Home /

Expert Answers /

Accounting /

jack-hammer-company-completed-the-following-transactions-the-annual-accounting-period-ends-decembe-pa872

(Solved): Jack Hammer Company completed the following transactions. The annual accounting period ends Decembe ...

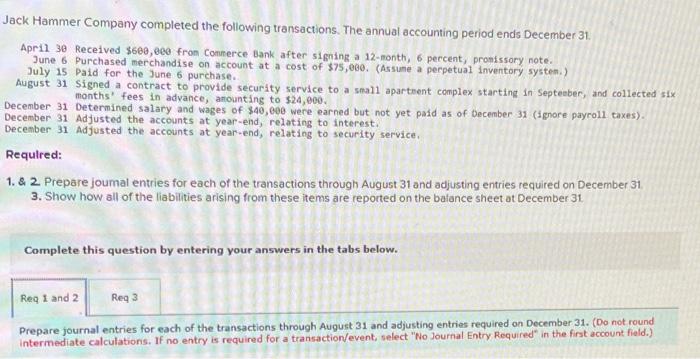

Jack Hammer Company completed the following transactions. The annual accounting period ends December 31. Apr11 30 Received , eee fron Conmerce bank after 51 ming a 12 -month, 6 percent, pronissory note. June 6 Purchased merchandise on account at a cost of . (Assume a perpetual inventory system.) July 15 Paid for the June 6 purchase. August 31 Signed a contract to provide security service to a small apartoent complex starting in Septeeber, and collected six months' fees in advance, anounting to . Decenber 31 Determined salary and wages of were earned but not yet paid as of December 31 (ignore payroll taxes). December 31 Adjusted the accounts at year-end, relating to interest. Decenber 31 Adjusted the accounts at year-end, relating to security service. Requlred: 1. \& 2. Prepare joumal entries for each of the transactions through August 31 and adjusting entries required on December 31 3. Show how all of the liabilities arising from these items are reported on the balance sheet at December 31. Complete this question by entering your answers in the tabs below. Prepare journal entries for each of the transactions through August 31 and adjusting entries required on December 31 . (Do not round intermediate calculations. If no entry is required for a transactionvevent, select "No Journal Entry Required" in the first account field.)

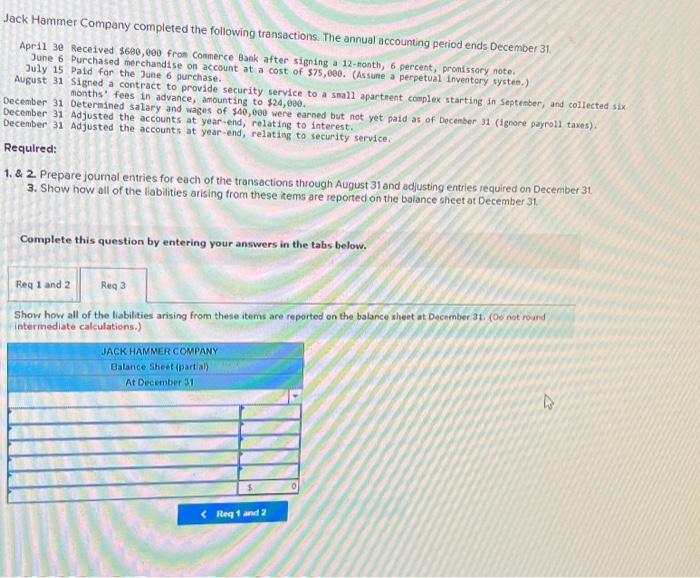

Jack Hammer Company completed the following transactions. The annual accounting period ends December 31 April 30 Received fron Conmerce Bank after signing a 12-fonth, 6 percent, pronissory note. June 6 Purchased merchandise on account at a cost of 575 , 000 . (Assune a perpetual inventory systen, ) July 15 Paid for the Juee 6 purchase. August 31 signed a contract to provide security service to a small apartnent complex starting in September, and collected six months. fees in advance, amounting to . December 31 Oeternined salary and wages of were earned but not yet paid as of Decenber 31 (ignore payroll taxes). Decomber 31 Adjusted the accounts at year-end, relating to interest. December 31 Adjusted the accounts at year-end, relating to security service. Required: 1. \& 2. Prepare journal entries for each of the transactions through August 31 and adjusting entries required an December 3. Show how all of the liablities arising from these items are reported on the balance sheet at December 31 . Complete this question by entering your answers in the tabs below. Show how all of the liabilities arising from these items are reported on the balance sheet at December 31 . (Oe not round intermediate calculations.)