Home /

Expert Answers /

Finance /

income-statement-data-of-corporation-a-for-2021-amounts-are-in-php-millions-sales-3-756-pa198

(Solved): Income statement data of Corporation A for 2021 (amounts are in PHP millions): Sales \( =3.756 \); ...

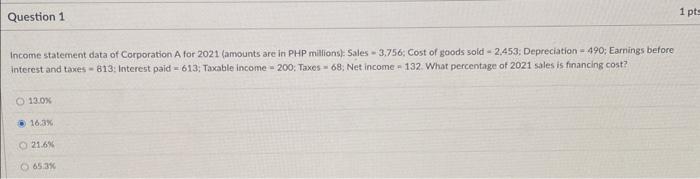

Income statement data of Corporation A for 2021 (amounts are in PHP millions): Sales \( =3.756 \); Cost of goods sold \( =2.453 \) : Depreciation \( =490 \); Earnings before interest and taxes \( =813 \); Interest paid \( =613 \); Taxable income \( =200 \) : Taxes \( =68 \); Net income \( =132 \). What percentage of 2021 sales is financing cost? \( 130 \% \) \( 16.3 \% \) \( 21.68 \) \( 65.3 x \)

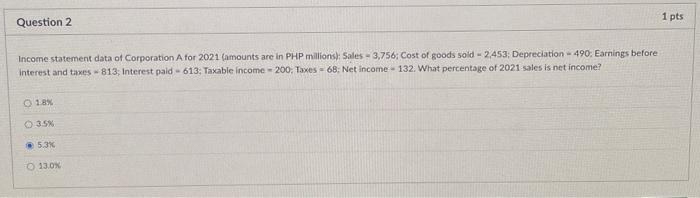

Income statement data of Corporation A for 2021 (amounts are in PHP millions): Sales - 3,756; Cost of goods sold = 2,453; Depreciation = 490 ; Earnings before interest and taxes \( -813 \); interest paid \( =613 \); Taxable income \( =200 \); Taxes = 68 ; Net income - 132: What percentage of 2021 sales is net income? 188 \( 5.3 \% \) \( 13.0 x \)

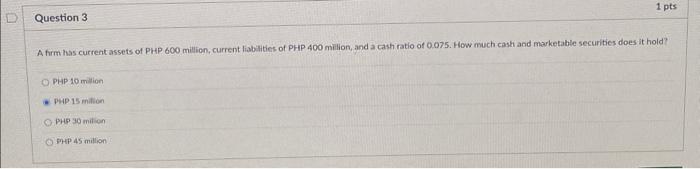

A firm has current assets of PHP 600 million, current liabilities of PHP 400 milion, and a cash ratio of \( 0.075 \). How much cash and marketable securities does it hold? PHP 10 million PuP 15 mition Phes 30 mition FHip 45 million

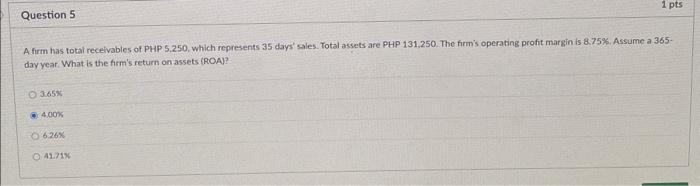

A firm has total receivables of PHP 5.250, which represents 35 days' sales. Total assets are PHP 131,250. The firm's operating profit margin is \( 8.75 \% \). Assume a 365 day year. What is the firm's return on assets (ROA)? \( 3.65 \% \) \( 4.005 \) \( 626 \% \) 41.71\%

Expert Answer

Financing cost = Interest expenses 613 Sales = 3,756 Financing costs as % of sales =Interest expenses/sales=6133,756=0.163 Answer 1 : Financing costs