Home /

Expert Answers /

Accounting /

journal-entries-nottaway-flooring-produces-custom-made-floor-tiles-the-company-39-s-raw-material-inv-pa868

(Solved): Journal entries Nottaway Flooring produces custom-made floor tiles. The company's Raw Material Inve ...

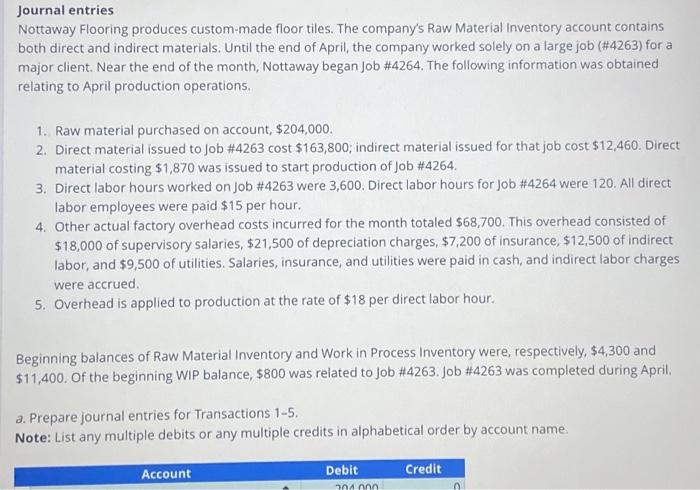

Journal entries Nottaway Flooring produces custom-made floor tiles. The company's Raw Material Inventory account contains both direct and indirect materials. Until the end of April, the company worked solely on a large job (\#4263) for a major client. Near the end of the month, Nottaway began Job \#4264. The following information was obtained relating to April production operations. 1. Raw material purchased on account, . 2. Direct material issued to Job cost ; indirect material issued for that job cost . Direct material costing was issued to start production of Job . 3. Direct labor hours worked on Job \#4263 were 3,600. Direct labor hours for Job were 120 . All direct labor employees were paid per hour. 4. Other actual factory overhead costs incurred for the month totaled . This overhead consisted of of supervisory salaries, of depreciation charges, of insurance, of indirect labor, and of utilities. Salaries, insurance, and utilities were paid in cash, and indirect labor charges were accrued. 5. Overhead is applied to production at the rate of per direct labor hour. Beginning balances of Raw Material Inventory and Work in Process Inventory were, respectively, and . Of the beginning WIP balance, was related to Job . Job was completed during April. a. Prepare journal entries for Transactions 1-5. Note: List any multiple debits or any multiple credits in alphabetical order by account name.