Is the current-year return on assets better than the \( 10 \% \) return of competitors for Apple? 4-b. Is the current-year return on assets better than the \( 10 \% \) return of competitors for Google?

ey comparative figures for both Apple and Google follow. Required: What is the total amount of assets invested for the current year in (a) Apple and (b) Google? 2. What is the current-year return on assets for \( (a) \) Apple and \( (b) \) Google? 3. How much are current-year expenses for (a) Apple and (b) Google? 4-a. Is the current-year return on assets better than the \( 10 \% \) return of competitors for Apple? 4-b. Is the current-year return on assets better than the \( 10 \% \) return of competitors for Google? 5. Relying only on return on assets, would we invest in Google or Apple? Complete this question by entering your answers in the tabs below. Relying only on return on assets, would we invest in Google or Apple?

Expert Answer

Answer 1: Total assets = Liabilities + Equity Hence: (a) Total mount of assets invested for the current year in Apple = $338,516 million (b) Total mou