(Solved): In the worksheet "lease amortization schedule", you will find information about a three- year leas ...

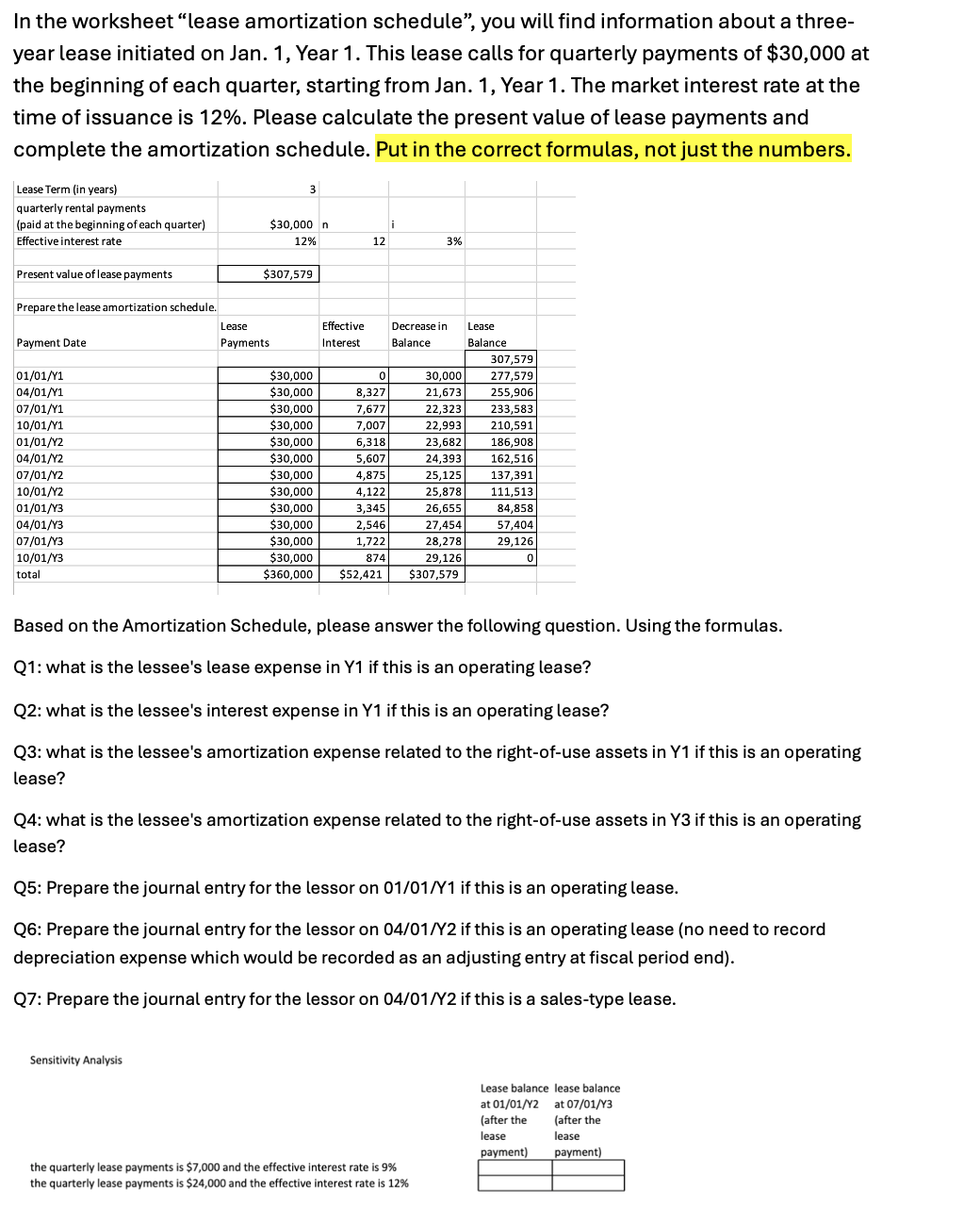

In the worksheet "lease amortization schedule", you will find information about a three- year lease initiated on Jan. 1, Year 1. This lease calls for quarterly payments of

$30,000at the beginning of each quarter, starting from Jan. 1, Year 1. The market interest rate at the time of issuance is

12%. Put in the correct formulas, not just the numbers. Based on the Amortization Schedule, please answer the following question. Using the formulas. Q1: what is the lessee's lease expense in Y 1 if this is an operating lease? Q2: what is the lessee's interest expense in Y 1 if this is an operating lease? Q3: what is the lessee's amortization expense related to the right-of-use assets in Y 1 if this is an operating lease? Q4: what is the lessee's amortization expense related to the right-of-use assets in Y 3 if this is an operating lease? Q5: Prepare the journal entry for the lessor on 01/01/Y1 if this is an operating lease. Q6: Prepare the journal entry for the lessor on 04/01/

Y2 if this is an operating lease (no need to record depreciation expense which would be recorded as an adjusting entry at fiscal period end). Q7: Prepare the journal entry for the lessor on 04/01/Y2 if this is a sales-type lease. Sensitivity Analysis: In Q8 and Q9 Solve for the Lease balance at 01/01/Y2 (after the lease payment) and lease balance at 07/01/Y3 (after the lease payment) using the following information: Q8. The quarterly lease payments is

$7,000and the effective interest rate is

9%Q9. The quarterly lease payments is

$24,000and the effective interest rate is

12%.