Home /

Expert Answers /

Accounting /

information-for-two-alternative-projects-involving-machinery-investments-follows-project-1-require-pa893

(Solved): Information for two alternative projects involving machinery investments follows. Project 1 require ...

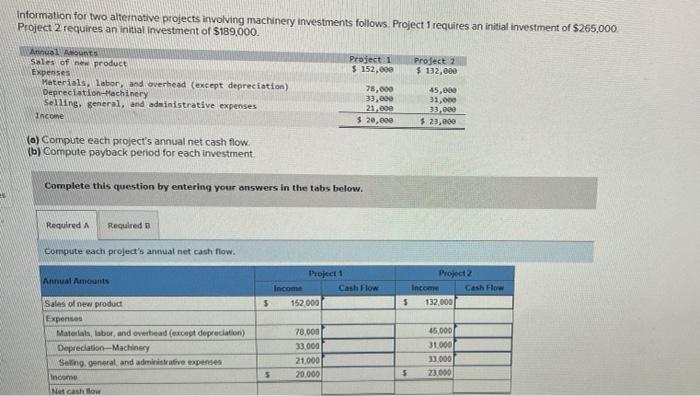

Information for two alternative projects involving machinery investments follows. Project 1 requires an initial investment of $265,000 Project 2 requires an initial investment of $189,000. Annual Amounts Sales of new product Expenses Materials, labor, and overhead (except depreciation) Depreciation Machinery Selling, general, and administrative expenses Income (0) Compute each project's annual net cash flow. (b) Compute payback period for each investment. Required A Required B Complete this question by entering your answers in the tabs below. Compute each project's annual net cash flow. Annual Amounts Sales of new product Expenses Materials, labor, and overhead (except depreciation) Depreciation-Machinery Selling, general, and administrative expenses Income Net cash flow $ 5 Income Project 1 152,000 Project 1 $ 152,000 78,000 33,000 21,000 20.000 78,000 33,000 21,000 $ 20,000 Cash Flow Project 2 $ 132,000 5 45,000 31,000 33,000 $ 23,000 Project 2 Income S 132,000 45,000 31,000 33.000 23.000 Cash Flow

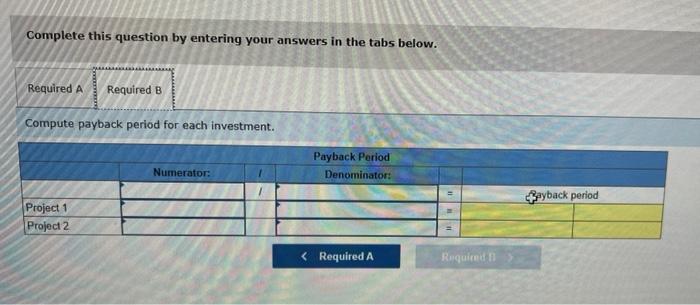

Complete this question by entering your answers in the tabs below. Required A Required B Compute payback period for each investment. Project 1 Project 2 Numerator: Payback Period Denominator: < Required A Required B ayback period

Expert Answer

a) annual net cash flow project 1 project 2 Net income $ 20,000