Home /

Expert Answers /

Finance /

jackie-owns-a-temporary-employment-agency-that-hires-personnel-to-perform-accounting-services-for-pa270

(Solved): Jackie owns a temporary employment agency that hires personnel to perform accounting services for ...

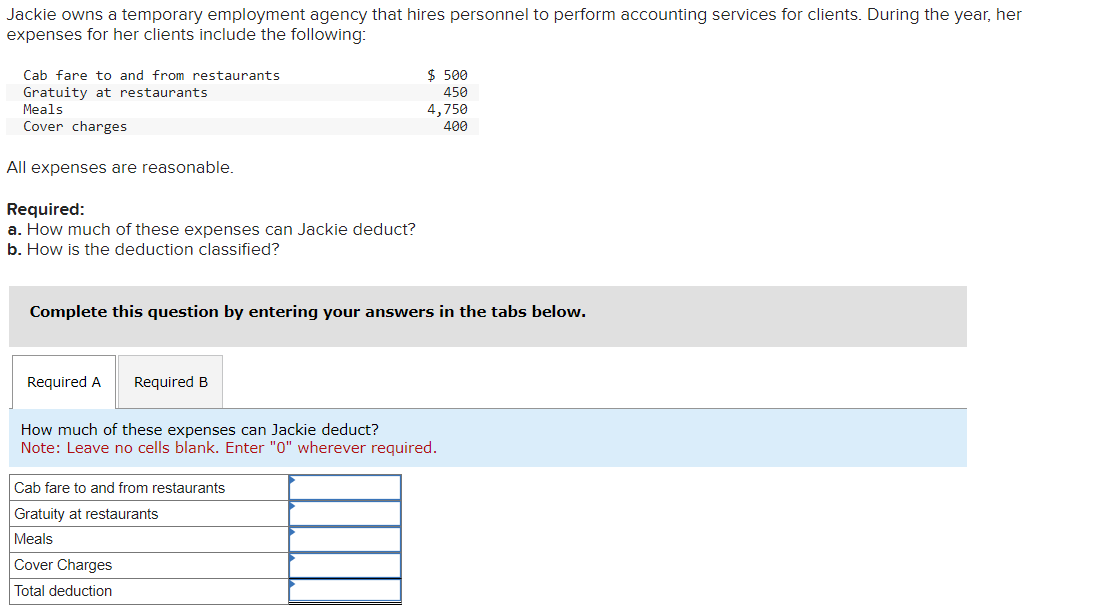

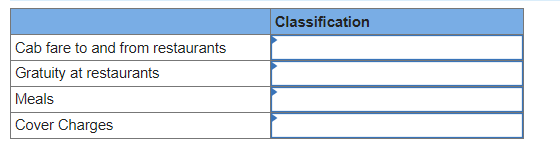

Jackie owns a temporary employment agency that hires personnel to perform accounting services for clients. During the year, her expenses for her clients include the following: All expenses are reasonable. Required: a. How much of these expenses can Jackie deduct? b. How is the deduction classified? Complete this question by entering your answers in the tabs below. How much of these expenses can Jackie deduct? Note: Leave no cells blank. Enter "0" wherever required.

\begin{tabular}{|l|l|} \hline Cab fare to and from restaurants & \\ \hline Gratuity at restaurants & \\ \hline Meals & \\ \hline Cover Charges & \\ \hline \end{tabular}

Expert Answer

a) Below is total Deduction Actual Amount de