Home /

Expert Answers /

Accounting /

indicate-the-effect-each-separate-transaction-has-on-investing-cash-flows-amounts-to-be-deducted-pa747

(Solved): Indicate the effect each separate transaction has on investing cash flows. (Amounts to be deducted ...

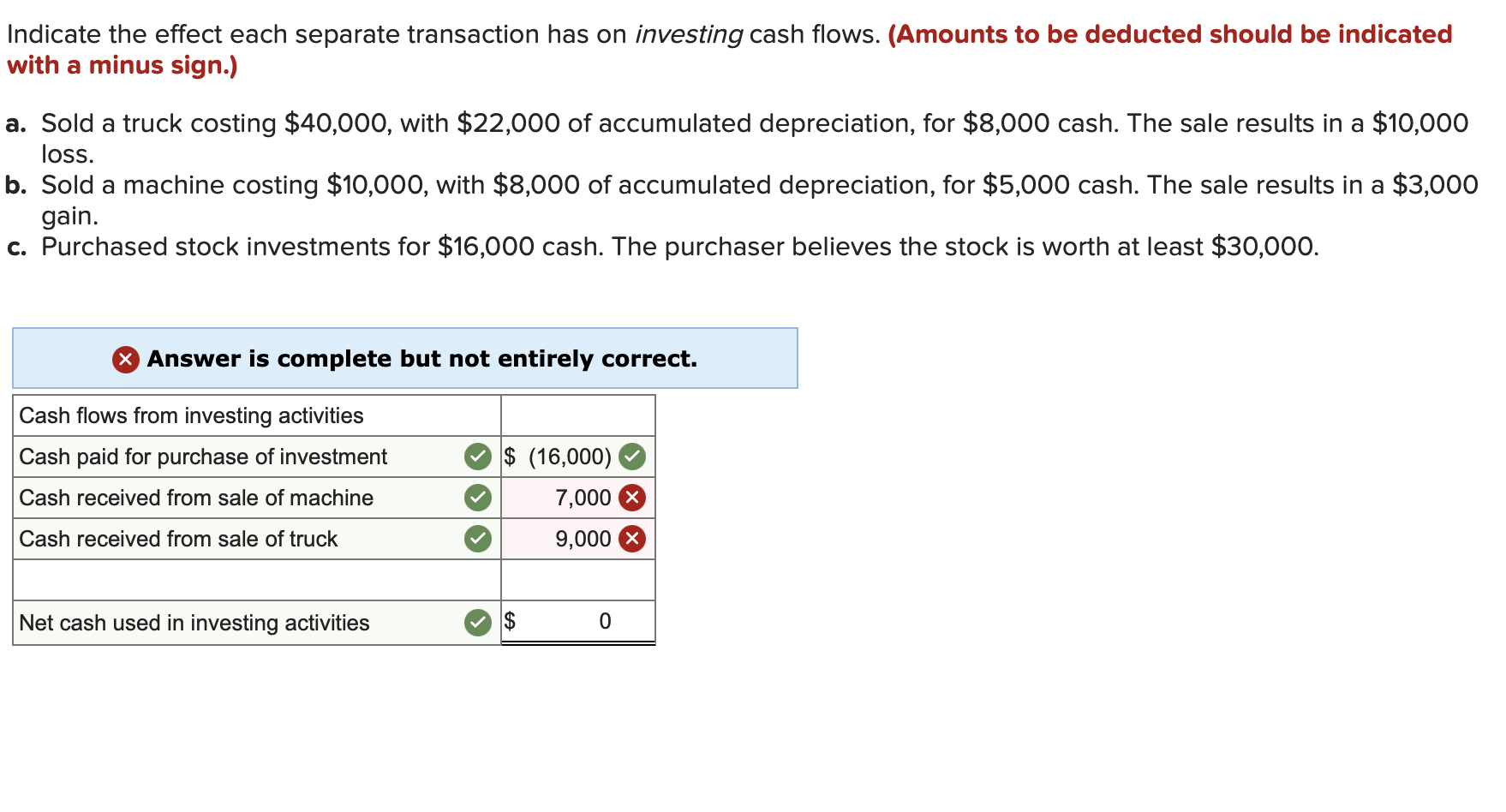

Indicate the effect each separate transaction has on investing cash flows. (Amounts to be deducted should be indicated with a minus sign.) a. Sold a truck costing \( \$ 40,000 \), with \( \$ 22,000 \) of accumulated depreciation, for \( \$ 8,000 \) cash. The sale results in a \( \$ 10,000 \) loss. b. Sold a machine costing \( \$ 10,000 \), with \( \$ 8,000 \) of accumulated depreciation, for \( \$ 5,000 \) cash. The sale results in a \( \$ 3,000 \) gain. c. Purchased stock investments for \( \$ 16,000 \) cash. The purchaser believes the stock is worth at least \( \$ 30,000 \). \( \varnothing \) Answer is complete but not entirely correct.

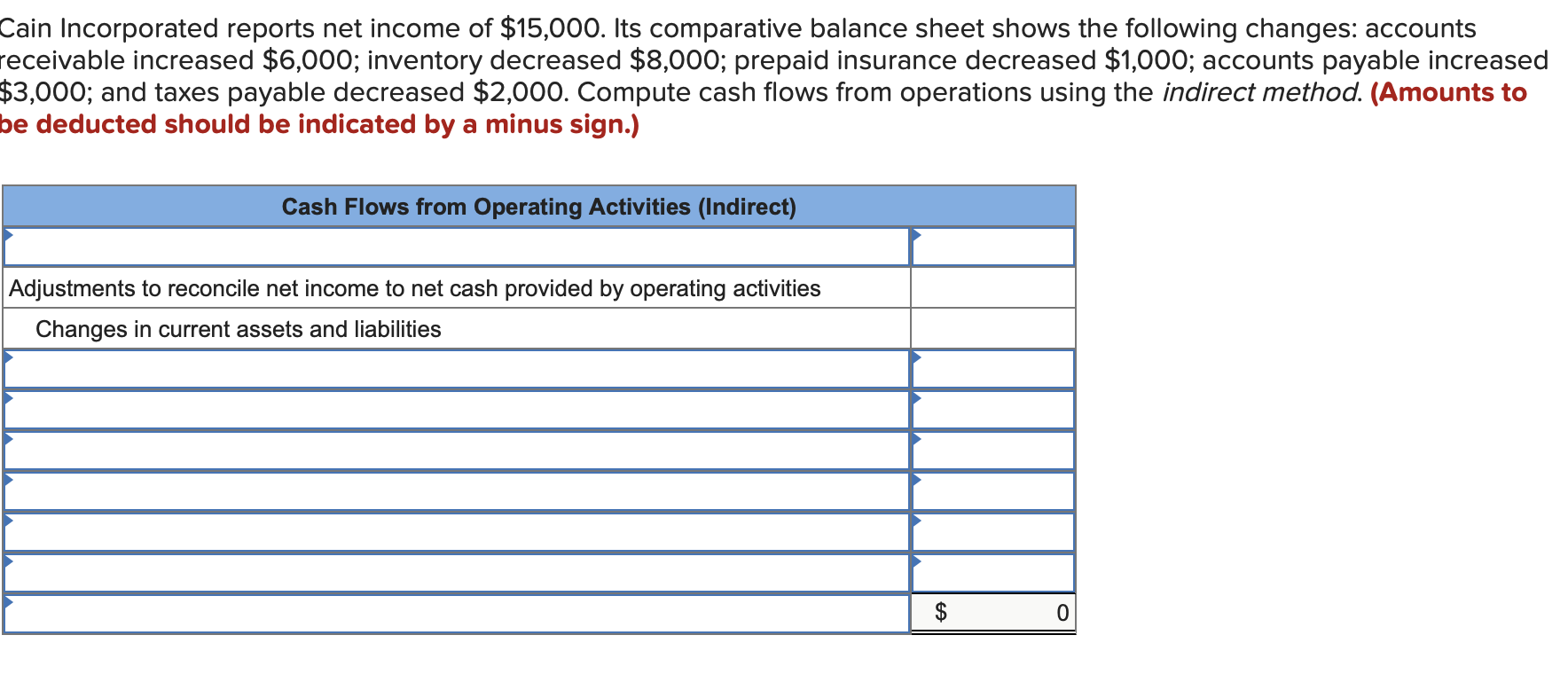

:ain Incorporated reports net income of \( \$ 15,000 \). Its comparative balance sheet shows the following changes: accounts eceivable increased \( \$ 6,000 \); inventory decreased \( \$ 8,000 \); prepaid insurance decreased \( \$ 1,000 \); accounts payable increased 3,000; and taxes payable decreased \( \$ 2,000 \). Compute cash flows from operations using the indirect method. (Amounts to e deducted should be indicated by a minus sign.)

Cain Incorporated reports net income of \( \$ 15,000 \). Its comparative balance sheet shows the following changes: accounts receivable increased \( \$ 6,000 \); inventory decreased \( \$ 8,000 \); prepaid insurance decreased \( \$ 1,000 \); accounts payable increased \( \$ 3,000 \); and taxes payable decreased \( \$ 2,000 \). Compute cash flows from operations using the indirect method. (Amounts to be deducted should be indicated by a minus sign.)

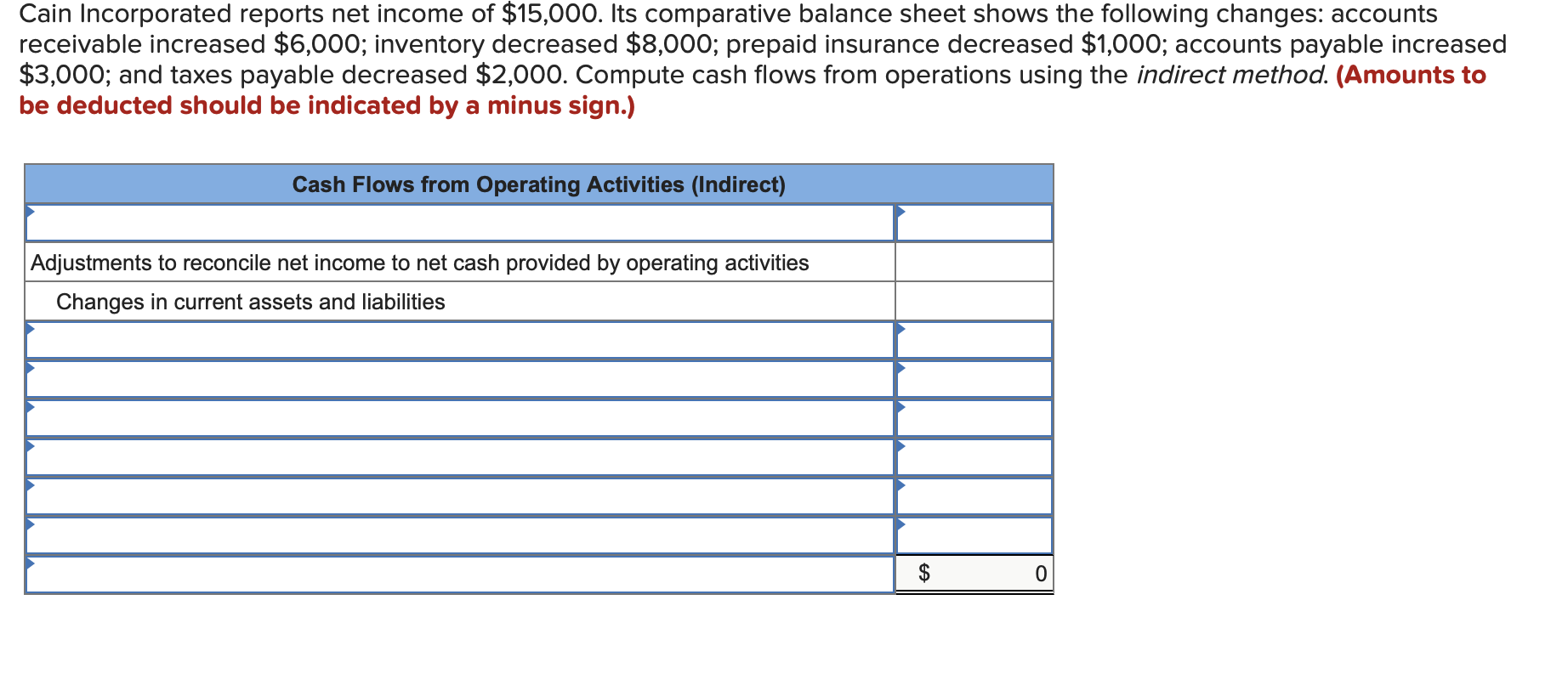

a. Net income was \( \$ 35,000 \). o. Issued common stock for \( \$ 64,000 \) cash. c. Paid cash dividend of \( \$ 14,600 \). d. Paid \( \$ 50,000 \) cash to settle a long-term notes payable at its \( \$ 50,000 \) maturity value. e. Paid \( \$ 12,000 \) cash to acquire its treasury stock. f. Purchased equipment for \( \$ 39,000 \) cash. Use the above information to determine cash flows from financing activities. (Amounts to be deducted should be indicated with a minus sign.)

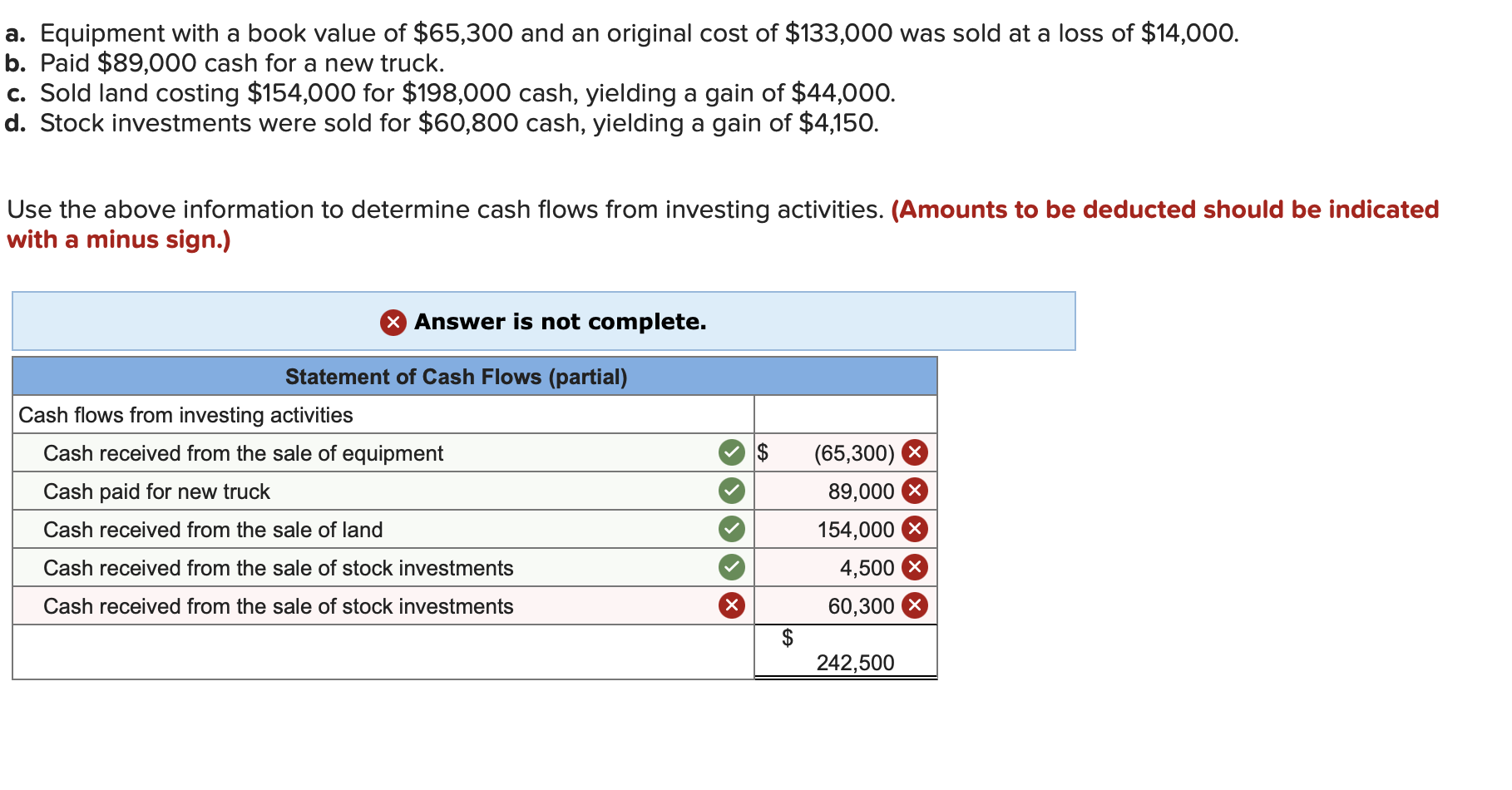

a. Equipment with a book value of \( \$ 65,300 \) and an original cost of \( \$ 133,000 \) was sold at a loss of \( \$ 14,000 \). b. Paid \( \$ 89,000 \) cash for a new truck. c. Sold land costing \( \$ 154,000 \) for \( \$ 198,000 \) cash, yielding a gain of \( \$ 44,000 \). d. Stock investments were sold for \( \$ 60,800 \) cash, yielding a gain of \( \$ 4,150 \). Use the above information to determine cash flows from investing activities. (Amounts to be deducted should be indicated with a minus sign.)

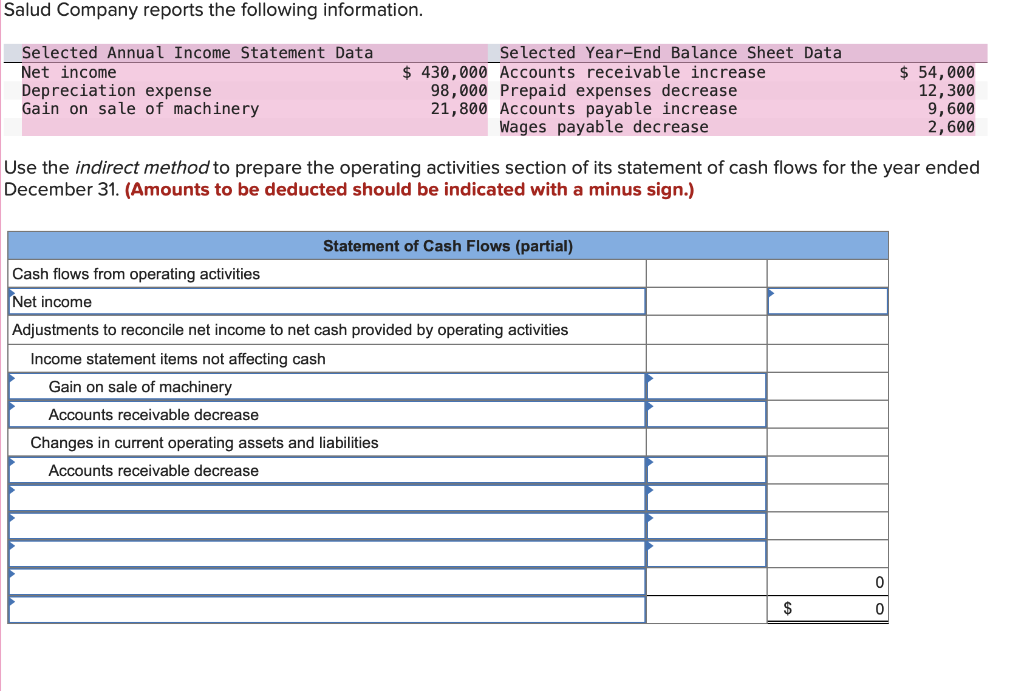

Salud Company reports the following information. Use the indirect method to prepare the operating activities section of its statement of cash flows for the year ended December 31. (Amounts to be deducted should be indicated with a minus sign.)

Expert Answer

Answer 1 Computation of net cash used in investing activities Cashflows from investing activities